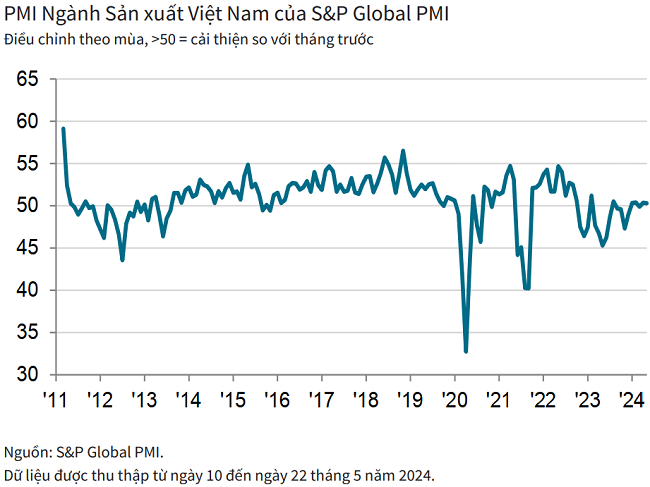

On June 3, S&P Global released the Purchasing Managers’ Index (PMI) report for Vietnam’s manufacturing sector for May 2024. The report highlighted three key points: manufacturing output increased for the second consecutive month, employment continued to decline, and input costs rose to a near two-year high.

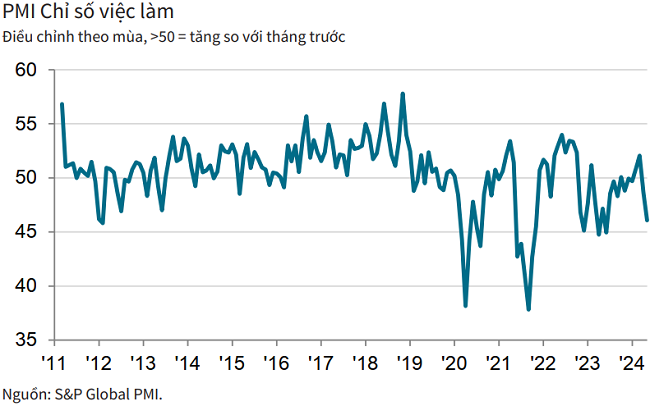

According to the report, Vietnam’s manufacturing growth slowed in May. Strong new order growth led to a faster increase in production. Companies also stepped up their purchasing activity, but employment fell for the second month in a row due to resignations and extended staff absences.

Meanwhile, input cost inflation accelerated significantly during the month. In response, manufacturers raised their selling prices for the first time since February.

New orders continued to rise sharply in May as stronger demand helped companies attract new clients and secure new orders. However, the rate of growth was slightly slower than in April.

New export orders also increased, although at a slower pace than total new orders. The rise in total new orders encouraged manufacturers to boost production for the second month in a row. Moreover, the rate of increase was faster and the strongest since September 2022.

Despite the rise in new orders and output, manufacturers reported a second consecutive monthly drop in employment in the middle of the second quarter. Survey participants attributed the decline to resignations and extended staff absences, with the latest fall being the sharpest and most marked in almost a year.

Despite the lower staffing levels, companies were able to manage their workloads in May, which led to a reduction in backlogs after a slight increase in the previous survey period.

While employment continued to fall, purchasing activity rose further in May as companies sought to meet higher production requirements. This was the second increase in as many months, and the rate of growth was more pronounced than in April.

Companies that purchased inputs during the month faced steep price rises. In fact, the rate of inflation accelerated significantly and was the fastest since June 2022. Some survey participants mentioned that the weak currency contributed to higher material prices, while others reported increases in oil and fuel prices. About a quarter of respondents reported higher input costs, while 5% noted a decrease.

The sharp rise in input costs led to an increase in selling prices, which was the first time in three months. The rate of inflation was one of the two fastest in 15 months, matching that seen in October 2023.

After no change in April, suppliers’ delivery times lengthened slightly in May. Survey members mentioned that shortages of goods and geopolitical issues were the reasons for the delay.

Meanwhile, stocks of both purchases and finished goods continued to decline, with the respective phases of reduction extending to nine and five months.

Plans to expand factories, launch new products, and expectations of further new order growth supported positive sentiment about output over the coming year. Business confidence was largely unchanged from April, remaining below the index average and indicating relatively low optimism.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, stated that the data for Vietnam’s manufacturing PMI was mixed. On the positive side, new orders continued to rise sharply, with signs of sustained demand growth leading to stronger production expansion in May.

On the other hand, there were concerns about employment and inflationary pressures. Employment continued to fall sharply, potentially limiting the production capacity of companies. Meanwhile, the rate of cost increase was the fastest in nearly two years, leading to higher output prices. This could have a dampening effect on demand in the coming months.

Overall, companies remained optimistic about the future, hoping that their success in attracting new orders would help overcome the countervailing factors affecting other aspects of their business.