|

Business Targets of VNPT in 2023

Source: VietstockFinance

|

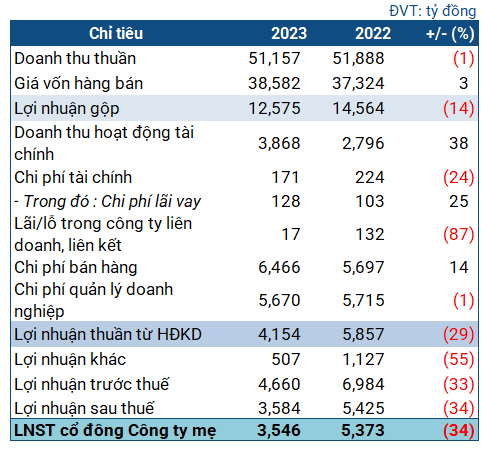

According to the 2023 audited financial statements, VNPT witnessed a slight 1% decline in revenue, amounting to over 51 trillion VND. However, a 3% increase in cost of goods sold resulted in a gross profit of nearly 12.6 trillion VND, a 14% decrease compared to the previous year.

The financial income for the period surged to nearly 3.9 trillion VND, a 38% increase compared to the previous year. However, this increase was insufficient to offset the rise in expenses, including a 14% increase in selling expenses, amounting to nearly 6.5 trillion VND, and management expenses, which slightly decreased but remained high at nearly 5.7 trillion VND.

Additionally, profit from associated companies decreased by almost eight times, reaching only 17 billion VND, while other profits more than doubled, surpassing 507 billion VND. Ultimately, the enterprise’s net profit amounted to over 3.5 trillion VND, a 34% decrease compared to the previous year.

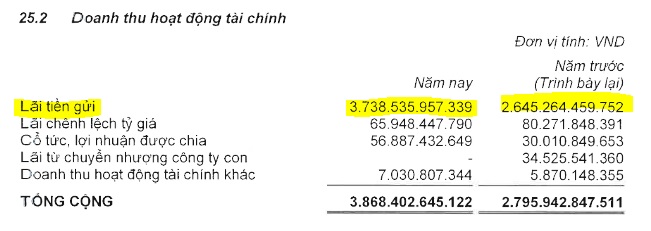

Regarding financial income targets, the report’s notes revealed that the majority of the revenue was derived from interest income. Within the asset structure, the enterprise held nearly 2.7 trillion VND in cash and short-term deposits. Furthermore, VNPT possessed a substantial amount of 58 trillion VND in held-to-maturity investments as of December 31, 2023, reflecting a 20% increase from the beginning of the year. This was attributed to fixed-term bank deposits with original maturities of 12-13 months and remaining maturities of less than 12 months.

Source: VietstockFinance

|

Delving deeper into the balance sheet, VNPT’s total assets as of the end of 2023 amounted to nearly 105 trillion VND, a 3% increase from the beginning of the year. Short-term assets accounted for over 71 trillion VND, a 12% increase. Accounts receivable increased by 15%, reaching 7.7 trillion VND, while inventory value at the end of the period stood at nearly 1.3 trillion VND, a 24% decrease compared to the beginning of the year.

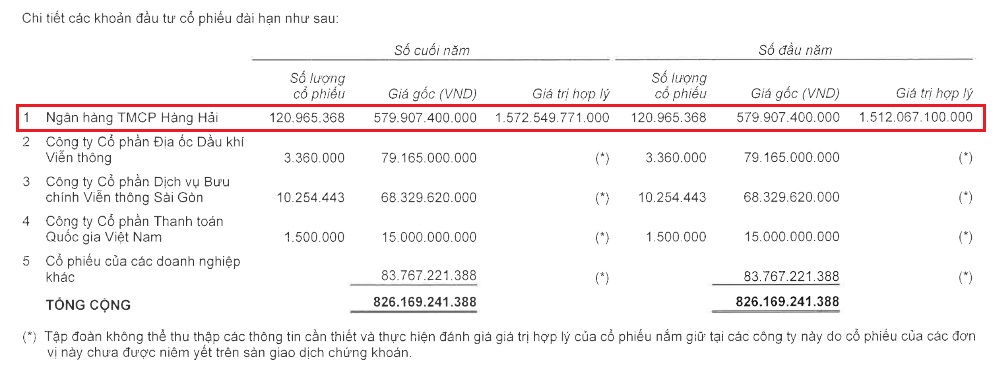

VNPT’s long-term equity investment portfolio had an original value of 826 billion VND, with the largest investment being in the Maritime Bank (HOSE: MSB). The enterprise holds nearly 121 million shares, representing 6.05% of the charter capital. The original value of this investment was nearly 580 billion VND, but its fair value as of the end of 2023 was nearly 1.6 trillion VND, indicating a profit of nearly 993 billion VND.

Source: VNPT

|

On the liabilities side of the balance sheet, short-term debt increased by 9%, reaching nearly 30 trillion VND. Short-term borrowings slightly decreased to nearly 1.8 trillion VND.

By Chau An

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.