The State Bank of Vietnam (SBV) and Saigon Jewelry Company (SJC) officially started selling gold bars directly to the public today. The SBV set the gold price for June 3, 2024, at VND 78.98 million per tael, which is the price at which the SBV sells gold to commercial banks and SJC. The stable gold price directly offered to the people is VND 79.98 million per tael, which is VND 1 million higher than the SBV’s price to banks, including taxes and fees.

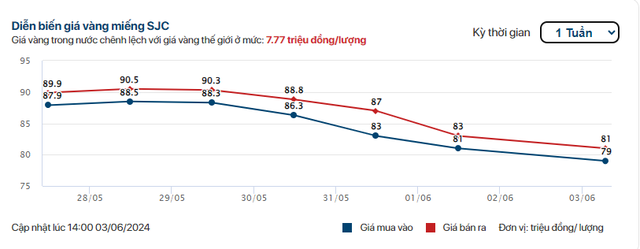

Previously, after the SBV announced its decision to stop auctioning and allowing four state-owned commercial banks to sell gold directly to the people from May 30, SJC gold prices plummeted, falling by an average of VND 3-4 million per tael per day.

Today (June 3), SJC gold prices at business companies continued to drop sharply below the VND 80 million per tael threshold in selling prices, the lowest in the past three months. This price is about VND 1 million per tael higher than the price announced by the SBV.

Specifically, at Saigon Jewelry Company, SJC gold prices were listed at VND 77.98-79.98 million per tael. Meanwhile, SJC gold prices at Bao Tin Minh Chau were listed at VND 78-79.98 million per tael.

SJC gold prices in the past week. Chart: CAFEF

According to Associate Professor Dr. Dinh Trong Thinh, an economic expert, the gold bar selling price of the state-owned commercial banks today will be the international gold price plus taxes, fees, and other reasonable costs, along with a certain fee for the four large banks.

This pricing aims to immediately achieve the goal of bringing SJC gold prices closer to international gold bar prices. As a result, SJC gold prices will drop significantly compared to the current rates.

Dr. Thinh added that with low and stable SJC gold prices, there would be a rush of people at these banks to buy gold at cheaper rates. However, he advised against this, stating, “This is unnecessary because we can buy gold at the price offered by the State Bank. This price will remain stable as the gold sale will continue for a relatively long time. But if we buy gold at a lower price, it will be challenging to sell it at a profit as gold shops may refuse to buy it. They can also register to buy gold at the four large banks. Therefore, we don’t need to rush to buy gold during these initial days, as it will only waste our time and energy waiting in long queues.”

Commenting on the sharp decline in gold prices last week, Dr. Nguyen Tri Hieu attributed it to two main reasons. First, the government’s decision to inspect all gold enterprises and businesses to ensure compliance with legal regulations and take strict action against violations to stabilize the gold market.

Second, the news that the four state-owned banks would sell gold directly to the people significantly impacted the market, causing a sudden drop in gold prices. Meanwhile, the banks assigned to distribute gold under the SBV’s direction will sell gold to the people at the SBV’s set price rather than buying it.

Dr. Hieu predicted that gold prices would continue to fall, narrowing the gap between domestic and international gold prices. He also noted that the price difference depends on the fluctuations in international gold prices.

Previously, Dr. Dinh The Hien, an economic expert, stated that a difference of VND 2-4 million per tael between SJC gold prices and world gold prices is reasonable.

According to Dr. Hien’s forecast, SJC gold prices in Vietnam will drop to the range of VND 74-76 million per tael as international gold prices are currently fluctuating around VND 72 million per tael.