After finding its rhythm, the VN-Index quickly recovered. Stocks across all three capitalization levels—large, mid, and small—bounced back. As of May 16, 2024, the VNMID index recorded a growth of 9.7% from its low, with VNSML (+8.39%) and VN30 (+8.99%) also showing significant increases.

AVOIDING PENNY STOCKS?

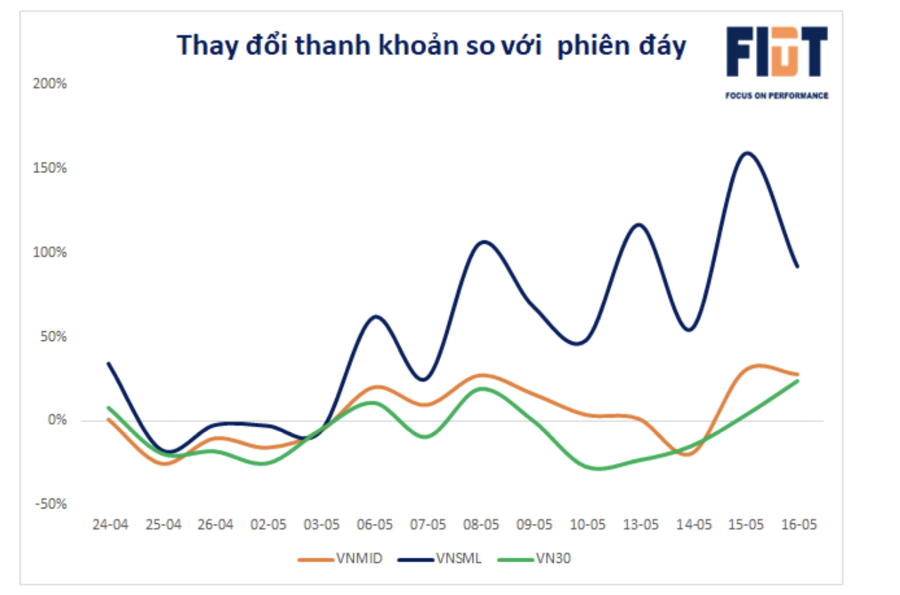

While the VNSML index didn’t experience the strongest recovery, it witnessed the most remarkable improvement in liquidity, attracting the attention of numerous investors even as money flow decreased in the large and mid-cap groups.

Regarding penny stocks, experts from FIDT emphasize that small-cap stocks are not inherently inferior or less worthy of attention. In the long run, most stocks have the potential for growth. In fact, historical data over the past 20 years reveals that the VNSML index has grown in tandem with the mid and large-cap segments.

In the short term, however, analysis shows that the VNSML index has consistently performed well in the first three months following a significant decline, rarely dipping into negative territory.

At present, the VNSML index has rebounded to pre-crash levels. High-profit investment opportunities are now scarcer. This is the time for investors to reap the benefits of their stock accumulation at lower prices. Meanwhile, the current price range may not be enticing enough for those who missed the previous wave to jump in.

Given these factors, FIDT suggests that small-cap stocks may require appropriate discounts to strike a balance between supply and demand. Investors who purchased stocks at lower prices and have confidence in the long-term prospects of these businesses can continue to enjoy their gains. Those who missed out on previous opportunities can await more favorable discounts before entering the market.

Analyzing the past decade’s data, mid-cap stocks have the highest probability of growth and have outperformed large and small-cap stocks in terms of price appreciation.

So, while “all roads lead to Rome,” choosing the broader path may make it easier to catch a ride and ensure a more comfortable journey.

Investing is essentially capital management, and the primary rule is never to lose money, and never forget that rule. Some small-cap stocks may offer the allure of high returns, but investors must consider their capital scale and assess whether these stocks have sufficient liquidity to absorb their holdings when it’s time to realize profits. Avoid situations where profits exist only on paper,” FIDT experts caution.

MARKET ADJUSTMENT SIGNALS

Securities expert Nguyen The Minh asserts that penny stocks are typically the last segment to experience growth in a bull market.

Investors are drawn to penny stocks for two main reasons. First, the volatility of these stocks can be significant. While a large-cap stock may gain 10% in a week, a penny stock could potentially double in value over the same period. Secondly, as investors seek opportunities and successfully realize profits in large-cap stocks, they tend to shift their focus to mid and small-cap stocks. The previous week witnessed a strong rebound in the Midcap group, positively impacting penny stocks.

However, penny stocks are highly speculative and often lack compelling narratives. They are also less transparent, with financial reports sometimes used to manipulate stock prices. These stocks frequently feature grandiose plans that rarely come to fruition. Penny stocks are typically suitable only for investors with a high-risk appetite and those skilled in short-term trading.

“When money flows into small-cap stocks, it’s like shopping in a market—once you’ve bought from the large stalls, you move on to the smaller ones. This behavior often signals an impending risk,” warns Mr. Minh.

Additionally, the market currently faces notable adjustment risks. Firstly, inflationary pressures have returned, with rising prices for agricultural produce, metals, and energy. Commodity price indices across the board have climbed, and when inflation rises, the stock market becomes vulnerable.

Secondly, since late April, many stocks have doubled in value, and the VN-Index is just 20 points shy of the 1300 mark, creating short-term pressure.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)