Gold bars stacked in a vault

China is currently selling US Treasury bonds while actively buying raw materials, particularly gold. The country is experiencing a gold rush, accompanied by a surge in demand for copper and silver.

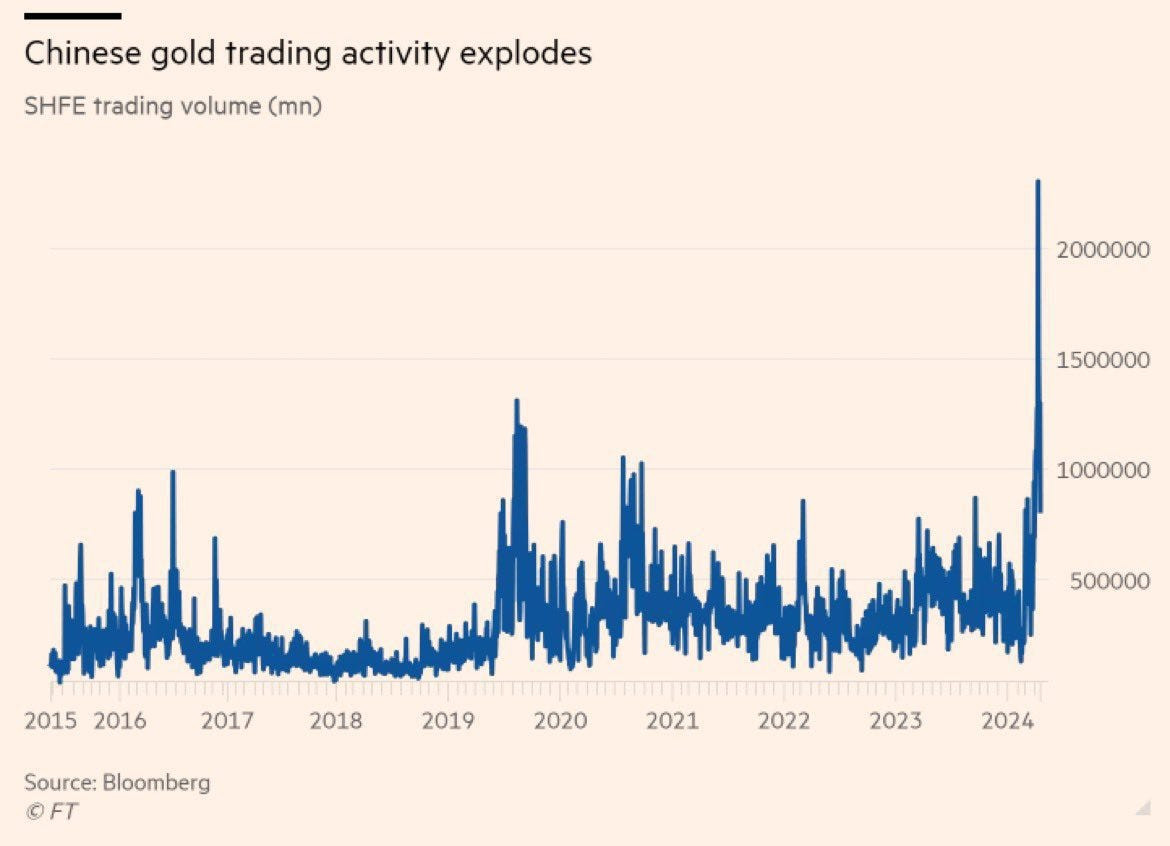

Last week, gold prices broke historical records, with China being the main driver of this surge. Trading volume on the Shanghai Exchange (SHFE) has exploded in recent days:

Shanghai Gold Exchange trading volume

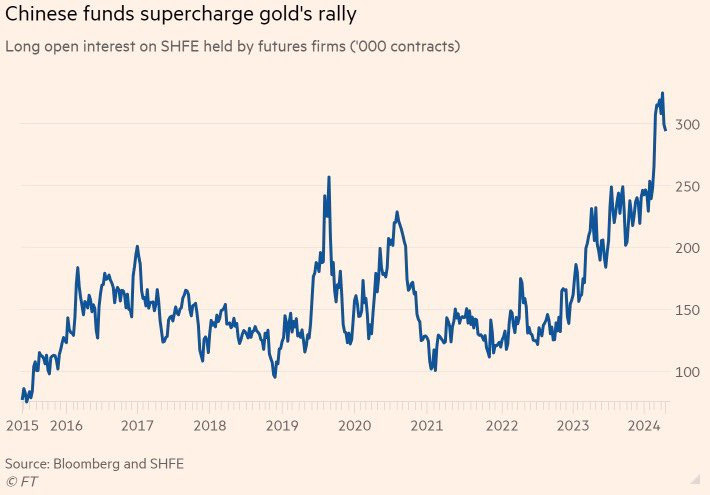

This trading frenzy is accompanied by a record number of open long positions in the futures market:

Number of open long positions on the Shanghai Exchange (in thousands)

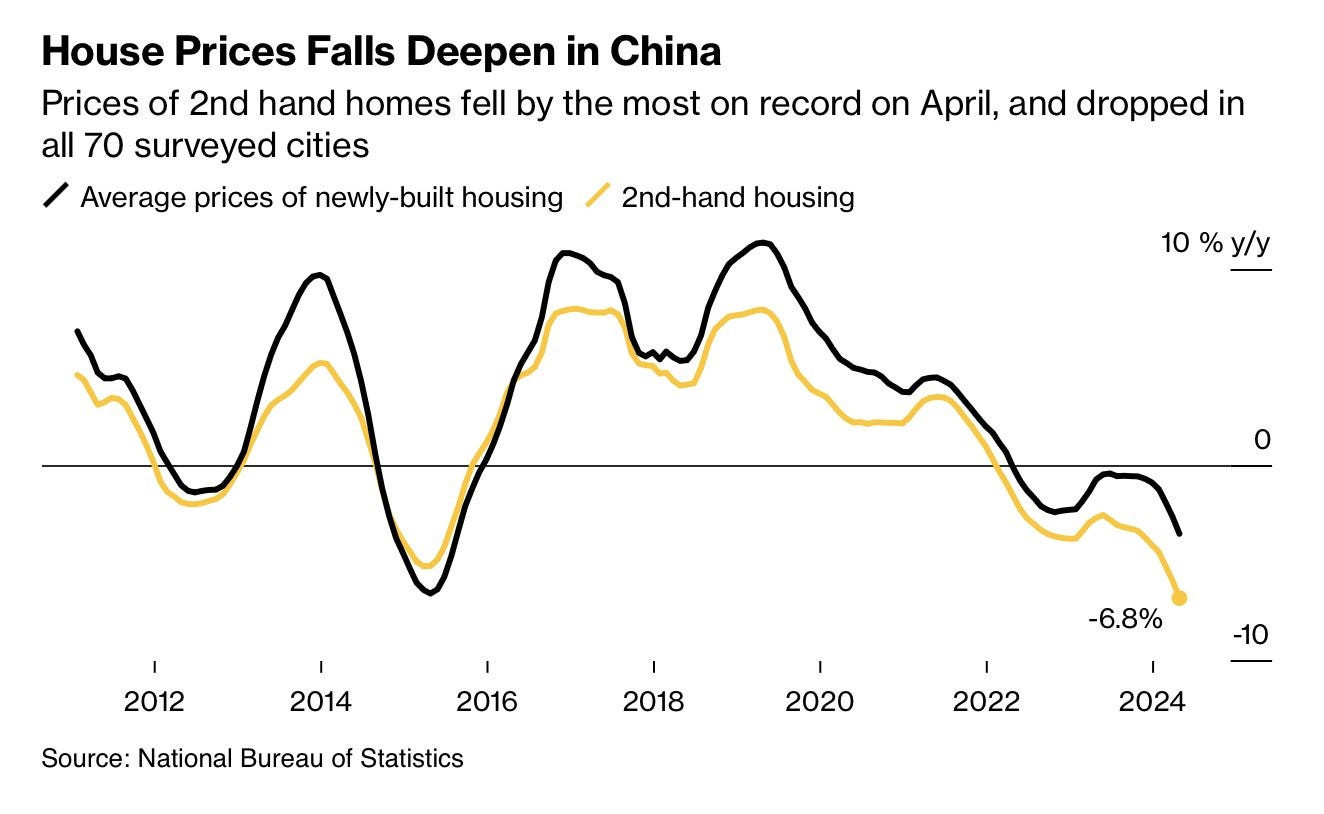

What is behind this increased interest in gold among Chinese investors? Gold has become a preferred asset as the stock market underperforms and the real estate market declines.

In fact, in recent weeks, the decline in China’s real estate market has accelerated:

The first drop in real estate prices coincided with the start of the gold rush in China. Additionally, the surge in gold demand coincides with the accelerating downturn in the real estate market. Property prices have fallen by 6.8% year-on-year, an unprecedented figure in contemporary Chinese economic history:

China’s used home prices in April 2024 fell at a record pace and declined in all 70 cities surveyed.

The importance of the real estate sector and the scale of debt in this industry have raised concerns about massive intervention by China’s monetary authorities. Such actions would significantly impact the value of the yuan.

Is the gold rush a sign of an impending currency devaluation?

Regardless, this gold rush is accompanied by a surge in other metals. Copper prices also soared to new record highs last week. This occurred as the slowdown in China’s real estate market was expected to put downward pressure on this industrial metal.

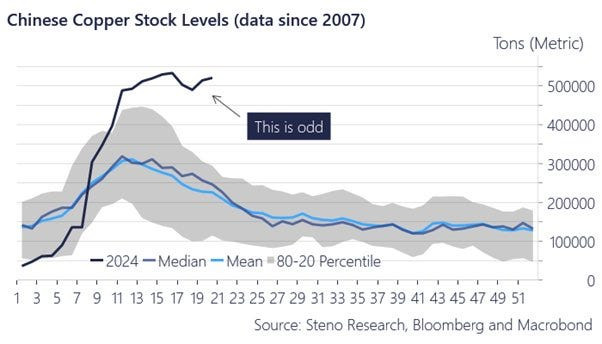

In reality, China’s copper inventories are much higher than expected, and analysts are closely examining stock levels, concluding that the short-term outlook for copper is bearish.

At current prices and inventory levels, it would be reasonable to predict that China will continue to export large volumes of copper:

China’s copper inventories are currently very high.

However, from another perspective, the high copper inventories due to the real estate downturn contradict a new reality: China is building up its raw material reserves.

Why is China stockpiling so much copper?

By accumulating metals, China is removing physical inventories from the market.

Procuring copper is becoming particularly challenging, especially in Western countries. The significant price difference between the New York Mercantile Exchange (NYMEX) and the London Metal Exchange (LME) has shaken the global copper market, leading to a surge in supplies to the US. The disconnect between paper and physical markets highlights the difficulties in sourcing physical metals.

The scarcity of physical supplies indicates a tight market and is a key reason for the recent surge in copper prices:

The COMEX-LME copper price spread (premium) is at a record high.

The disconnect between the paper and physical markets could force manufacturers to enter into over-the-counter (OTC) transactions with producers. For copper, we seem to have entered a new environment in terms of supply.

This pressure on copper is also reflected in the fact that copper concentrate refining charges are now negative for the first time in history. In other words, refiners are willing to pay their suppliers to continue receiving copper ore. There is an increasing scarcity of copper ore supplied to the refining market, where competition is intensifying.

Another metal that took a big leap last week was silver.

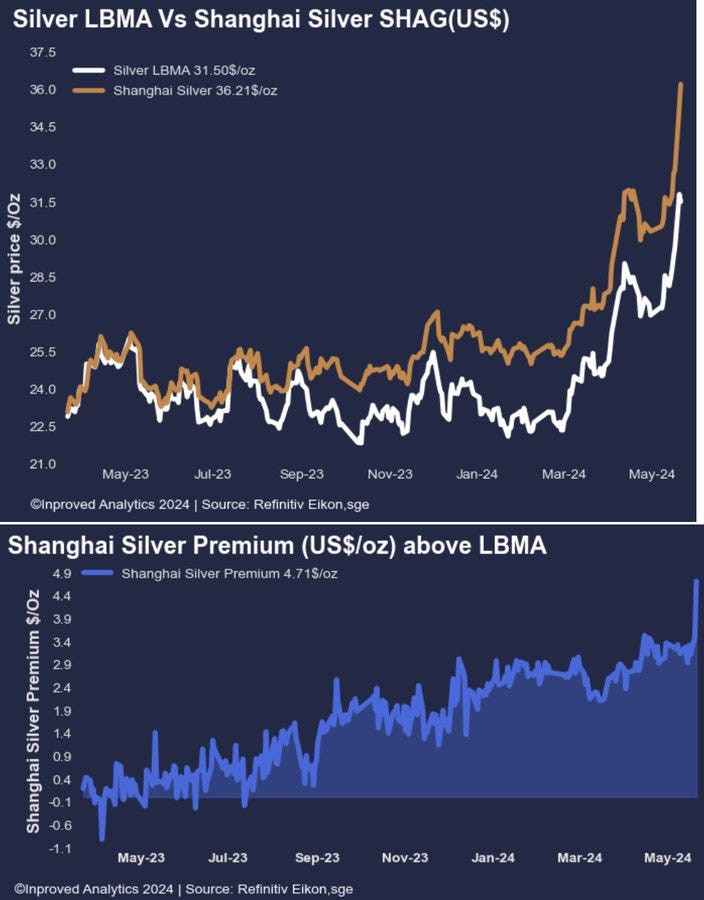

Silver prices on the Shanghai Exchange continued to break records, while the price spread between the Chinese and London markets is also at a historical high:

Silver prices on the LBME and SHFE.

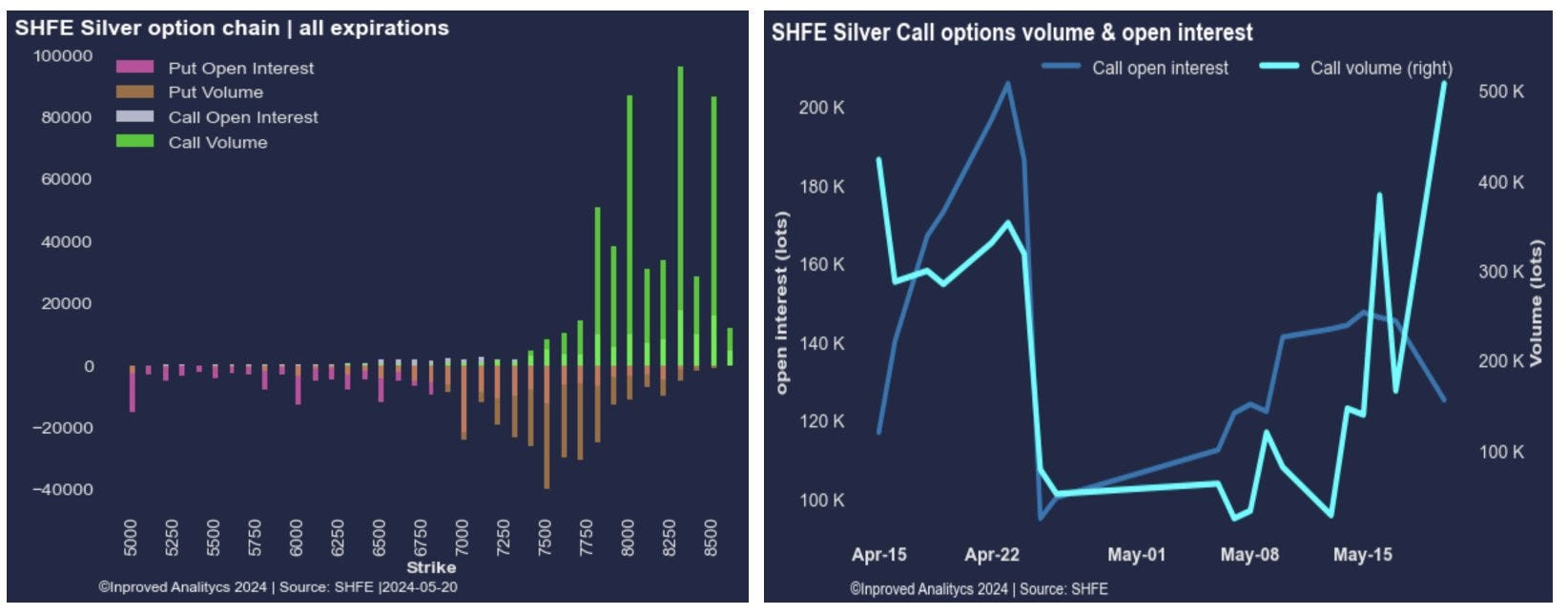

The volume of silver futures contracts on the SHFE also hit an all-time high. The strong inflow of buy orders even forced the Chinese government to increase margin requirements to curb speculation:

Information on silver trading on the SHFE.

China’s gold rush is turning into a silver rush! This phenomenon has not been observed in Western countries.

Nominally, silver prices have returned to levels last seen 11 years ago, but in reality, there is still a long way to go to reach the peak achieved in 2020, which was equivalent to $34.45 per ounce. At present, silver prices have yet to catch up with inflation:

Silver prices adjusted for inflation.

Looking back at the peak in 1980, we can see that silver still has a long way to go to reach its value at that time. In fact, after adjusting for inflation, silver prices have declined significantly over the past 45 years. The silver-to-inflation ratio is currently trying to break through the boundary between increase and decrease.

The continuous rise in silver prices indicates that the metal is breaking out of its downtrend. This signal is what many investors have been waiting for to return to mining companies.

In China, the current gold rush is accompanied by a surge in copper and silver.

This rush for physical metals occurs as China accelerates its sale of US Treasury bonds. China has reduced its holdings of US Treasury bonds for three consecutive months, liquidating a total of $76 billion. China’s reserves now stand at $767.4 billion, returning to similar levels as in 2009.

Reference: Goldbroker