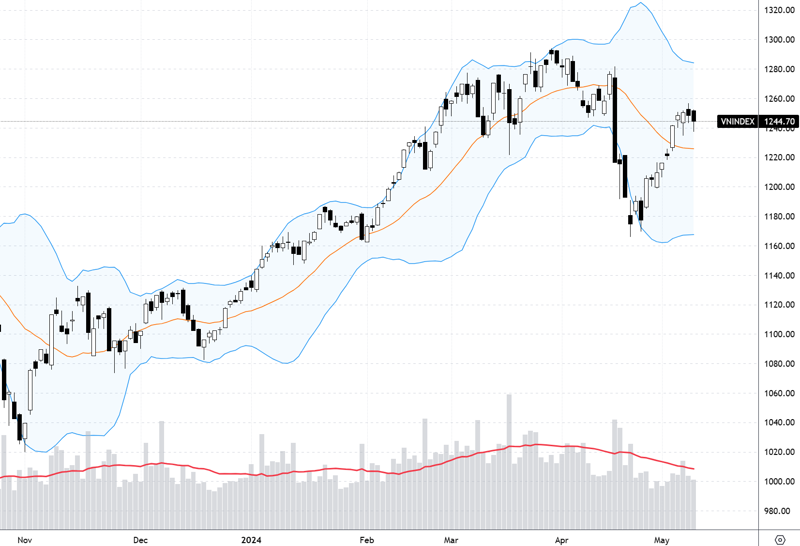

After four consecutive weeks of declines, the market suddenly picked up momentum last week and posted its fourth straight weekly gain, with the VN-Index approaching the March 2024 peak. After a cautious wait for further signals the previous week, experts are now optimistic and even expect the market to reach new highs.

Improved liquidity in the last three sessions of the week was one of the highly regarded signals. Previously, liquidity was cautious, but active trading towards the end of the week indicated the presence of “fomo” money. The market rose along with improved liquidity, demonstrating the ability to absorb profit-taking near the old peak. Some even argued that if the market were pushed up further, the “fomo” level would be even higher, and the market could “decisively” conquer the March 2024 peak.

Regarding the leading stocks, experts also observed a quick rotation of money flow, and there was no leading group of stocks that increased continuously. However, this is considered normal, and the possibility of positive effects from the rotational increase still exists.

May is usually considered a quiet period for news, but experts also pointed out some new positive factors, such as the Fed’s interest rate expectations after the April macroeconomic data, and the National Assembly is expected to approve the amended Land Law early… These are supportive factors. In addition, experts also suggested looking at market developments, as there have been no large-volume distribution sessions, the trend is still positive, although the market may experience strong fluctuations when approaching the peak.

Nguyen Hoang – VnEconomy

As VN-Index approaches the peak, selling pressure increases. Last week, you were still unsure if the market had peaked and were waiting for further signals this week. With new developments, do you think the market will break through the March peak?

Once the leading stock groups start to accelerate and combine with strong “fomo” money flow, I expect the market to decisively conquer the short-term peak around 129x.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Last week, the index signaled a break from the small sideways range of 1,234-1,257 points, indicating that it might have absorbed the supply in the 1,250-1,280 range, opening up the possibility of continuing the current uptrend. I think there may be a slight correction when approaching the old peak of around 1,290 points in the short term, but the signal indicates the possibility of breaking through the March peak. The market context is also brighter as supportive information has emerged, as I expected at the beginning of the month.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

VN-Index has now broken out of the downtrend channel and closed above the 20, 50, 100, and 200-day MA; although it faces strong resistance around the March peak, VN-Index is performing well, rebounding with strong money flow in the last three sessions after more than five sessions of accumulation. I am leaning towards the scenario that VN-Index will hover for another 1-2 weeks in the old peak area to absorb supply before “breaking” the peak.

Le Duc Khanh – Director of Analysis, VPS Securities

The market is performing better than expected, gradually rising and accumulating in the context of not much favorable information. VN-Index returned to strong resistance of 1,270 – 1,275 points, which may cause some corrections. I think that reaching the old peak and breaking through the 1,290-point mark can also happen within May.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The recovery momentum from VN-Index’s 1,170-point bottom is quite steep and has returned to the area where the index fell sharply in mid-April, so the pressure of fluctuations will increase during the upward journey.

However, in the last three sessions, liquidity has also been attracted back, so this steep increase will likely attract strong “fomo” investors in the coming time. In addition, the money flow is lacking in the fields with high capitalization ratio in VN-Index such as Banking, Real Estate, and Securities. Once the leading stock groups start to accelerate and combine with strong “fomo” money flow, I expect the market to decisively conquer the short-term peak around 129x.

Ho Nguyen Thuy Tien – Director of Individual Customers, Rong Viet Securities

At the end of the trading session, VN-Index increased by 4.33 points (+0.34%), closing at 1,273.11 points. Matched order liquidity on the HOSE increased to 830.8 million shares. VN30-Index rose 1.88 points (+0.14%), closing at 1,310.15 points. In the current area, VN-Index is close to the March, April 2024 peak.

Liquidity in the last three sessions has slightly increased compared to previous sessions, indicating that suppliers are increasing profit-taking, but money flow is still good and absorbing supply. With the signal of overcoming profit-taking pressure, the market has the opportunity to break through the resistance level of 1,277 points and expand the recovery momentum in the coming time. However, at the challenging area around 1,290 points, the market is likely to face strong fluctuations. Therefore, investors can expect the possibility of gradually expanding the market’s recovery momentum, but still need to pay attention to the supply, which tends to increase and cause disputes in the coming time.

Nguyen Hoang – VnEconomy

In this uptrend, the VN30-Index has performed stronger than the VN-Index. However, the leading stocks are not stable, and bank stocks surged on May 16 but weakened very quickly. Other pillars such as MSN, GVR, and HPG are also unstable and show clear profit-taking signals. Is this a sign of disagreement among money flows?

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

VN30 has outperformed VN-Index in the recent recovery and has re-approached the short-term peak in April, so the pressure of strong fluctuations in large-cap stocks is understandable. However, it can be observed that money flow is moving relatively positively, continuously shifting between sectors without focusing on any particular stock. This creates differentiation but still indicates the signal of active buying demand, and the index still has room to maintain the upward momentum.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In the recent period, I noticed that money flow rotated quite quickly between sectors, and many stocks rose sharply and then consolidated for a few sessions before rebounding. Although the money flow is not unanimous, looking at the VN30 movement, I do not see any signs of a peak confirmation, as VN30 is still above the old peak, and the indicators are quite positive. Therefore, if you are holding stocks that are moving slowly, investors should be patient and set a specific stop-loss level to manage risks.

I am leaning towards the scenario that VN-Index will hover for another 1-2 weeks in the old peak area to absorb supply before “breaking” the peak.

Nguyen Viet Quang

Ho Nguyen Thuy Tien – Director of Individual Customers, Rong Viet Securities

Recently, VN30-Index has outperformed VN-Index. However, the leading stocks are not stable.

Bank stocks surged in the session on May 16 but then showed a downward trend in the next session. Other pillars such as MSN, GVR, and HPG are also unstable and show clear profit-taking signals.

In the early stages of the uptrend, there were groups of securities, banks, steel, investment funds, and garment stocks that benefited from positive macroeconomic factors. A cautious mentality and limited disbursement, along with a short-term search for stocks with positive news, created short waves in some sectors.

I also noticed that the margin ratio increased significantly in some stocks in the recent sessions, while business results did not show any sudden positive changes. Liquidity has improved but is still low compared to the beginning of 2023, indicating a cautious market sentiment.

In my opinion, these factors cause disagreement among money flows in different sectors.

Le Duc Khanh – Director of Analysis, VPS Securities

Money flow goes into many different stocks but still focuses on fundamental and leading stocks, including speculative stocks. VN30 stocks attract investors’ attention because they are high-quality stocks, and this group tends to increase before large-cap and small-cap stocks. This is simply a characteristic of large-cap stocks performing better than the overall market in an uptrend.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

In this uptrend, VN30 is stronger than VN-Index, mainly due to the pull from stocks outside the banking sector, such as HPG, FPT, MWG, VJC, PLX, and GVR, while the banking group is weaker and only started to agree to increase on May 16, helping VN30 to break through the peak. Currently, I assess that money flow is still rotating quite well, and the leading stocks that have increased may take a short break while the banking group can take turns to pull VN-Index to break through the peak.

There is a basis for concern that the market will return to a downtrend in the current period. Investors should be cautious about new buying decisions, limit the use of margin, and closely control their investment portfolios to protect their achievements in this phase.

Ho Nguyen Thuy Tien

Nguyen Hoang – VnEconomy

From a technical perspective, if VN-Index fails to break through the old peak, this uptrend will still be limited to a normal recovery level. Some are concerned that the market will return to a downtrend, especially as the market enters a quiet period with little supportive information. What are your thoughts on this?

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

Currently, VN-Index is performing well, and there are no negative signs indicating that it will return to a downtrend: there have been no distribution sessions in the recovery, the number of rising sessions and liquidity in rising sessions are dominant, and there are no signs of divergence,… So, I think it is too early to worry about the market returning to a downtrend. When there are 2-3 distribution candles, signs of divergence, or reversal candle clusters, then it won’t be too late to manage risks.

Le Duc Khanh – Director of Analysis, VPS Securities

The market’s adjustment after VN-Index returned to the 1,270 – 1,290 area is normal; the important thing is how it will develop, which groups will increase or decrease alternately, and what the trading strategy should be. The medium-term uptrend is still confirmed, so the more important thing is to find stocks with better profit efficiency. If the overall market has not really entered a large wave, there will still be 10 – 15 stocks that perform better than VN-Index.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

From my perspective, VN-Index is likely to have confirmed a medium-term bottom at 1,166 points and is expected to continue to rise and break through the March peak. Therefore, I no longer think about the scenario of a downtrend returning and causing the market to break through the April bottom. If there is selling pressure around the old peak area, it is likely to be a short-term correction, and the probability of breaking through the 1,166-point bottom is very low.

As I mentioned above, positive information is emerging, including both international and domestic news. Last week, CPI data in the US met expectations, easing from the previous month, boosting the sentiment of US stock indexes, with the Dow Jones closing at the 40,000-point threshold for the first time in history. Asian markets also recorded a positive week, especially China, as the Chinese government is expected to introduce new policies to support the real estate market, which has been frozen for many years. Domestically, the National Assembly is expected to approve the early enforcement of the amended Land Law, helping to unfreeze the real estate market soon, and the news that the US will recognize Vietnam as a market economy has also boosted investor sentiment.

I think that reaching the old peak and breaking through the 1,290-point mark can also happen within May.

Le Duc Khanh

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

From a technical perspective, I think there are three notable resistance areas in this uptrend of VN-Index, namely 1,260 (+-10), 1,29x, and 1,330 (+-10). Successfully testing the short-term support level of around 1,260 points will be a good premise for VN-Index to break through the short-term peak of around 129x. At that time, the index is likely to face a significant correction at the medium-term resistance level of 1,330 (+-10) points.