Global rice supply shifts from deficit to surplus

The United States Department of Agriculture (USDA) has released its Outlook for Rice Markets 2024/2025. In it, the department forecasts global rice production for the current crop year to reach a record high of 527.6 million tons, a 10.3 million-ton increase from last year. The global harvested area is expected to reach a record high of 167.6 million hectares, a near 1% increase from the previous year.

Cambodia, China, the European Union (EU), India, Indonesia, Iraq, Pakistan, and Thailand are projected to account for most of the expanded rice-planted area in 2024/25.

The global average rice yield for 2024/25 is forecasted to be a record-high 4.17 tons/hectare (rough rice), a 1% increase from the previous year. Both China and India, the world’s largest rice-producing countries, are predicted to achieve record yields. Together, China and India account for over 50% of the world’s rice production.

This forecast is based on assumptions of normal weather conditions in major rice-producing countries and a reduction in the impact of the El Niño phenomenon in Southeast Asia at the beginning of summer.

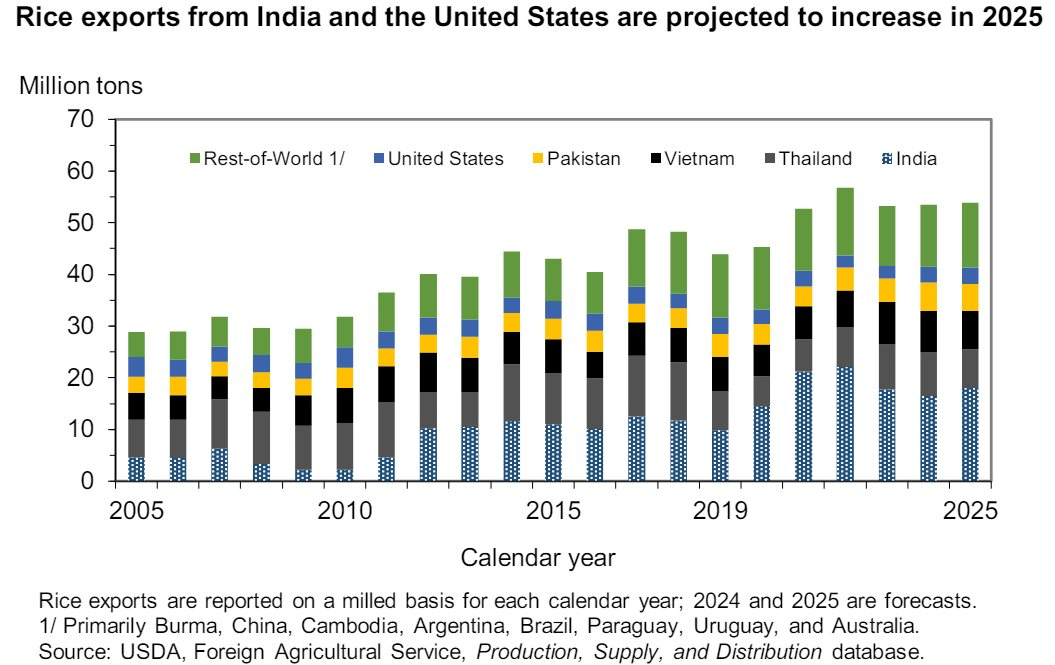

India and the US are expected to increase rice exports in 2025.

According to the USDA, global rice consumption is expected to reach a new high of 526.4 million tons this year, a 4.8 million-ton increase from the previous year. This shift will end three consecutive years of supply shortages, moving from a 4.3 million-ton deficit in 2023-2024 to a 1.2 million-ton surplus in the upcoming crop year.

India’s rice consumption is forecasted to reach a record 120 million tons, supported by rice distribution programs for the poor.

In contrast, China’s rice consumption will decline for the third consecutive year due to a reduction in the use of rice as a substitute for other grains in animal feed. Meanwhile, the Sub-Saharan African, South Asian, and Middle Eastern regions, which are experiencing population growth, will continue to increase their rice consumption.

Global rice trade is expected to reach 53.5 million tons in 2024, a slight increase of nearly 0.3 million tons from the previous year, and is projected to inch up to 53.8 million tons in 2025. Brazil, Cambodia, India, and the US are expected to expand their exports in 2025, while Myanmar, Pakistan, Thailand, and Vietnam are predicted to export less rice.

Regarding global rice imports in 2025, the markets with increased purchases will be Bangladesh, the Middle East, the Philippines, Sub-Saharan Africa, the US, and Vietnam. The increased imports from these markets will outweigh the significant decline in Indonesia’s imports and weaker imports in South America.

According to the USDA, India will remain the world’s largest rice exporter in 2025, with exports expected to reach 18 million tons, a 1.5 million-ton increase from the estimated exports in 2024. This will give India a share of over one-third of global rice trade. Despite some trade restrictions, India’s rice exports are expected to increase due to significant production growth and large stocks.

The USDA predicts a further increase in global rice stocks of 1.2 million tons, reaching 176.1 million tons in the 2024-2025 crop year. China (59%) and India (21%) together account for 80% of global rice inventories. Both governments maintain public stockholding programs.

In the US, rice stocks are predicted to increase by 12% due to large carry-in stocks and record-high imports. Overall, the USDA assesses that stocks in major rice-exporting countries will recover, providing a stable outlook for global supply.

Vietnam becomes the world’s second-largest rice importer

The USDA forecasts Vietnam’s rice production to reach 27 million tons in the 2024-2025 crop year, unchanged from the previous year. This prediction is based on an expected increase in Vietnam’s rice-planted area by 5,000 hectares to 7.15 million hectares, offsetting a slight decrease in yield to 6.04 tons/hectare.

While this represents an increase, Vietnam’s rice-planted area remains below the record high of 7.82 million hectares in the 2014-2015 crop year due to saltwater intrusion in the Mekong Delta and government encouragement to reduce rice monoculture.

The USDA predicts that Vietnam will import 2.95 million tons of rice, a 7.3% increase from the previous year, making it the second-largest rice importer globally. This increase in imports is due to continued purchases of paddy rice from Cambodia for milling and export from Vietnam. Additionally, Vietnam also imports brown rice from India.

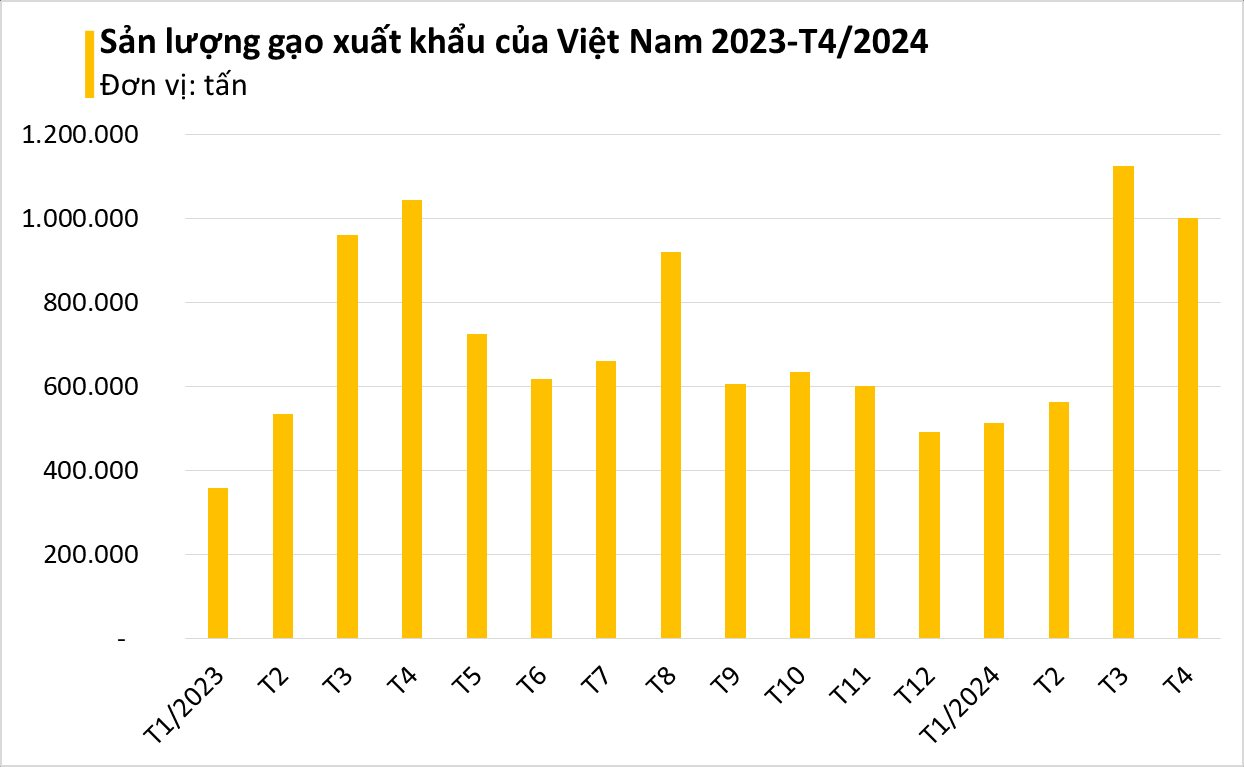

Meanwhile, Vietnam’s rice exports are expected to reach 7.5 million tons, a 6.3% decrease from the previous year. This reduction is attributed to increased consumption and stagnant production.

The quotation for 5% broken rice from Vietnam in the week ending May 7th increased by $10 per ton since April 9th, reaching $595 per ton as the winter-spring harvest in the country’s southern region nears its end. The winter-spring crop, which benefits from sufficient irrigation, is Vietnam’s largest and accounts for the majority of the country’s rice exports.

Reference: USDA