Illustration

Preliminary statistics from the General Department of Vietnam Customs indicate that exports of animal feed and raw materials in April brought in 89.29 million USD, a 12.2% increase from the previous month. Cumulative exports of this commodity in the first four months of the year exceeded 311 million USD, a 4% decrease compared to the same period in 2023.

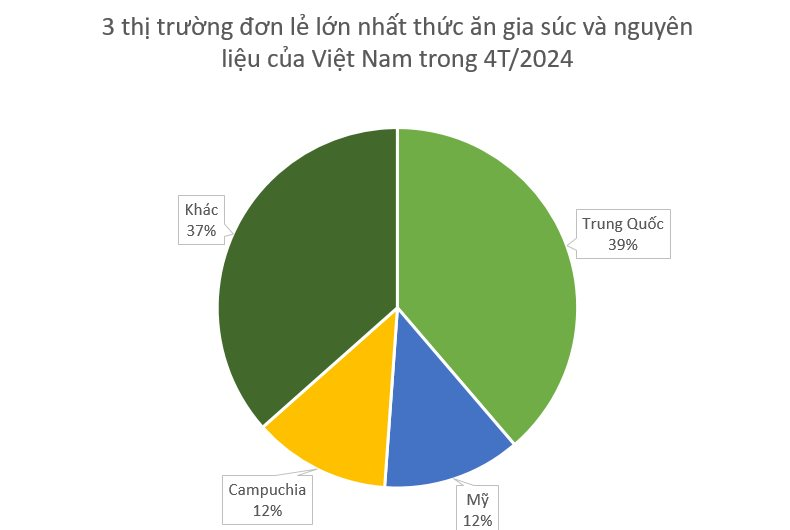

In terms of market share, China was the largest importer of Vietnamese animal feed and raw materials, with a total import value of 120 million USD in the first four months, despite a 16% decrease compared to the previous year. Notably, exports to China in April alone surged to over 40 million USD, marking a significant 30% increase compared to March.

The United States, the second-largest export market for Vietnam, has also significantly increased its imports of this commodity, reaching over 38.6 million USD in the same period, reflecting a remarkable 113% year-on-year growth.

Cambodia, the third-largest market, imported 38.4 million USD worth of animal feed and raw materials from Vietnam in the first four months, a 31% decrease compared to the same period last year.

Exports to the FTA-RCEP market reached 237.58 million USD, a 12.9% decrease compared to the same period last year, accounting for 76.3% of the total export turnover. On the other hand, exports to the FTA CPTTP market recorded a slight increase of 2.8%, totaling 42.99 million USD and contributing 13.8% to the overall turnover. Additionally, exports to the Southeast Asian market amounted to 99.86 million USD, a 10.9% decrease, making up 32% of the total.

According to a market study by Mordor Intelligence, the scale of Vietnam’s mixed animal feed market is expected to grow from 11.54 billion USD in 2023 to 15.30 billion USD by 2028, attaining a compound annual growth rate (CAGR) of 5.80% during the forecast period (2023-2028).

As of 2022, the top ten animal feed-producing countries were China (260.739 million tons), the United States (240.403 million tons), Brazil (81.948 million tons), India (43.360 million tons), Mexico (40.138 million tons), Russia (34.147 million tons), Spain (31.234 million tons), Vietnam (26.720 million tons), Argentina (25.736 million tons), and Germany (24.396 million tons).

Data from the Animal Husbandry Department estimates that industrial feed production in 2023 will reach 20 million tons, ranking Vietnam eighth in the world. Of this, pig feed accounts for approximately 55.7% (11.15 million tons), poultry feed constitutes around 40.8% (8.17 million tons), and the remaining 3.4% is for other animal feed.

From 2020 to 2022, animal feed prices soared, increasing by 40% compared to pre-2020 levels, creating significant challenges for large-scale farmers.

Towards the end of 2023, animal feed prices began to stabilize, and the potential reduction in import taxes on raw materials for animal feed production, including soybean meal, will provide a foundation for businesses to plan herd rebuilding and expand their operations in the coming years.

While Vietnam’s pig farming industry is among the world’s leading, it is highly susceptible to fluctuations in animal feed prices due to the reliance of feed manufacturers on imported raw materials. The country’s feed resource areas remain fragmented and small-scale, failing to meet the demands of businesses.

Experts emphasize the need for Vietnam to devise a well-structured and robust strategy to develop domestic feed resources. One crucial solution is to promote the cultivation of crops using biotechnology as feed sources, aiming for high yields and productivity to supplement the domestic supply and reduce imports.