Consumers shopping at the fair and exhibition “Can Tho City – 20 years of achievements and development”. Photo: Trung Chanh |

Uptrend

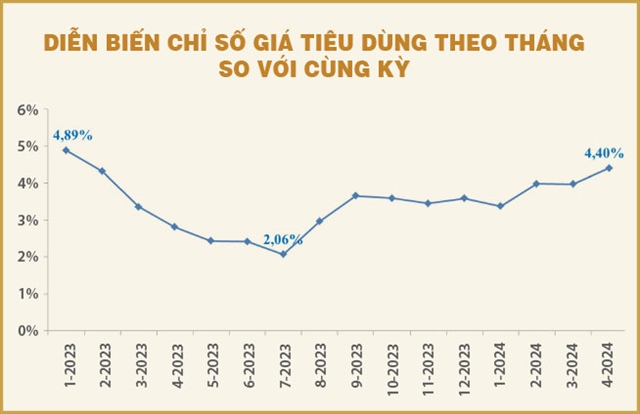

According to the General Statistics Office of Vietnam, the Consumer Price Index (CPI) averaged a 3.93% increase for the first four months of 2024 compared to the same period in 2023. This continues the upward trend since August of last year. The primary reason for the CPI increase is the rise in housing and construction material prices (cement, steel, sand, and rental rates), which increased by 5.54%, causing a 1.04 percentage point increase in the overall CPI. Additionally, the education index rose by 8.84%, and the medicine and medical services index increased by 6.74%, also contributing to the CPI rise for the first four months of this year.

If we look at April alone, CPI increased by 4.4% year-on-year, marking a continuous rise since July 2023. Of the 11 main consumer goods and service groups, eight saw price increases compared to the previous month. The main driver was the increase in gasoline and oil prices, which pushed up transportation services by 1.95%. This was the primary factor in the high CPI for April. Notably, air passenger transport prices increased by 10.42% compared to the previous month. Additionally, the medicine and medical services group increased by 0.92%, other goods and services by 0.27%, and housing, building materials, and gasoline and oil by 0.21%.

|

Electricity and gasoline are two input fuels for most industries, and their price increases can push up the prices of most commodities, especially essential goods and services. Specifically, a 10% increase in electricity prices will directly impact a 0.33 percentage point increase in the overall CPI. |

A recent assessment by the Ministry of Planning and Investment suggests that inflationary pressure from the demand side (monetary factors) is not significant, but rather, it comes mainly from the supply side (production costs). This is an issue that needs particular attention and close monitoring to proactively devise price management solutions. Indeed, the data also shows that in 2023 and the first four months of this year, the economy’s production costs continued to rise, as the costs of most production inputs increased relatively, leading to cost-push inflation.

For instance, the Drewry’s World Container Index, a composite of container freight rates, rose sharply by 11% in week 20/2024 compared to the previous week, reaching $3,511 per 40ft container. This index is up 104% from the same period last year and 147% higher than the 2019 pre-pandemic average of $1,420. This is a consequence of the geopolitical tensions in the Middle East, including attacks on ships in the Red Sea since last year. These developments have strongly influenced the prices of goods, raw materials, and fuels imported into Vietnam.

|

According to the Vietnam Commodity Exchange (MXV), at the close of trading on Monday (May 20), 25 out of 31 raw materials saw price increases, pushing the MXV-Index up 1.33% to 2,376 points, the highest since mid-February last year. For example, wheat prices have reached their highest level in ten months, copper has set a new record, and silver has risen alongside gold and is currently at its highest level in 11 years.

Previously, data from the General Statistics Office showed that the average price of food commodities in the first four months of this year increased by over 16% compared to the same period last year, influenced by the rise in global food prices. As a result, the group of food and catering services in the first four months of this year increased by 3.7% compared to the same period last year, significantly impacting the overall CPI increase. In the current inflation basket, food and beverages account for about 25% of the total value.

Risks

Many experts argue that inflationary pressure this year will remain unpredictable, given factors such as gold and foreign exchange rates, which have been on an upward trend since the beginning of the year. Specifically, domestic gold prices have continuously risen, setting new record highs in recent weeks, in tandem with the surge in global gold prices.

As an economy with a high degree of openness, the US dollar/dong exchange rate significantly impacts the import price index, putting pressure on inflation. Vietnam’s production activities rely heavily on imported raw materials and resources from abroad. While domestic enterprises may not yet be able to secure their production inputs, foreign-invested enterprises tend to source from parent companies or affiliated companies in other countries to optimize profits.

According to statistics from the General Statistics Office, in the first four months of 2024, the import turnover of goods was estimated at over $115 billion, up 15.4% compared to the same period last year. Notably, production materials accounted for 94%, or about $108.33 billion. It is worth noting that not only the prices of production goods with imported raw materials have increased, but the prices of imported consumer goods will also rise.

One of the factors that will significantly impact inflation in the coming period is the adjustment of prices for goods managed by the State, including public services. After a nearly four-year delay or incomplete implementation in 2023, these prices will be further adjusted in 2024-2025. For example, medical examination and treatment fees have been implemented with the effectiveness of the Law on Examination and Treatment since the beginning of this year.

Among the goods with sharp price increases in the first four months of this year, some groups of public services managed by the State, such as education and healthcare, have been adjusted according to the roadmap, causing the education and healthcare service indexes to increase significantly by 9.4% and 8.5%, respectively, compared to the same period last year. This trend is likely to continue in the coming period.

Similarly, electricity prices are gradually moving towards market-based pricing, taking into account all input costs. Specifically, the Ministry of Industry and Trade has proposed considering further adjustments in 2024, following two increases last year. Along with shortening the electricity price adjustment period from six months to three months, price adjustments may occur as early as the second quarter of 2024. Currently, EVN is proposing to expand its authority to decide on price increases from below 5% to below 10%, which could lead to more substantial increases in the future.

Tensions in the Middle East are also pushing oil prices higher. After the Iranian President was killed in a plane crash on May 19, global oil prices surged. It is important to note that electricity and gasoline are two input fuels for most industries, and their price increases can push up the prices of most commodities, especially essential goods and services. Specifically, a 10% increase in electricity prices will directly impact a 0.33 percentage point increase in the overall CPI.

Finally, the synchronous reform of salary policies, effective July 1, 2024, may cause a chain reaction, leading to increases in many types of goods and services in the market, as has happened in the past. However, experts believe that price increase expectations are not strong at present, as people’s lives are still challenging, and they are cautious about spending.

Tuệ Nhiên