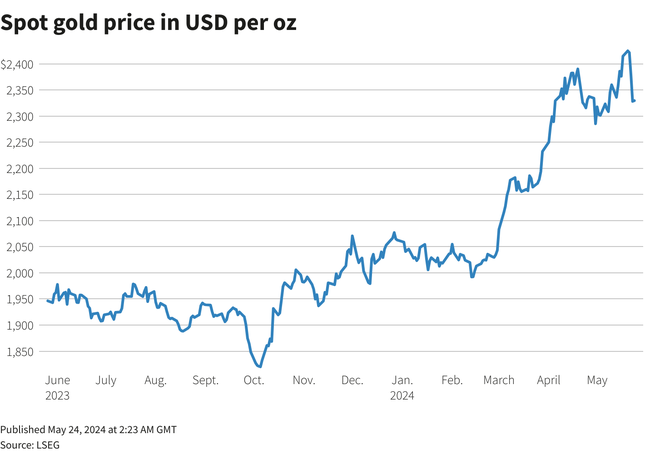

Gold spot prices closed at $2,330.19 per ounce on May 24, edging closer to May’s low. US gold futures continued to decline, slipping by 0.3% to $2,330.80 per ounce.

Reuters attributes this to a “daze”, as gold prices have been on a downward trajectory since peaking at $2,449.89 per ounce on May 20, the highest ever.

Just days after peaking, gold spot prices dropped by 5%. This marked the most substantial weekly decline in eight months. The sudden shift can be attributed to the Fed’s meeting minutes released on May 22, which indicated a potential rate hike instead of the expected cut.

Global gold prices are taking a hit.

Ilya Spivak, Head of Macro Strategy at Tastylive, commented to Reuters that the “hawkish tone” of the Fed’s May meeting signaled a lack of confidence in cutting rates. This boosted Treasury yields and the dollar, making gold less appealing.

The May 22 meeting minutes revealed that some Fed officials favored a rate hike, shattering expectations of a November rate cut, which had a 72% likelihood. While gold bullion is considered an inflation hedge by investors, higher interest rates make holding gold less lucrative.

Additionally, Spivak attributed the volatility in gold prices partly to China’s gold hoarding tendencies. Despite a 9% decrease compared to the previous year, the People’s Bank of China continues to prioritize gold accumulation, he added.

Meanwhile, silver spot prices rose by 0.4% to $30.21 per ounce. Platinum increased by 0.1% to $1,019.90 per ounce, and palladium climbed by 0.3% to $971.80 per ounce. All three metals are heading towards similar losses as gold.

In the oil market, Brent crude futures inched up by 2 cents to $81.38 per barrel, while West Texas Middle (WTI) crude futures dipped by 1 cent to $76.86 per barrel. Both oils are at their lowest levels in several months.

Brent crude futures are on track for a weekly decline of over 3%, while WTI crude futures are down nearly 4% from the previous week.

Oil prices stabilized as investors digested the Fed’s new stance on interest rates and higher US gasoline demand ahead of the Memorial Day weekend, marking the start of the summer driving season.

Attention now turns to OPEC+ (Organization of the Petroleum Exporting Countries and allies), who will decide on voluntary output cuts of 2.2 million barrels per day after their meeting in early June.