MHC announces a 5% stock dividend for 2023

In 2023, MHC achieved impressive financial results with over 279 billion VND in net revenue, marking a significant 44% increase from the previous year. The company’s remarkable performance was largely attributed to the successful transfer of real estate in Ecopark by the parent company, resulting in a substantial growth in both real estate revenue (a three-fold increase to nearly 114 billion VND) and financial revenue from securities trading, which rose by 4% to almost 147 billion VND.

As a consequence of these positive developments, MHC returned to profitability, recording a net profit of nearly 26 billion VND, in contrast to a net loss of nearly 31 billion VND in 2022. The company surpassed its revenue target by 50% but fell short of its profit goal, achieving only 70% of the planned figure.

Given these outcomes, MHC proposes a 5% stock dividend for 2023, meaning that shareholders owning 100 shares will receive 5 new shares. The issuance of these additional shares is anticipated to take place in the third or fourth quarter of 2024. With approximately 41.4 million shares currently in circulation, MHC is expected to issue an extra 2.1 million shares to fulfill the dividend payment.

|

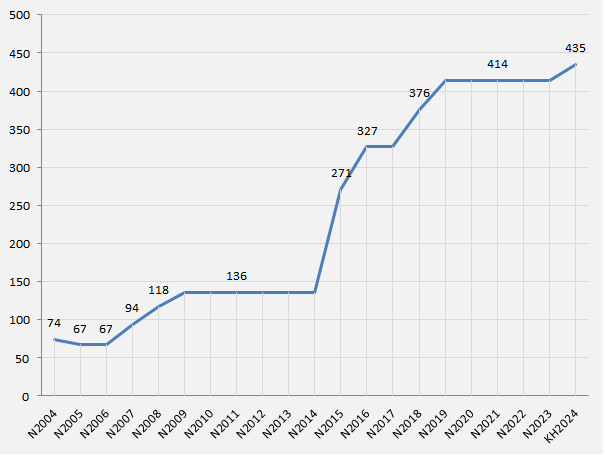

MHC’s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

Following the completion of this issuance, MHC’s chartered capital is projected to increase by nearly 21 billion VND, from 414 billion to 435 billion VND.

Target of a 25% increase in pre-tax profit

|

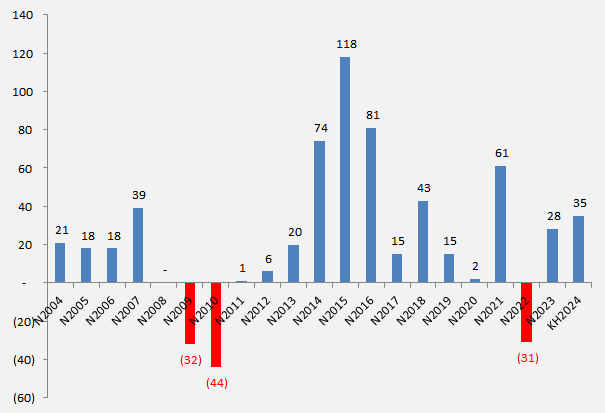

MHC’s 2024 pre-tax profit plan. Unit: Billion VND

Source: VietstockFinance

|

For the year 2024, MHC has set a total revenue target of 250 billion VND, representing an 11% decrease from the previous year’s performance. However, the company aims to achieve a pre-tax profit of 35 billion VND, indicating a substantial increase of more than 25%.

In terms of strategic direction for the new year, MHC intends to maintain its focus on real estate business services (targeting urban and residential projects), financial investments, and operations in the transportation and logistics sectors. Additionally, the company is actively seeking investment opportunities in other promising and potential industries and businesses.

| MHC’s quarterly financial results |

Wrapping up the first quarter of 2024, MHC recorded a slight increase in net revenue, reaching over 4 billion VND, a modest 2% improvement from the same period last year. Despite continuing to operate below cost, the company managed to narrow its gross loss to slightly over 271 million VND, compared to a gross loss of nearly 1 billion VND in the previous year’s first quarter.

Although MHC operated below cost, it managed to turn a profit in the first quarter, reporting a net profit of more than 6 billion VND. This positive outcome was largely due to a significant improvement in financial performance, which shifted from a loss of nearly 32 billion VND to a profit of almost 11 billion VND. In terms of its profit target, the company has achieved 20% of its planned pre-tax profit for the year.

Khang Di