After experiencing a “boom” phase with an average annual growth rate of approximately 45% in the 2018-2021 period, the bond market entered a “crisis of confidence” in 2022, marked by a series of successive incidents.

Consequently, the issuance of new corporate bonds stalled in 2022 and continued until the first half of 2023.

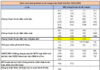

Thanks to supportive solutions from the government, the bond market in 2023, especially in the latter part of the year, has shown signs of recovery, although not as robustly as in the previous period. Statistics from the Vietnam Bond Market Association (VBMA) show that the value of new issuances in 2023 reached VND 333,988 billion, an increase of 37.8% compared to 2022. Of this, the total value of private placements reached VND 296,917 billion, an increase of 19.4%, while the value of public offerings reached VND 37,070 billion, a 74.6% increase compared to the same period.

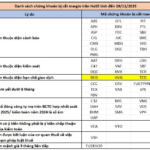

Although the corporate bond market has shown significant improvement towards a healthier direction after the 2022-2023 purging phase, the quality of corporate bonds still carries potential risks and needs to be closely monitored. Notably, the value of public offerings has not seen the strong change expected.

To develop the corporate bond market – an effective long-term capital mobilization channel for enterprises and an attractive investment channel for investors – it is essential to improve mechanisms and policies related to the control and development of the bond market. In this context, credit rating activities play a crucial role.

However, credit rating activities in Vietnam are still in their infancy compared to other countries in the region, where the use of credit ratings for bond-related activities is quite common. For instance, the utilization rate of credit ratings for bonds in Indonesia is 92%, Thailand 84%, and Malaysia 56%.

With this in mind, Vietnam Economic Magazine/VnEconomy is collaborating with Moody’s Ratings and VIS Rating to organize a workshop titled “Developing the Corporate Bond Market towards 2030: A Perspective from Credit Ratings.” The event aims to share international experiences and their applicability to Vietnam, striving to elevate the scale of the corporate bond market to a minimum of 25% of GDP by 2030.

The workshop will focus on two main contents:

– Part 1: Vietnam’s Corporate Bond Market: This part will analyze and assess the current state of Vietnam’s corporate bond market and explore the experiences of regional countries in promoting their bond markets.

– Part 2: Developing the GSS Bond Market (Green, Social, and Sustainable): This part will offer solutions to accelerate sustainable finance activities in Vietnam.

The workshop will feature three important presentations:

(i) Trends and Bottlenecks in 2024 of Vietnam’s Corporate Bond Market – A Credit Rating Perspective

(ii) Time to Start a New Cycle: Experiences in Promoting Sustainable Growth from Regional Markets

(iii) Accelerating Sustainable Finance Activities in Vietnam and Beyond“

The discussion will be enriched by the participation of esteemed guests:

+ Mr. Hoàng Văn Cường, Member of the Finance and Budget Committee of the National Assembly, Vice President of the Vietnam Economic Science Association;

+ Mr. Nguyễn Mạnh Hà, Deputy Head of the Research and Policy Coordination Department, National Financial Supervisory Commission;

+ Mr. Trần Lê Minh, General Director of VIS Rating;

+ Mr. Jeffrey Lee, Director for the Asia-Pacific region, Moody’s Ratings;

+ Ms. Tạ Thị Bích Thảo, Deputy General Secretary of the Vietnam Bond Market Association.

Additionally, representatives from the State Securities Commission, the Institute for Financial Strategy and Policy, the Vietnam Bond Market Association, the Vietnam Bankers Association, the Vietnam Real Estate Research Institute, as well as banks and enterprises, will join the discussion.

The program will be broadcast live on VnEconomy.vn, VnEconomy Fanpage, and VnEconomy Youtube channel on May 17, 2024.

We cordially invite interested readers to follow and join the discussion!