The PITCO Annual General Meeting for 2024 was held on the morning of June 14, 2024. Photo: Tu Kinh

|

Petrolimex Import-Export Joint Stock Company (PITCO, HOSE: PIT) predicts that while the Vietnamese economy will regain its growth momentum in 2024, the world will continue to face political and social instability, presenting significant risks for the company’s exports.

Currently, PIT’s business is focused on two main segments: spices and paint. The company has decided to shut down its fuel segment, largely due to the opening of the Dau Giay-Phan Thiet highway, which caused a significant decrease in the number of vehicles passing through their gas stations. The production volume has dropped by about 70%.

Regarding the export of pepper and other spices, PIT maintains stable operations and plans to further strengthen this segment by seeking new customers and exploring potential markets, such as participating in international trade fairs. The company will also focus on promoting the export of premium spices in the domestic market.

Additionally, PIT intends to develop new premium spice products and invest in additional production lines at the Tan Uyen spice factory. Currently, the factory operates at a capacity of 5 million products per year and has to work overtime, including on Saturdays and Sundays, to meet demand.

In the paint segment, PIT’s leadership remains cautious about the real estate market, anticipating that the ongoing stagnation could lead to challenges in paint sales for the company.

According to Chairman of the Board of Directors, Tran Trung Kien, the paint segment has signed additional contracts with foreign partners, and the factory is currently operating at maximum capacity. However, there are issues with equipment and infrastructure, as they have become outdated after many years of use.

The company plans to reduce intermediary costs, such as warehouse rental and domestic human resources expenses. They also aim to increase profits by promoting export processing cooperation with domestic and foreign partners to maximize factory capacity.

Achieving half of the profit target in the first quarter

PIT’s loss in 2023 was mainly due to a provision for expenses of more than 11 billion VND, including a high proportion of debt owed by Dong A Steel Joint Stock Company, amounting to about 9.5 billion VND.

As the parent company and the paint subsidiary both have long-overdue debts that cannot be reconciled, it is determined that these debts cannot be recovered. The Supervisory Board proposed to make the necessary arrangements and accounting adjustments according to regulations.

Additionally, the Supervisory Board suggested that the Tan Uyen Enterprise lacks cross-checking from the company, and there is room for improvement in the ratio of whole and ground pepper sales to total sales volume. They proposed changes to include cross-checking of goods and raw materials between the parent company and the subsidiary and increasing the sales ratio from the production enterprise.

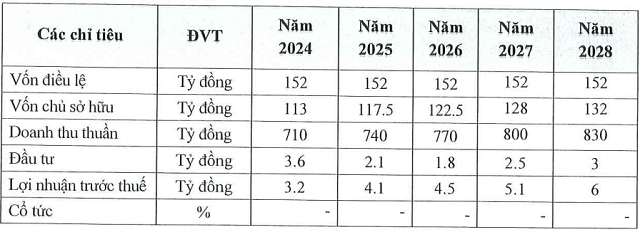

Given these circumstances, PIT sets a modest target for revenue, aiming to maintain the same level as last year’s achievement of 710 billion VND. They aim for a post-tax profit of 2.6 billion VND after incurring a loss of nearly 9 billion VND in the previous year. For the next four years, the company plans to increase revenue by 30 billion VND annually, reaching 830 billion VND by 2028. The target for pre-tax profit is set at 6 billion VND, double that of 2024.

In the first quarter of this year, revenue doubled compared to the same period last year, reaching 263 billion VND. This helped the company return to profitability, earning 1.3 billion VND after a loss in the fourth quarter of 2023 and a significant improvement compared to the same period a year ago. Thus, the company has achieved 37% and 50% of its revenue and profit targets, respectively, in just the first quarter.

PIT attributes this performance to the stable global situation, which has led to increased demand and a significant rise in pepper prices. Compared to the beginning of the year, accounts receivable have increased by 55%, reaching nearly 118 billion VND. Notable customers include Ottogi Vietnam Co., Ltd. (10.6 billion VND) and Frutex Australia (15.7 billion VND).

Operational business indicators of PIT for the period 2024 – 2028. Source: PIT

|

All bad debts have been provisioned, but dividends may take a long time due to difficulties

According to General Director, Huynh Duc Thong, long-term shareholders of PIT may have to wait a long time to receive dividends as the company still has accumulated losses. He expressed, “The company is doing its best, but due to provisions for expenses, PITCO is still facing many difficulties.”

The solution, according to the leadership, is straightforward: increase sales to improve revenue. Additionally, a challenge for the company is the long-standing issue of value-added tax (VAT) refunds, totaling nearly 50 billion VND that has not been refunded. As a result, the company has had to borrow large sums to finance its business operations, including paying employee salaries, leading to high financial costs.

“PITCO is one of the companies with the highest financial costs in the Petrolimex system,” said the Chairman.

The 2019-2024 term is considered the most volatile period for PIT so far, with changes in personnel and business performance. The provisions for bad debt expenses are also partly due to issues from previous years, which have impacted the current results.

The company stated that all outstanding issues, including difficult-to-recover debts, have been transferred to the enforcement agencies in the districts. The Board of Directors is committed to ensuring that no further provisions will be made in 2024.

Resignation of the General Director and election of the new Board of Directors for the term 2024-2029

PIT shareholders elected five members to the Board of Directors for the term 2024-2029. Four members were nominated by the parent company, PGCC Joint Stock Company (holding 56.34% of the shares), including Mr. Tran Trung Kien, Mr. Vu Cuong, Mr. Van Tuan Anh, and Ms. Dau Khanh Phuong. Mr. Nguyen Duc Cuong was nominated by a group of shareholders holding 18.2%.

The new Supervisory Board members include Ms. Nguyen Thi Hue and Ms. Nguyen Hoang My Linh, nominated by PGCC, and Ms. Le Thuy Dao, nominated by a group of shareholders holding 18.79%.

After the meeting, Mr. Kien was re-elected as Chairman of the Board of Directors and temporarily appointed as General Director during the personnel reorganization process. He represents 26.33% of the voting shares of the parent company. Mr. Kien also serves as Chairman of the Members’ Council of Petrolimex Paint One Member Limited Liability Company.

Board member and Deputy General Director, Van Tuan Anh (born in 1977), represents 13.17% of the capital. Ms. Dau Khanh Phuong (born in 1976) is currently the General Director and a member of the Members’ Council of Petrolimex Paint. Mr. Vu Cuong (born in 1976) is the Deputy General Director of PGCC. The youngest member is Mr. Nguyen Duc Cuong, born in 1995.

Prior to the meeting, Mr. Thong resigned from his position as General Director and Information Disclosure Officer due to personal reasons. PIT subsequently appointed Mr. Kien as the temporary General Director until the Annual General Meeting of Shareholders in 2024. Deputy General Director, Nguyen Van Hai, was appointed as the new Information Disclosure Officer.

Board of Directors of PIT for the term 2024 – 2029. From left to right: Mr. Nguyen Duc Cuong, Mr. Van Tuan Anh, Mr. Tran Trung Kien, Ms. Dau Khanh Phuong, and Mr. Vu Cuong. Photo: Tu Kinh

|

Supervisory Board members for the term 2024 – 2029. From left to right: Ms. Nguyen Hoang My Linh, Ms. Le Thuy Dao, and Ms. Nguyen Thi Hue. Photo: Tu Kinh

|