Illustration photo

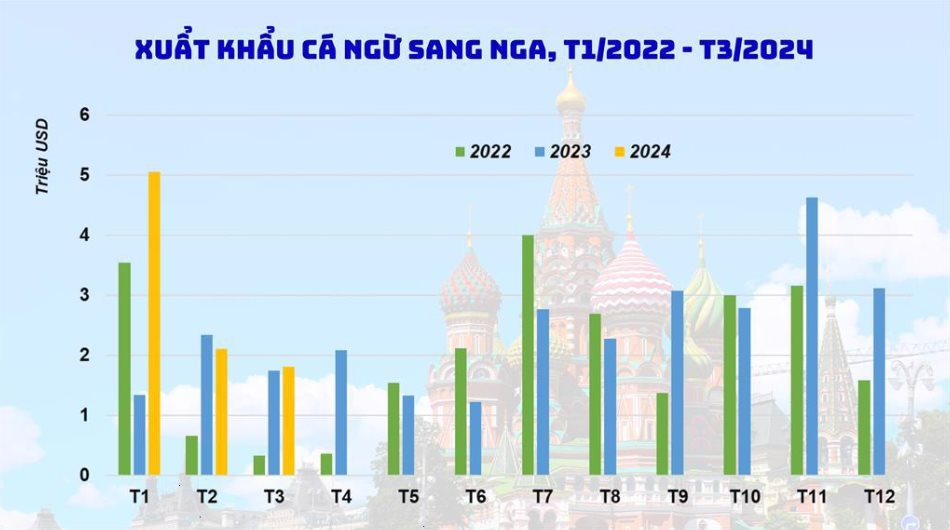

According to statistics from Vietnam Customs, Vietnam’s tuna export turnover increased from 14 million USD in 2021 to nearly 29 million USD in 2023. In the first three months of 2024 alone, the export value reached nearly 10 million USD, a sharp increase of 65% compared to the same period in 2023. With this growth rate, Russia is currently the fourth largest single market for Vietnam, accounting for 4.65% while the country’s tuna export turnover in the first quarter reached 215 million USD, up 19% over the same period in 2023.

Among Vietnam’s tuna products exported to Russia, frozen tuna meat/loin is the key product, accounting for 75% of the total export turnover.

In 2023, more than 15 Vietnamese enterprises participated in exporting tuna to the Russian market. Among them, Tuna Vietnam, Hai Trieu Co., Ltd., and AHFishco were the top three companies in tuna exports to Russia, accounting for over 61% of the total export turnover.

Source: Vietnam Association of Seafood Exporters and Producers (VASEP)

Currently, freight transportation from Vietnam to Russia is more favorable. Russian transport groups have opened direct routes from Ho Chi Minh City – Haiphong – Vladivostok, and some other shipping lines have launched new routes, making cargo transportation faster and shorter. In addition, there is also a railway transportation system supporting trade with Russia, making cargo transportation more diverse and easier.

Moreover, the tariff preferences after the signing of the Vietnam-Eurasian Economic Union Free Trade Agreement (VN-EAEUFTA) in 2015 have greatly enhanced the competitiveness of Vietnam’s seafood products, including tuna, in this economic market, especially in Russia.

Specifically, Vietnam is currently the third-largest supplier of tuna to the Russian market, after China and Thailand. While Vietnam’s key export product, frozen tuna meat/loin with HS code 030487, is exempt from export tariffs to Russia under the VN-EAEUFTA agreement, products from China and Thailand are subject to a 3.8% tariff.

The US has banned Russian fish products. Due to these restrictions, in 2023, Russia’s seafood exports decreased by 5% in value to 5.8 billion USD. After the sanctions were applied, China became the main market for Russian seafood purchases (accounting for 49.6% in volume and 49.8% in value).

For Vietnam, since the beginning of this year, Vietnamese tuna export enterprises have made efforts to expand the tuna export market right from the start of the year. In 2023, along with the difficulties of the world economy, Vietnam’s tuna exports brought in only 845 million USD, a decrease of 17%. In the first quarter of 2024, tuna products were exported to more than 80 markets, while last year it was 70 markets. However, experts predict that the tuna industry will struggle to achieve the billion-dollar target as in 2022.