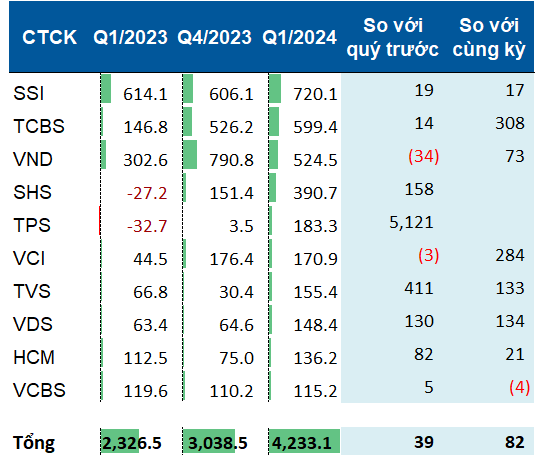

According to VietstockFinance, the total proprietary trading profits of securities companies in the first quarter reached over 4.2 trillion VND, nearly doubling that of the same period last year and a 40% increase from the previous quarter.

The results of the proprietary trading segment have significantly contributed to the first-quarter profits of the entire securities sector. The total profits of 78 securities companies exceeded 6,451 billion VND, a 114% increase from the same period last year. Compared to the previous quarter, profits rose by nearly 40%.

|

Top 10 Securities Companies with the Highest Proprietary Trading Profits in Q1/2024

Unit: Billion VND

Source: VietstockFinance

|

SSI Securities led the top proprietary trading profit list with a profit of up to 720 billion VND. Proprietary trading results increased by 17% and 19% compared to the same period last year and the previous quarter.

Techcom Securities (TCBS) ranked second, with a profit of nearly 600 billion VND. VNDIRECT Securities followed closely, reporting a profit of over 500 billion VND. However, the profit decreased by more than 33% compared to the previous quarter.

In this quarter, the proprietary trading of Saigon-Hanoi Securities (SHS) and Tien Phong Securities (TPS) witnessed strong breakthroughs, respectively reaching over 390 billion VND and 183 billion VND. In addition to turning losses into profits compared to the same period last year, these two companies also reported significant profit increases compared to the previous quarter.

The top-profiting group included many well-known securities companies, such as Vietcap Securities (VCI), Thien Viet Securities (TVS), Rong Viet Securities (VDS), Ho Chi Minh City Securities Corporation (HSC), and Vietnam Joint Stock Commercial Bank for Industry and Trade Securities Company (VCBS).

In terms of portfolio composition, SSI Securities focused on financial assets measured at fair value through profit or loss (FVTPL) in deposit certificates (25 trillion VND) and unlisted bonds (11.4 trillion VND).

In the equity portfolio, SSI held prominent stocks such as VPB, STB, FPT, and HPG. At the same time, to hedge the risk of covered warrants (CW), SSI held a significant amount of HPG and STB shares.

For TCBS, unlisted bonds were the “trump card” in their financial asset portfolio. As of the end of the first quarter, the company held more than 16.5 trillion VND in unlisted bonds. Their listed equity portfolio was valued at nearly 500 billion VND, temporarily recording a loss of over 7.5%.

VNDIRECT Securities’ FVTPL asset portfolio also focused on unlisted bonds (8.7 trillion VND) and deposit certificates (4.5 trillion VND).

The company’s equity portfolio was also significant, amounting to over 2.6 trillion VND in listed and unlisted stocks. Prominent stocks in their portfolio included VPB, HSG, ACB, C4G, and LTG.

Unlike the above-mentioned securities companies, SHS’s proprietary trading focused more on equities, including prominent stocks such as VPB, MWG, FRT, SHB, and TCD.

At TPS, unlisted bonds accounted for half of their FVTPL asset portfolio. The remaining half was evenly split between listed equities and deposit certificates.

Vietcap Securities is known for its massive available-for-sale (AFS) asset portfolio. At the end of the first quarter, the company held over 4.2 trillion VND in AFS assets, with a market value of more than 6.8 trillion VND, an increase of over 60%. Prominent stocks in their portfolio included KDH, PNJ, IDP, MSN, MBB, FPT, and TDM.

VCBS had a similar portfolio allocation to SSI, focusing primarily on unlisted bonds and deposit certificates.

TVS’s portfolio reflected a conservative strategy, with a high proportion of deposit certificates. In terms of equities, the company held stocks such as VNM, HPG, IDC, and KBC…

VDS adopted a strategy focused on equities. The company held stocks such as HSG, VNM, DBC, ACB, MWG, CMG, and QNS…

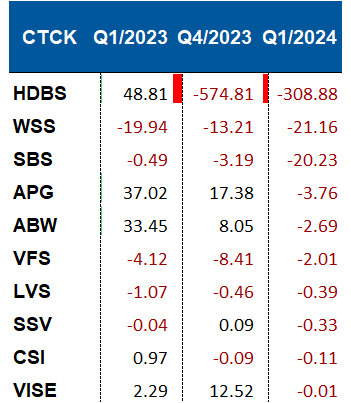

Despite favorable market conditions, some securities companies reported losses in proprietary trading. The heaviest loss was incurred by HD Securities (HDBS), with a loss of nearly 310 billion VND. The next two companies, SBS and Wall Street Securities (WSS), reported losses of about 20 billion VND each.

|

Securities Companies with Proprietary Trading Losses in Q1/2024

Unit: Billion VND

Source: VietstockFinance

|

HDBS primarily held unlisted bonds, valued at nearly 410 billion VND.

In the group reporting losses in proprietary trading, SBS invested in equities. Their portfolio recorded a loss of over 15%.

Wall Street Securities (WSS) held many UPCoM-listed stocks, such as HAF, ILF, and MGG.

FVTPL and AFS asset portfolios as of March 31, 2024