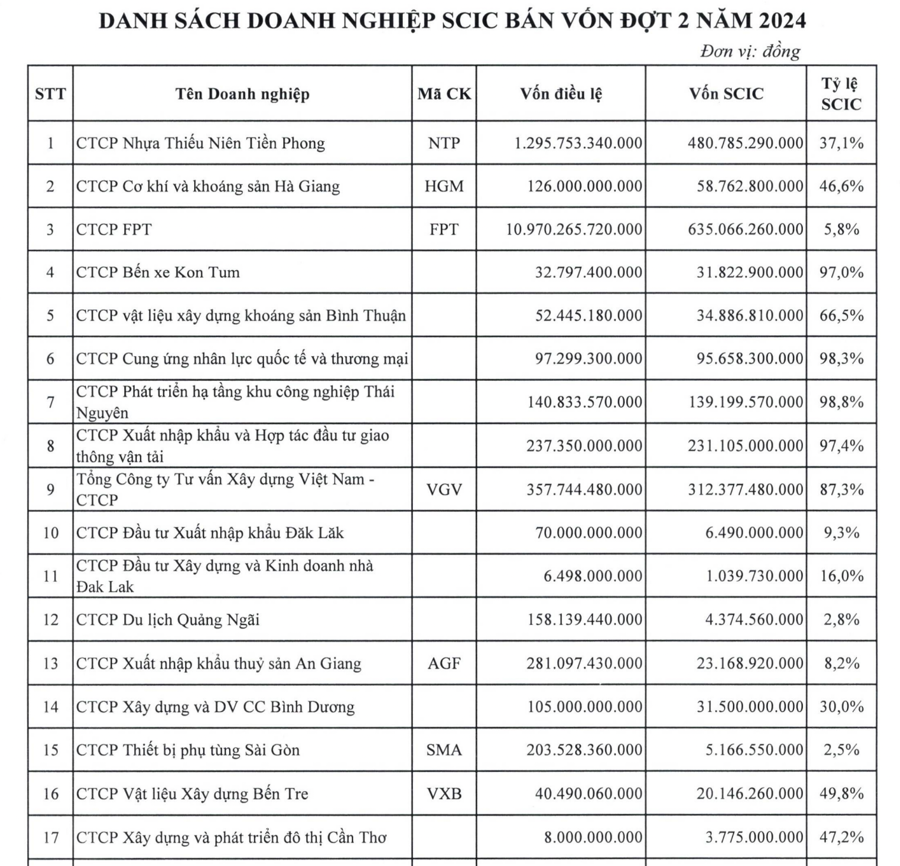

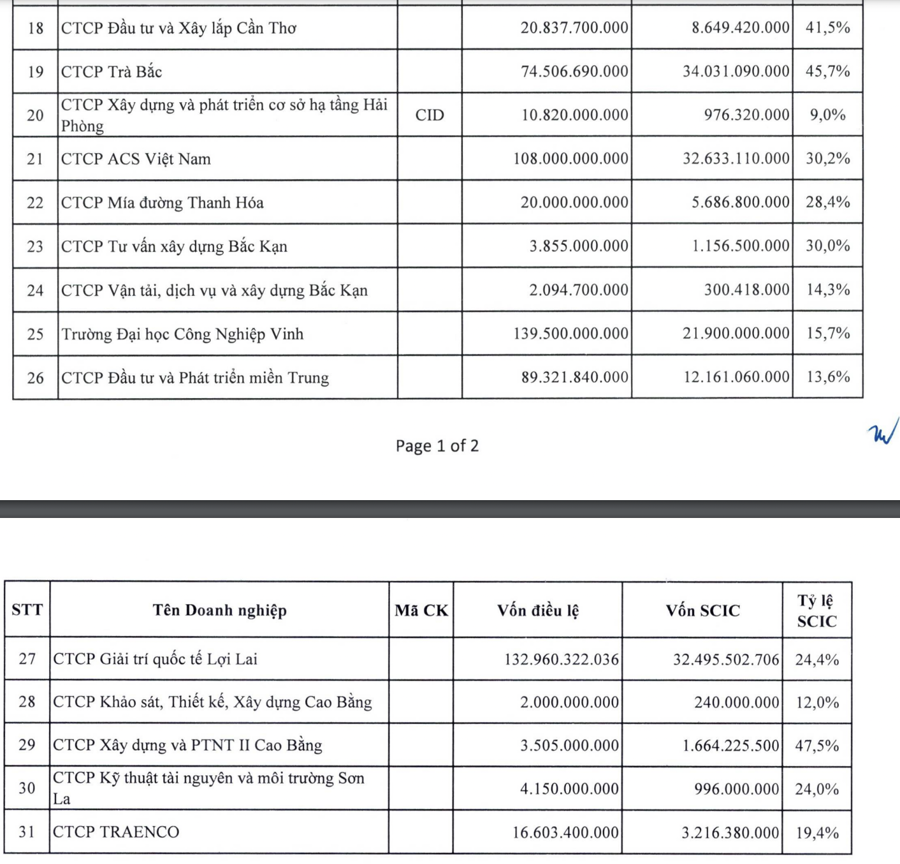

The State Capital Investment Corporation (SCIC) has just announced its second divestment list for 2024, featuring 31 enterprises.

Familiar names on the stock exchange are included, such as NTP Plastic Joint Stock Company (NTP), Hanoi Machinery and Mineral Joint Stock Company (HGM), FPT Corporation (FPT), Vietnam Construction Consulting Corporation (VGV), An Giang Fisheries Import and Export Joint Stock Company (AGF), Saigon Equipment and Spare Parts Joint Stock Company (SMA), Ben Tre Construction Materials Joint Stock Company (VXB), and Hai Phong Infrastructure Development and Construction Joint Stock Company (CID).

Notably, SCIC’s holdings in FPT Corporation stand at VND 635 billion, equivalent to 5.8% of the company’s charter capital. This divestment is expected to be a highlight of 2024, providing a breakthrough impetus for the market in the coming period.

Next is NTP Plastic Joint Stock Company, in which SCIC holds 37.1% of the charter capital, equivalent to VND 480 billion. This is followed by Vietnam Construction Consulting Corporation, with an investment value of VND 312 billion (87.3% charter capital), and the Joint Stock Company for Transport Investment and Import-Export (97.4%) with VND 231 billion.

Earlier, in the first divestment list of 2024, SCIC announced its plan to divest from 27 enterprises, including listed companies such as Domesco Medical Import Export Joint Stock Company (DMC), Vietnam Book Joint Stock Company – Savina (VNB), Seaprodex Vietnam Joint Stock Corporation (SEA), Vietnam Plastic Joint Stock Company (VNP), and Vietnam Electronics and Computer Joint Stock Corporation (VEC)…

However, so far, SCIC has only successfully divested from Vinacontrol Group Joint Stock Company (VNC) and Feature Film Company No. 1.

At the Conference on the Announcement and Implementation of the Development Strategy towards 2030, with a vision towards 2035, and the Business Plan and Investment Plan towards 2025 of SCIC, held earlier this year, Mr. Nguyen Chi Thanh, Chairman of the Members’ Council of SCIC, stated that the current portfolio of SCIC does not include many efficient enterprises, and the number/value of enterprises to be received is also not significant.

“Therefore, SCIC needs to further promote its investment activities and transform its operating model into a financial organization that fulfills the role of a government investor,” said Mr. Thanh. According to SCIC, as of the beginning of 2024, its portfolio comprised 113 enterprises, excluding 12 enterprises held according to the draft Scheme for Restructuring SCIC. The majority of the remaining enterprises are inefficient and challenging to divest from.

Mr. Thanh also pointed out that there are only two years left in the five-year plan, and the business targets for 2024-2025 are extremely challenging regarding capital sales and investment in the context of some fundamental legal obstacles that have not been resolved. These include the arrangement of housing and land before capital divestment in enterprises with more than 50% charter capital and the unclear decision-making authority of the SCIC Members’ Council regarding investment.

Hence, SCIC hopes to continue receiving the attention and guidance of ministries, sectors, central agencies, the Government, and the Prime Minister. Immediate support is sought, especially in resolving legal obstacles, to implement and complete the 2024-2025 business plan on time.