TPBank’s savings interest rates have been officially adjusted with a significant increase across all tenors, averaging 0.3-0.4%/year.

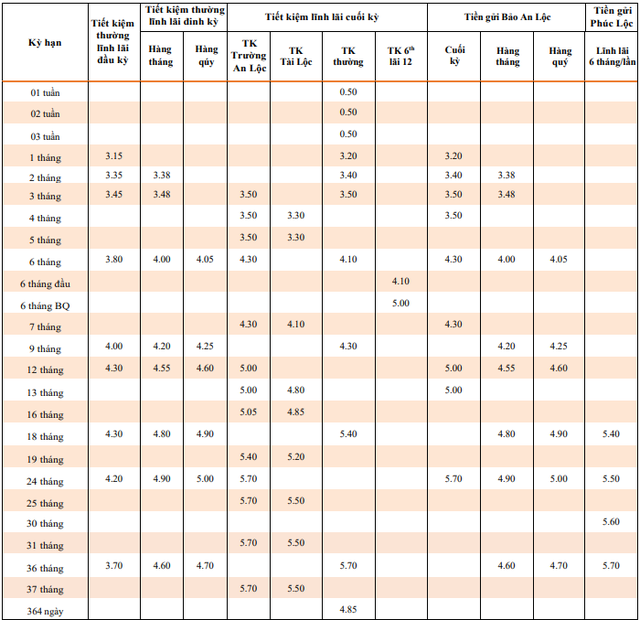

According to the counter savings interest rate table applicable to the end-of-term interest payment method, customers who choose the traditional savings method with tenors ranging from 1 month to 36 months will receive interest rates between 3.2% and 5.7% per year.

Specifically, the interest rate for the 1-month tenor has increased by 0.4% to 3.2% per annum, while the 2-month tenor has seen a similar increase to 3.4%.

The interest rates for the 3 and 4-month tenors have also been adjusted upwards by 0.4% to 3.5%.

For the 6-month tenor, the interest rate has increased by 0.3% to 4.1% per annum, while the 9-month tenor has seen a similar increase to 4.3%.

The 18-month tenor now offers an interest rate of 5.4%, an increase of 0.3% from before.

Lastly, the 36-month tenor has witnessed the highest increase of 0.4%, bringing its interest rate to an impressive 5.7% per annum.

TPBank’s latest counter savings interest rates.

For customers who opt for the 364-day tenor, the interest rate has been adjusted to 4.85% per annum, a slight increase of 0.1% from the previous month.

Short-term savings interest rates, ranging from 1 week to 3 weeks, remain unchanged at 0.5% per annum.

Online savings interest rate table.

The online savings interest rate table offers interest rates ranging from 3.5% to 5.7% per annum for tenors between 1 and 36 months. Specifically, the 1-month tenor offers an interest rate of 3.2% per annum, while the 2-month tenor stands at 3.4%.

For the 3-month tenor, the interest rate is 3.5% per annum. Moving forward, the 6 and 9-month tenors offer an interest rate of 4.3%, while the 12-month tenor provides a rate of 5%.

The 18-month tenor has an interest rate of 5.4%, and the 24 and 36-month tenors offer the highest rate of 5.7% per annum.