Địa Ốc Hoàng Quân Annual General Meeting 2024 on 01/06/2024

|

HQC’s social housing projects aim for a score of 8 or higher, with a revenue target of 2,000 billion VND.

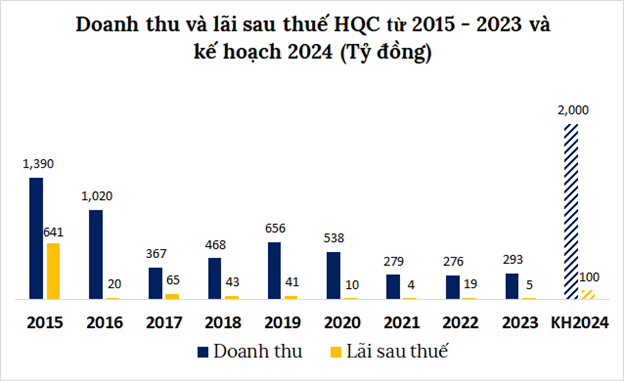

At the meeting, shareholders of Commercial Consulting Services Real Estate Joint Stock Company (HOSE: HQC) approved an ambitious 2024 plan with a revenue target of 2,000 billion VND, 6.2 times higher than in 2023. This is the company’s highest revenue target since its listing on the HOSE in 2010.

The profit-after-tax target is set at 100 billion VND, 19.2 times higher than in 2023, and the highest in nearly eight years (since 2016).

Source: VietstockFinance

|

HQC aims to complete at least 50 social housing projects with approximately 50,000 products (by 2030) and renovate or rebuild at least 10 old apartment buildings in Ho Chi Minh City, Dong Nai, and Long An to achieve its goals.

In addition to social housing, HQC plans to invest in, collaborate, and develop commercial real estate, industrial real estate, and resort real estate. Currently, HQC is focusing on implementing the Ham Kiem 1 Industrial Park project in Binh Thuan and the Binh Minh Industrial Park project in Vinh Long.

Over the past decade, HQC has consistently set high business targets but has fallen short of achieving them. Mr. Truong Anh Tuan, Chairman of HQC’s Board of Directors, attributed this to macroeconomic challenges, global market conditions, and the Board’s overly optimistic assessments of the market and HQC’s capabilities. He acknowledged that these experiences have been valuable lessons for HQC.

HQC has been a pioneer in social housing for over a decade and has faced numerous challenges, including a lack of capital when the government cut the 30,000 billion VND loan package. As a result, the company struggled to access funding from banks and investment funds, hindering the completion of projects and impacting revenue and profit targets.

However, HQC is optimistic about 2024, citing advantages such as a large land fund, well-prepared social housing projects, collaborations with the state’s land fund and Novaland (NVL), and support from several banks for social housing projects.

Mr. Tuan expressed confidence in HQC’s future performance, predicting revenue of 4,000 billion VND in 2025 and 6,000 billion VND in 2026. He emphasized that the company aims to complete and deliver 5,000 social housing units annually, starting with 3,000 units in 2024, and a profit target of 5% of revenue. He stated that achieving the 2,000 billion VND revenue target for 2024 is not optional but mandatory.

Mr. Tuan also shared that HQC aims to be a leader, not just a pioneer, in developing social housing and low-income housing. He asserted that on a scale of 10, HQC’s social housing projects would score a perfect 10 for quality and at least an 8 for amenities.

Mr. Truong Anh Tuan, Chairman of HQC’s Board of Directors, at the Meeting

|

Will HQC have a new Board of Directors in 2025?

The meeting also approved the dismissal of Ms. Nguyen Thi Dieu Phuong (Mr. Tuan’s wife) from her position as Vice Chairwoman of the Board of Directors and the dismissal of two Board members, Mr. Truong Thai Son (Mr. Tuan’s brother) and Mr. Nguyen Van Toan. Mr. Tran Anh Tuan was elected as a member of the Board of Directors for the 2020-2024 term.

As a result, the number of members on HQC’s Board of Directors for the 2020-2024 term has been reduced from five to three, including Mr. Truong Anh Tuan, Mr. Ly Quang Minh, and Mr. Tran Anh Tuan.

In March 2024, the Board of Directors dismissed Mr. Truong Duc Hieu (Mr. Tuan’s brother) from his position as a member of the Board of Directors. Thus, all four dismissed members were relatives of the Chairman of HQC.

When asked about this, Mr. Tuan asserted that there were no conflicts involved in these dismissals. He explained that the new major shareholders wanted to ensure their interests and bring a market-oriented culture to the company. Mr. Tuan also hinted at the possibility of a new Board of Directors and new elements in 2025.

“If the General Meeting continues to trust me, I will remain as Chairman for a while,” he said. “The new major shareholders want to join the Board of Directors to share their knowledge and experience and accompany the company in the field of social housing.”

What is the purpose of the collaboration with NVL?

On May 22, Novaland Group Joint Stock Company (HOSE: NVL) and HQC signed a cooperation agreement to develop social housing projects. The two companies plan to deliver approximately 3,000 social housing units in various localities in 2024 and jointly develop new social housing projects using NVL’s existing land fund.

NVL partners with HQC for social housing projects, aiming to deliver 3,000 units in 2024

Regarding the collaboration with NVL, HQC’s Chairman explained that the two companies aim to leverage their strengths and support each other. HQC has expertise in social housing, which NVL needs as it has committed to providing 200,000 social housing units as part of the government’s initiative to develop one million social housing units. HQC has committed to delivering 50,000 units towards this initiative.

“Together, HQC and NVL account for a quarter of the one million social housing units planned, which is a significant contribution,” Mr. Tuan emphasized.

As NVL specializes in high-end real estate, it would be challenging for them to develop and sell social housing under their brand. Therefore, the two companies will collaborate as investors, with HQC managing NVL’s land funds dedicated to social housing projects. NVL will also support HQC in marketing and sales, among other areas.

Is the An Phu Sinh project feasible?

Before the meeting, HQC announced the cancellation of a plan to issue private placement shares to convert debt. Instead, the company proposed a plan to raise 1,000 billion VND by issuing private placement shares to acquire a 15-hectare residential area in Long An Province.

HQC’s leadership assessed the An Phu Sinh project as feasible, with almost complete compensation, solid legal grounds, an approved investment plan, a 1/500 planning ratio, and a construction permit. HQC intends to build houses with amenities, targeting affordable commercial housing.

The project has the support of partner banks and owners. Typically, commercial housing is more profitable than social housing but requires more capital. Mr. Quan, a leader at HQC, expressed confidence in the project’s profitability and noted that the previous developer had encountered difficulties, leading to the sale to HQC.

Regarding the plan to raise 1,000 billion VND to acquire the project, Mr. Tuan assured that professional investors are committed to purchasing shares and ensuring the project’s profitability.