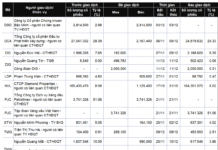

Specifically, TV2’s Board of Directors plans to present a 2024 revenue target of nearly VND 1.3 trillion, a 16% increase from the previous year’s performance. The profit before tax target remains relatively flat at VND 66 billion.

The company attributes the challenges of 2023 to macroeconomic factors and an unpredictable global landscape. The world has witnessed unprecedented changes and complexities, with intensifying strategic competition among major powers and prolonged military conflicts. Global inflation has soared, prompting central banks to raise interest rates and tighten monetary and fiscal policies. The pandemic has also contributed to a slowdown in global economic growth. Additionally, financial, monetary, and energy and food security risks persist.

Domestically, Vietnam faced high inflationary pressures, volatile fuel and raw material prices, and a significant impact on the energy sector. TV2’s cautious target for 2024 reflects the anticipated difficulties in the coming year.

Despite these conservative targets, TV2’s performance in the first quarter of 2024 exceeded expectations, with a nearly 92% increase in revenue to over VND 238 billion and a 34% rise in net profit to more than VND 11 billion. The company attributes these impressive results to the EPC contract for the Hau Giang Biomass Power Plant project, which entered a peak construction phase to meet its COD target for December 2024. Additionally, TV2’s role as the primary consultant for the survey and design of the 500kV Power Line Project (Quang Trach – Pho Noi) contributed to this success, with the project being accepted and completed within the quarter.

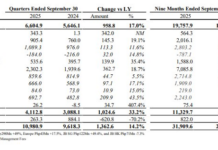

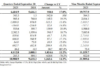

| TV2’s Financial Performance in the Last Two Years |

In terms of profit distribution, TV2 proposes a dividend payout of 10% for 2023 and intends to maintain or increase this rate for 2024.

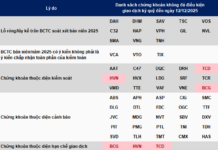

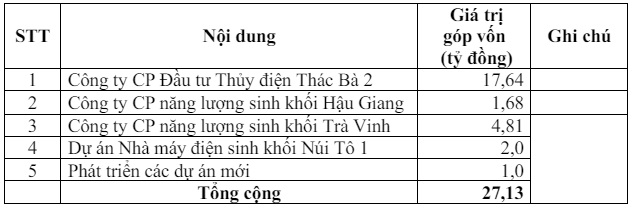

The company also outlines investment and capital contribution plans totaling over VND 27 billion for 2024. The majority of this amount, nearly VND 18 billion, will be allocated to Thac Ba 2 Hydropower Joint Stock Company. Additionally, TV2 has allocated a budget of VND 46.4 billion for its 2024 capital construction plan.

|

TV2’s Investment and Capital Contribution Plan for 2024

Source: TV2

|

Notably, TV2 intends to establish three wholly-owned limited liability companies, as outlined in the 2019 Annual General Meeting’s resolution on the “Orientation for Development; Plan for Restructuring the Organizational Model and Enhancing Operational Efficiency for the 2019-2025 period, with a vision towards 2030.” These companies will be formed by converting three existing branches: the Survey and Construction Branch, the Electrical and Mechanical Branch, and the Power Plant Operation and Maintenance Branch.

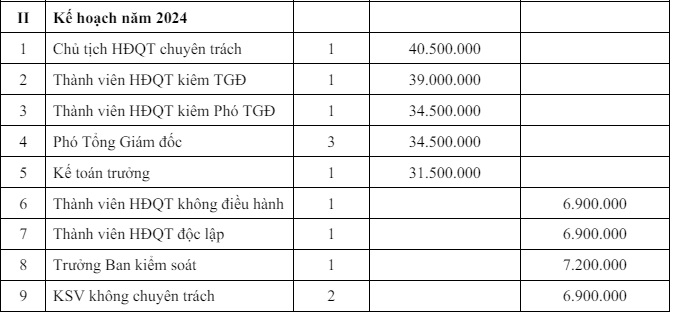

Regarding executive compensation, TV2 plans to allocate VND 40.5 million per month to the Chairman of the Board of Directors for 2024, as detailed in the table below.

|

TV2’s 2024 Remuneration Plan

Source: TV2

|

Chau An