The global coffee market is bracing for a significant event as Volcafe, a leading coffee trading company based in Switzerland, forecasts a fourth consecutive year of unprecedented Robusta coffee shortage.

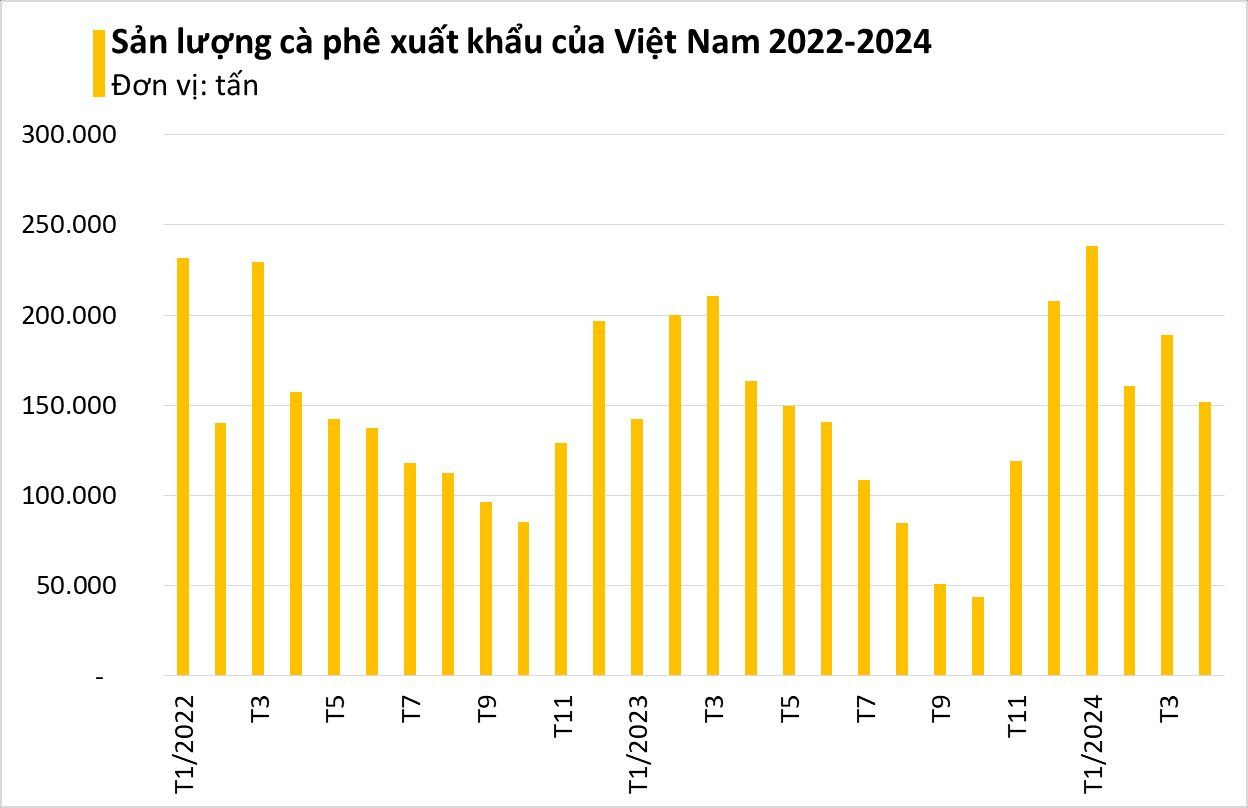

This dire situation stems from Vietnam, the largest producer of this coffee variety, as it continues to battle drought conditions impacting its yield.

According to Volcafe’s report, Vietnam’s Robusta coffee output for the 2024/25 crop year is anticipated to reach only 24 million bags (each bag weighing 60 kg), the lowest in 13 years.

The lack of rainfall in Vietnam has caused irreversible damage to the coffee flowering season. Additionally, reduced fertilizer usage and a shift towards durian farming, which has decreased coffee-growing areas, have further exacerbated the situation.

Robusta coffee holds a significant role in Vietnam’s coffee exports, accounting for 90% of the total. Consequently, Vietnam is ranked as the world’s second-largest coffee bean producer and the top producer of Robusta coffee.

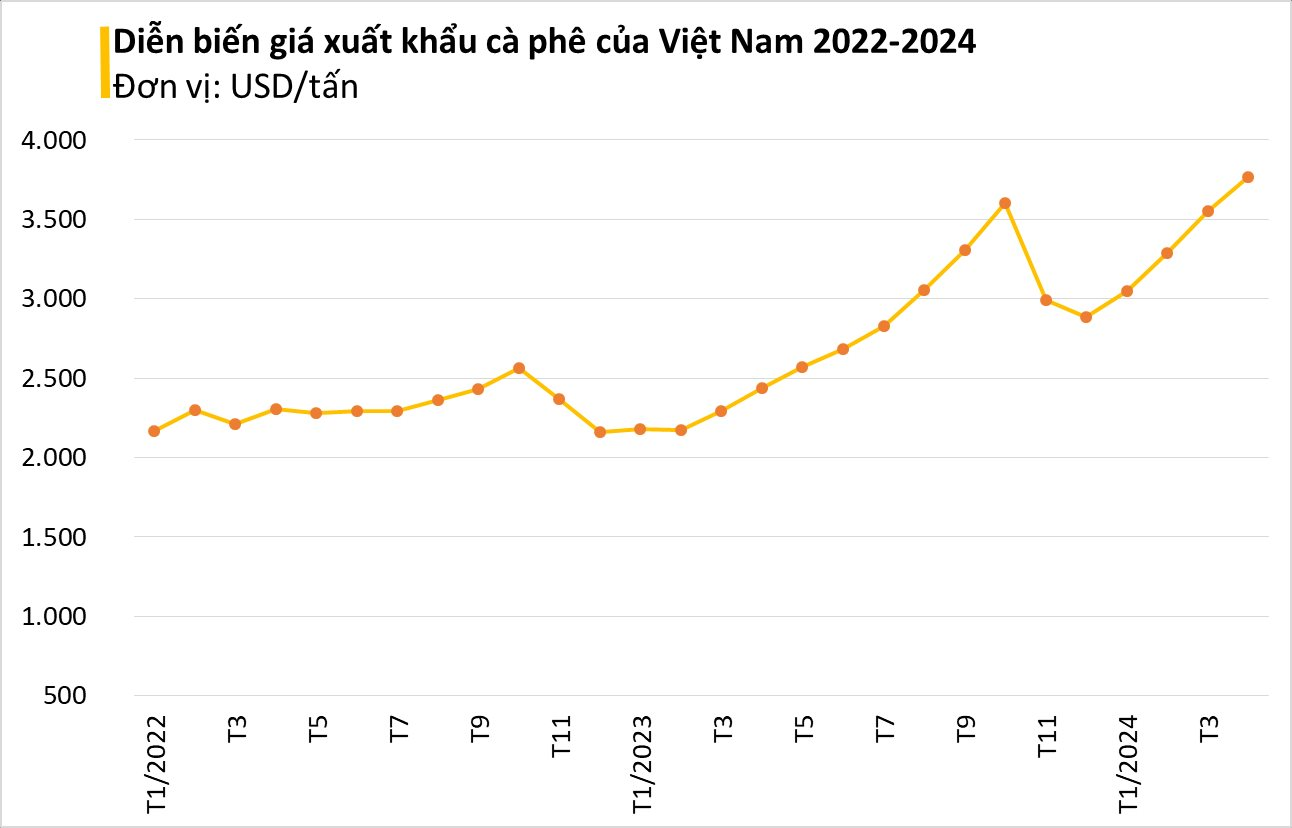

Volcafe predicts a global Robusta coffee deficit of 4.6 million bags for the 2024/25 crop year, down from the previous season’s 9 million bags. This supply constraint has fueled a boom in Robusta coffee prices, with futures traded in London surging to new highs above $4,300 per ton in late April.

To address the current Robusta coffee shortage, Volcafe suggests that prices must rise further to curb demand or encourage buyers to opt for more Arabica coffee.

This forecast is less than ideal for coffee enthusiasts who are already facing higher costs for their daily brew.

The world is facing a shortage of the less expensive Robusta coffee variety due to the El Niño weather phenomenon, which continues to wreak havoc on crops in Southeast Asia.

The demand for Robusta coffee has been driven by the growing popularity of instant coffee in emerging markets. However, the company predicts that this demand will slow down as cost increases are passed on to consumers.

“Blends with a high proportion of Robusta are still significantly cheaper than those with a high proportion of Arabica. Therefore, consumers continue to opt for Robusta-heavy blends,” the report stated.

According to the report, the industry’s demand has shifted towards Arabica beans in the last six months. However, a stronger shift or a more significant reduction in Robusta demand is necessary to alleviate the tight supply situation.

Record exports from Brazil, the second-largest Robusta coffee producer, in the previous crop year are offsetting the shortage in Asia. Nevertheless, Brazil’s Robusta coffee production is expected to decline in the 2024/25 crop year due to severe drought and heat waves last fall, according to Volcafe.

The outlook for Arabica coffee supply is more positive, and global supply for this variety is expected to exceed consumption in the 2024/25 crop year. However, Volcafe forecasts only a slight surplus of 700,000 tons for Arabica due to unfavorable weather conditions in Vietnam, Brazil, and Central American countries.

The state of Minas Gerais, which accounts for about 30% of Brazil’s Arabica coffee production, received no rainfall last week, marking the fourth consecutive week without precipitation.

Reference: Yahoo Finance