|

Deputy Governor of the State Bank of Vietnam Dao Minh Tu at the event on May 22, 2024.

|

This information was shared by Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu at the launch ceremony of the Vietnam ESG Forum, held on May 22, 2024.

Vietnam Actively Engages in Green Transition Commitments

Mr. Dao Minh Tu acknowledged that ESG practices, green growth, and sustainable development have become an inevitable trend and a goal that all countries are striving towards. Vietnam is among the nations facing significant environmental and social challenges and is heavily affected by climate change, which negatively impacts its economic development and the well-being of its citizens. Therefore, in recent years, Vietnam has actively participated in international commitments towards a green transition, reducing greenhouse gas emissions, and mitigating the impacts of climate change, with the aim of achieving sustainable development.

The SBV Deputy Governor shared that, among nearly 150 countries committed to the Net Zero target, Vietnam has been one of the fastest to take timely action to fulfill this commitment by issuing a policy framework for green growth.

As a crucial financial provider for the economy, the banking sector has always recognized its role and responsibility in “greening” investment capital for sustainable development goals, including the application of environmental, social, and governance (ESG) criteria, contributing to the realization of sustainable development. This stems from four key factors.

The four factors include the increasing ESG regulations that require banks to comply and continuously update their policies and practices to demonstrate their environmental and social responsibility; enhancing the reputation of banks by integrating and transparently reporting on ESG-related matters; improving risk management effectiveness, as ESG risks are not standalone but interconnected with the risks of credit institutions; and by adopting ESG, credit institutions have the opportunity to expand their market reach and develop credit products while attracting green investment capital from international financial organizations.

The SBV has also issued numerous directives and circulars to promote green credit growth and manage environmental and social risks in credit activities, guiding credit institutions to develop green banking practices that focus on environmental protection, combating climate change, and fostering green growth and sustainable development.

47 Credit Institutions with Green Credit Outstanding Balances

According to Mr. Dao Minh Tu, during the 2014-2020 period and the follow-up until 2024, credit institutions have shown a shift in their mindset towards sustainable practices. Many credit institutions, based on SBV regulations, have proactively collaborated and received green capital, technical assistance, and guidance from international financial organizations to establish internal regulations for managing environmental and social risks in their credit operations.

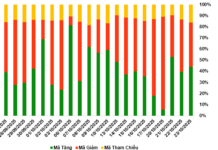

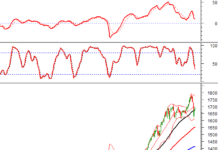

From 2017 to 2023, the credit balance of the system for green sectors achieved an average growth rate of more than 22% per year. As of March 31, 2024, 47 credit institutions had green credit outstanding balances totaling VND 636,964 billion, accounting for approximately 4.5% of the total outstanding credit balance of the economy. The credit balance assessed for environmental and social risks by the credit institution system has grown steadily over the years, reaching approximately VND 2.9 million billion, or over 21% of the total outstanding loans of the economy.

“The SBV understands that practicing ESG, greening the banking industry, and aiming for sustainable development goals present both opportunities and challenges. It requires urgency and determination, from awareness to action, and a step-by-step improvement of monetary and credit policies to support the implementation process of credit institutions”, affirmed Mr. Tu.

Moving forward, the SBV will continue to refine the legal framework to enhance the management of environmental, social, and climate risks in the credit activities of credit institutions. Simultaneously, the SBV will closely monitor, provide guidance, and promptly address any difficulties faced by credit institutions in implementing environmental risk management as stipulated in Circular 17/2022.

The SBV will also instruct credit institutions to focus their resources on financing green economic sectors and projects that contribute to achieving the country’s low-emission growth model. Additionally, the SBV will guide credit institutions in providing green credit and reporting on the implementation of green credit after the Prime Minister issues the National Green Classification List.