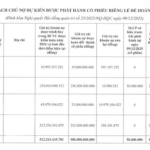

Vietnam’s Ministry of Transport has proposed a large-scale investment plan to upgrade the country’s expressway network, requiring significant external funding. The plan, presented to the government, includes upgrading 2-lane expressways, which are expected to cost around VND 87.5 trillion, with state capital contributing VND 82.56 trillion (only VND 6.039 trillion has been allocated so far). The remaining VND 5 trillion needs to be raised from investors.

For the 4-lane expressway upgrades, an estimated VND 425.705 trillion is required, with state capital accounting for VND 412.570 trillion (VND 2 trillion allocated, and VND 410.572 trillion still needed). Approximately VND 13.140 trillion needs to be sourced from investors for this portion.

Upgrading the Ho Chi Minh City – Trung Luong Expressway to 8 lanes is estimated to cost VND 22.2 trillion, but attracting private investment has proven challenging.

Notably, the Ho Chi Minh City – Trung Luong Expressway (40km long) will require approximately VND 22.2 trillion to upgrade to 8 lanes as per the approved plan. This project is expected to be entirely funded by external sources and implemented through a PPP model.

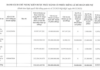

Additionally, projects such as the Hoa Lac – Hoa Binh, Tuyen Quang – Ha Giang (in Tuyen Quang province), Hoa Binh – Moc Chau (in Hoa Binh province), and Huu Nghi – Chi Lang expressways will require significant external funding to complete the approved number of lanes.

Despite revisions to the Law on Investment in the form of Public-Private Partnerships (PPP Law), which took effect on January 1, 2021, this model has not attracted much interest from investors. According to the Ministry of Transport, only 6 PPP projects have been approved since the law came into force.

Previously, the PPP model faced challenges in 8 projects during the first phase of the North-South Expressway (2017-2021), with 5 projects lacking bank guarantees and 2 projects encountering prolonged credit negotiations.

“In countries with a strong PPP investment model, infrastructure project funding comes from diverse sources, including seed money from the state budget, project bond issuance, equity capital from enterprises, and loans from financial institutions or highway development funds. However, in Vietnam, the highway development fund has yet to be established, and while project bond issuance is mentioned in the PPP Law, there are no implementing guidelines. As a result, when banks do not commit credit, investors lose out on opportunities.” – Chairman of VARSI

The Vietnam Expressway Corporation has revealed that while some expressway upgrade projects are being processed under the PPP model, they are facing certain difficulties. In many cases, local transportation plans are not well-coordinated, leading to situations where the state invests in a PPP project in one area while simultaneously constructing a parallel project using public investment in another area, resulting in reduced traffic flow and revenue for the PPP project.

“PPP projects in transportation often involve substantial investments, making businesses heavily reliant on bank loans. When a project fails to generate sufficient revenue, banks become concerned about the risks associated with PPP projects and tighten their long-term credit policies, making it challenging for businesses to access bank credit,” said a representative from the Vietnam Expressway Corporation.

Ensuring Equity and Building Investor Trust

In an interview with Tien Phong, TS Nguyen Huu Duc, a senior consultant on transportation planning for JICA (Japan International Cooperation Agency), pointed out that PPP investments in transportation offer relatively low profits but carry significant risks related to project effectiveness.

For instance, PPP contracts may contain clauses that are unfair to the private sector, and constant changes in legal regulations, along with delays in resolving issues, can deter businesses from investing. According to Duc, the current regulation limits state capital participation in PPP projects to no more than 50% of the total investment. This fails to ensure the feasibility of transportation infrastructure projects, which often require substantial land clearance funds before construction can begin.

Additionally, the risk-sharing mechanism, which includes state support through budget reserves or commitments to share the burden of emerging risks with the private sector, is inadequate in the PPP Law’s provisions.

“State planning often lacks coordination, leading to financial plan disruptions for investing enterprises. Moreover, when risks arise, the resolution process can be protracted, as seen in recent BOT projects, causing businesses to lose trust,” Duc added.

According to PGS.TS Tran Chung, Chairman of the Vietnam Road Traffic Infrastructure Investors Association (VARSI), the essence of the public-private partnership model is a contract between the state and private investors to divide benefits, risks, and responsibilities in constructing a work or providing a public service.

While the two parties are equal partners through the project contract, the state’s position as a managing authority in the “partner” role still carries the imprint of a public authority, leading to inequality between the two sides. This is a significant reason why investors are hesitant about this relatively new investment model.

Given the current context, with limited opportunities for PPP transportation projects using the BOT model, it is necessary to develop other contract types to attract capital. To draw businesses into PPP projects, the state should offer diverse capital support and create transparency and equity to build investor confidence, encouraging them to invest in building a better Vietnam and serving its people.