Gold prices on the move

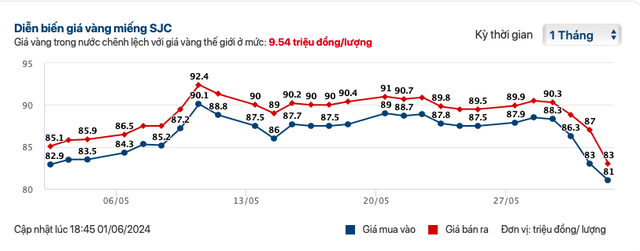

In recent times, domestic gold prices in Vietnam have been on a rollercoaster, experiencing sharp increases. Compared to the beginning of the year, SJC gold prices have surged by 20%, while plain round gold ring prices have increased by an estimated 18%.

The surge in gold prices has widened the gap between domestic and international gold prices. At some points, the difference between domestic and world gold prices reached up to 18-20 million VND per tael.

Experts believe that the volatile nature of gold prices is often seen as a safe haven during economic uncertainties. When gold prices rise, it can attract investors seeking to protect their assets from risks, helping to stabilize the market psychology.

However, on a negative note, high gold prices can encourage speculation, increasing market volatility and creating asset bubbles. This could lead to financial instability when the bubble bursts.

Additionally, when people and investors rush to buy gold, capital may be withdrawn from other sectors such as manufacturing, technology, and services, leading to a shortage of investment capital for other important areas of the economy.

In response to the sharp increase in domestic gold prices, the State Bank of Vietnam (SBV) organized gold bar auctions in an attempt to narrow the gap between domestic and world prices. However, even after nine auctions, gold prices continued to climb.

On May 29, the SBV announced that it would stop auctioning gold and proceed with gold imports. Specifically, the SBV instructed the Big 4 banks to sell gold directly to the people. Following this announcement, SJC gold prices suddenly reversed course and declined.

On May 30, SJC gold prices plummeted by up to 4 million VND per tael during the morning session, a rare occurrence in recent times, reaching 84.5-88.0 million VND per tael.

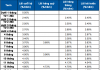

On the morning of June 2, SJC gold prices at Saigon Jewelry Company, Phu Nhuan Jewelry Company, and Bao Tin Minh Chau were listed at 81-83 million VND per tael. Some other businesses listed lower prices, such as DOJI at 80.95-82.75 million VND per tael.

From May 28 to the present, SJC gold prices have decreased by about 7.5 million VND per tael for both buying and selling. Compared to the peak selling price of 92.4 million VND in early May, gold prices have dropped by more than 11 million VupdateDynamic.

SJC gold prices over the past month.

Gold prices are expected to continue falling

Dr. Dinh The Hien, an economic expert, predicts that SJC gold prices will continue to drop as state-owned commercial banks sell gold directly to the people. He also applauds the SBV’s decision to import gold and sell it to state-owned banks.

According to Dr. Hien, Vietnam exports a variety of agricultural and aquatic products, generating positive foreign exchange value. Using a portion of this value to import gold meets the people’s demand for asset accumulation.

He also points out that Vietnam has allowed its citizens to hold gold, foreign currencies, and real estate. He analyzes that land accumulation often does not create value for the country. Instead, rising land prices can endanger the economy by increasing land rent and making it challenging for industrial parks to attract foreign investors.

On the other hand, gold has very high liquidity and can be converted into foreign currency at any time.

Furthermore, Dr. Hien believes that in the domestic market, Vietnam is an agricultural production economy in transition, and the psychology of gold hoarding is still quite strong, especially for generations born in the 1980s and earlier. For younger generations below 30 (the 90s generation), the demand for real estate investment outweighs the need for gold accumulation. In other words, the “gold-loving” generation will gradually decrease, leading to a reduction in gold demand.

In the long run, gold demand cannot continue to increase indefinitely as the real estate market will eventually recover, and people will realize that bank savings are one of the safest and most effective investment channels.

Regarding investment recommendations, Dr. Hien suggests that investing in gold at this time carries a double risk. First, the world gold price has surpassed $2,000, and the possibility of it going up or down is equal. Moreover, the gap between domestic and world gold prices is too high, which also poses a risk. Therefore, he advises that the safest investment strategy at this stage is to avoid chasing assets with too many risks.

“Looking at gold at this time, each investor will have a different psychology, including the psychology of following the crowd. However, it is essential to understand that only a small number of investors have the ability to enter and exit correctly according to the trend and benefit from it. In contrast, the majority who follow the upward trend will incur losses, not only in gold but also in many other investment assets,” Dr. Hien said.