With an execution rate of 41% (1 share receiving VND 4,100) and over 9.3 million shares in circulation, it is estimated that PMC will pay out more than VND 38 billion in remaining dividends for 2023 to its shareholders. The expected payment date is June 17, 2024.

Source: VietstockFinance

|

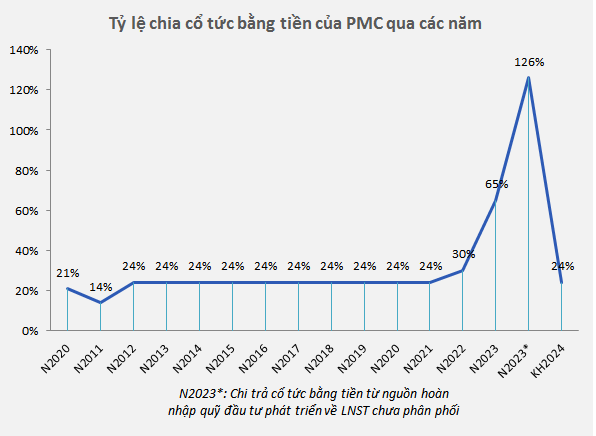

Initially, PMC’s cash dividend ratio, as approved by the 2023 Annual General Meeting of Shareholders, was set at 24% of charter capital. However, the company’s Board of Directors proposed and received approval at the 2024 Annual General Meeting to increase the dividend ratio for 2023 by an additional 41% of charter capital. Thus, the total cash dividend ratio for 2023 stands at 65% of par value, equivalent to nearly VND 61 billion.

Since mid-September of last year, PMC has paid the first and second installments of 2023 dividends, totaling a 24% distribution ratio (equivalent to more than VND 22 billion). Notably, the company also distributed dividends from the reinvestment fund’s reversion to retained earnings, amounting to 126% per share (nearly VND 118 billion).

Source: PMC’s 2023 Annual Report

|

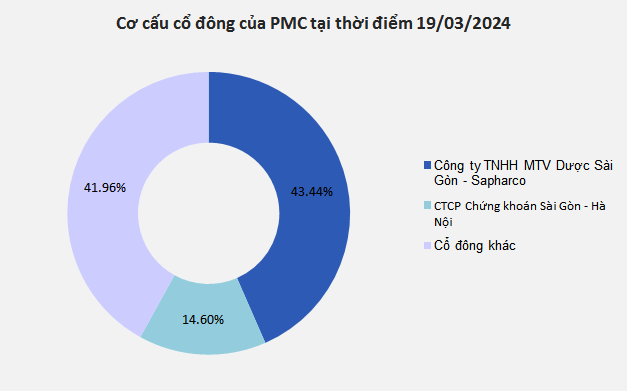

According to the 2023 Annual Report, as of March 19, 2024, Saigon Pharmaceutical – Sapharco JSC (a state-owned enterprise) was PMC’s largest shareholder, holding 43.44% of the shares. They are estimated to receive over VND 77 billion in dividends for 2023, including the additional payout from PMC’s reinvestment fund reversion.

Meanwhile, Hanoi Securities Joint Stock Company (SHS), with a 14.6% stake, is expected to earn more than VND 26 billion from the two dividend payments.

| PMC’s 2023 Financial Results |

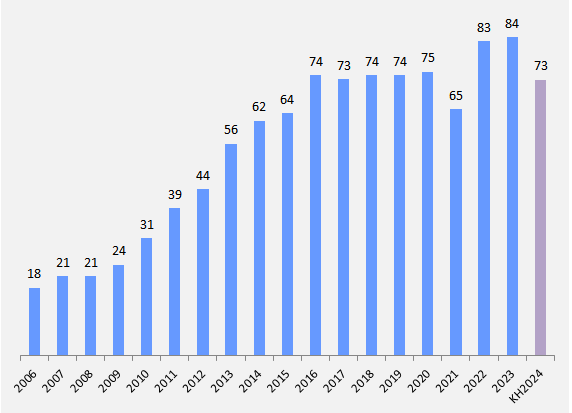

In 2023, PMC’s net revenue increased slightly by 3% compared to 2022, reaching over VND 485 billion. However, the cost of goods sold grew faster than revenue, increasing by 10% (due to higher promotional and complimentary item costs) which resulted in the company’s net profit remaining stagnant at over VND 83 billion.

Over the past five years, PMC has witnessed a shift in its production volume across different drug categories, with a rising trend in the production of liquid medicines, eye and nasal drops. The total production value has also increased slightly, averaging a 0.5% annual growth rate. The company’s pre-tax profit has grown at an average rate of 2.39% over the same period, thanks to accumulated profits from previous years (deposited in banks) that have boosted financial income (averaging a 33.7% annual increase).

Moving forward, from 2024 onwards, the declining bank deposit rates will likely lead to a decrease in financial income. Additionally, the cost of raw materials and packaging is expected to rise over time. Unless PMC finds alternative sources of raw materials at more competitive prices and implements solutions to improve productivity and increase production volume to reduce costs, the company may face challenges in maintaining the profit levels of 2022 and 2023.

|

PMC’s 2024 Net Profit Plan: In VND billions

Source: VietstockFinance

|

Therefore, PMC forecasts a net profit of VND 73 billion for 2024, representing a 13% decrease compared to the actual results of 2023.

| PMC’s Quarterly Financial Results |

In the first quarter of 2024, the company recorded net revenue of over VND 101 billion and a net profit of nearly VND 15 billion, both figures being roughly the same as the previous year’s first quarter. Compared to the annual plan, PMC has only achieved 18% of its profit target for the year.

|

Pharmedic Pharmaceutical and Medicinal Material JSC (PMC), formerly known as Pharimex Direct Medical Import-Export Company, was established in 1981. The company specializes in the production and trading of pharmaceuticals, medicinal materials, cosmetics, medical equipment, and other healthcare products. While their products are distributed nationwide, Ho Chi Minh City is their primary market. On October 9, 2009, PMC officially listed its shares on the Hanoi Stock Exchange (HNX). |