Shareholders raise concerns about customer service at Ha Long Beer and Beverage JSC’s annual general meeting.

A shareholder suggested that as the company develops, there is a need to establish standards and regulations on employee conduct.

In response, the company’s leadership shared that they had previously terminated over 200 employees, including sales directors, department heads, and customer service staff, due to poor attitudes towards customers in 2022.

Ha Long Beer and Beverage JSC, listed as HLB on the stock exchange, has a long history dating back to 1967. With a modest market capitalization, the company has gained attention for its high share price and generous cash dividend payouts.

HLB has consistently paid high dividends, with a 150% payout in 2022 and a 100% payout in 2021. The company’s large shareholders, including Aseed Holdings and the family of the former chairman, Doãn Văn Quang, have benefited significantly from these dividends.

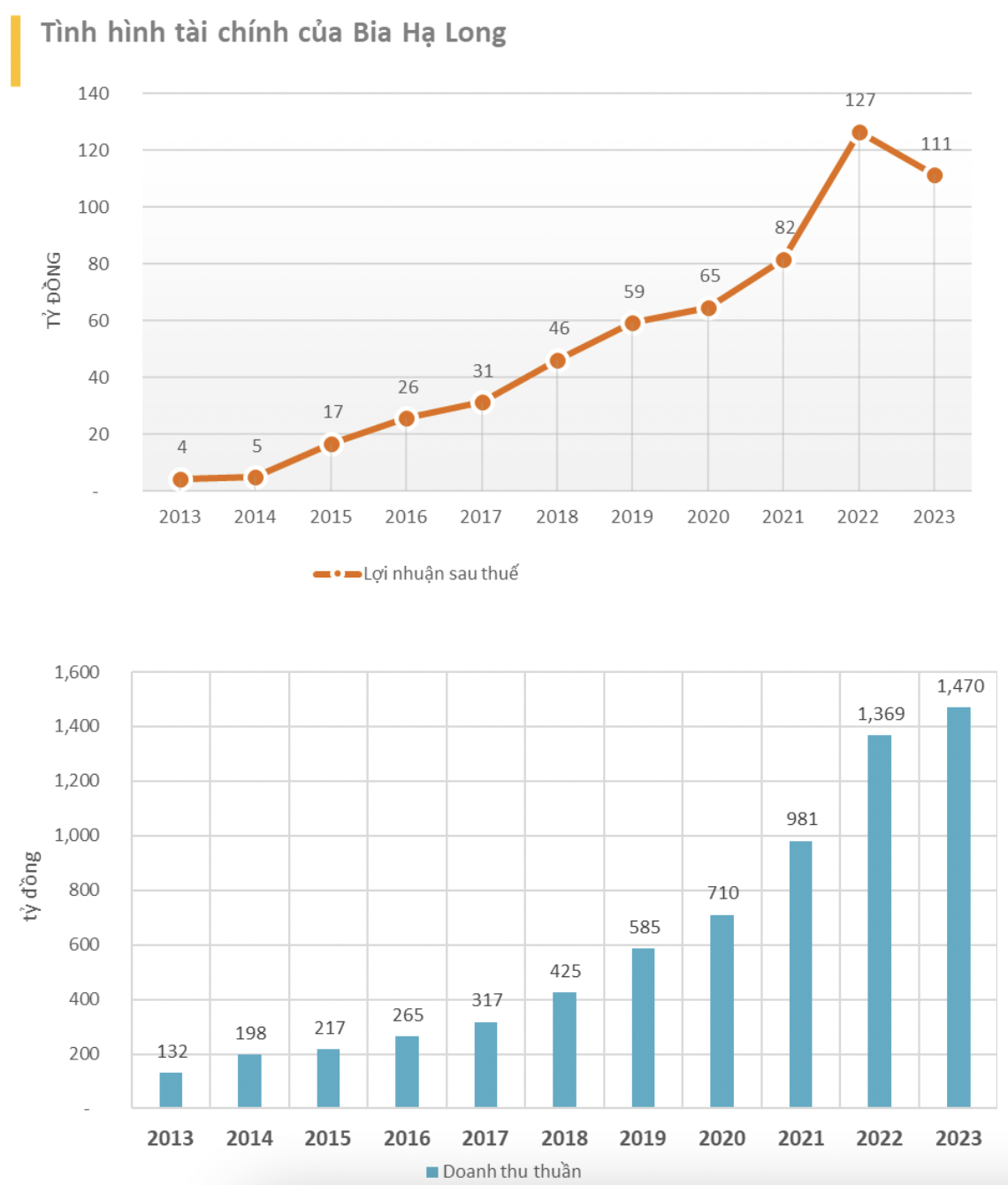

HLB’s 2023 audited consolidated financial statements revealed a challenging year for the company. While revenue increased by 7.4%, net profit after tax decreased by 12% compared to 2022. The company attributed this to economic downturns, reduced consumer spending, and stricter regulations on alcohol consumption.

Additionally, input costs for raw materials, fuel, and packaging increased by at least 20%, and the Russia-Ukraine conflict disrupted supply chains.

Looking ahead, HLB forecasts a 19% increase in revenue for 2024 but expects a nearly 12% decline in net profit. The company plans to distribute a cash dividend of 90% for 2023.