## Long An IDICO to Double Capital to VND 1,710 Billion, Approves Borrowing and Guarantee Limits

On June 3rd, the Board of Directors of Long An IDICO Joint Stock Company (IDICO – LINCO, UPCoM: LAI) issued a resolution to deploy a plan to issue shares. The plan was previously approved by the Annual General Meeting of Shareholders in 2024.

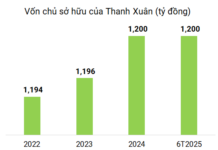

Specifically, LAI plans to issue 8.55 million shares (ratio 1:1) to existing shareholders, totaling VND 85.5 billion at par value. If successful, LAI’s owner’s equity will double to VND 1,710 billion, equivalent to 17.1 million shares. This is considered a condition and a source of long-term investment for the Company.

The company stated that the issuance capital will be taken in order from undistributed post-tax profits to the development investment fund, based on the value determined as of December 31, 2023, in the 2023 audited financial statements, totaling nearly VND 81 billion and over VND 4.6 billion, respectively.

The timing of the issuance will be after the State Securities Commission (SSC) announces the receipt of sufficient issuance report documents, expected in the second or third quarter of 2024.

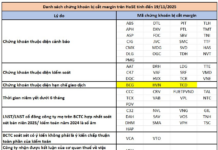

Also, on June 3rd, the LAI Board of Directors approved the 2024 working capital borrowing limit and the guarantee limit of the Company at the Long An Branch of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV Long An), totaling VND 95 billion.

The working capital borrowing limit at BIDV Long An was approved at VND 65 billion, while the payment guarantee limit and other guarantees were set at VND 10 billion and VND 20 billion, respectively. If there is a need to increase the payment guarantee balance, LAI will correspondingly reduce the working capital loan balance, ensuring that the total payment guarantee balance and working capital loan balance do not exceed VND 75 billion at any time.

## Robust 2024 Plan, with a Focus on the AEON Transfer Contract

At the 2024 Annual General Meeting of Shareholders held in early May 2024, a breakthrough business plan for 2024 was approved.

Specifically, LAI targets revenue of nearly VND 448 billion in 2024, up 106% compared to the previous year. This primarily consists of VND 317 billion in commercial real estate business revenue, a 269% increase, thanks to the transfer contract with AEON for a 14,560m2 commercial land plot with a 38-year lease term, along with the continued recognition of revenue from the sale of houses under construction that meet the conditions. The remaining revenue for LAI comes from construction activities, totaling VND 75 billion, and building materials trading, totaling VND 55 billion.

LAI expects a net profit of over VND 111 billion after deductions, a significant increase of 194%, mainly attributed to profits from the transfer contract with AEON.

In terms of investment activities, LAI plans to invest nearly VND 592 billion in the Hựu Thạnh Worker Housing Area project, over VND 123 billion in the Tân An Ward 6 Expansion Residential Area project and the land plot transferred to AEON, and VND 10 billion in other investments (machinery, new real estate, etc.). The total expected investment is VND 725 billion, of which VND 687 billion is borrowed capital (excluding interest).

It is evident that the focus of LAI’s 2024 business strategy is the transfer contract with AEON. To execute this, LAI will continue working with AEON Vietnam to negotiate and sign a contract supplement to extend the land use term for Plot 1 and change the purpose, as well as sign a transfer contract for Plot 2. They will also complete the necessary procedures to commence construction of power grid connections and hand over Plot 1 and related legal documents to AEON for the development of the AEON Tân An shopping center, in line with the signed agreement. Concurrently, LAI will continue to study the market and seek customers to sell or lease the remaining urban service plots and ODT (urban residential land) plots to investors to enhance the project’s investment efficiency.

Looking back at 2023, LAI signed a contract to transfer a portion of the project for Plot 1, totaling nearly VND 277 billion, to AEON Vietnam for the construction of a shopping center. The project has transferred 905 out of 909 total land plots, with the remaining 4 corner plots (covering an area of nearly 2,688m2) yet to be sold. The unsold public facility land includes an educational plot (5,900m2) and a healthcare plot (1,016m2).

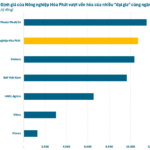

For AEON Vietnam, the project will be its eighth shopping center in Vietnam and the first in the Mekong Delta region, with a total investment of over VND 1,000 billion and an area of approximately 21,000m2. The project is expected to be completed by August 2025 and was inaugurated on May 18th.

* [Aeon Mall’s Performance in Vietnam: A Look at Their New Openings]

* [Retail Giant AEON Breaks Ground on Its 8th Shopping Center in Vietnam]

AEON Tân An Shopping Center Project, Expected to Operate by Late 2025

|