Mythology Park, part of the Dragon Hill International Tourist Area

|

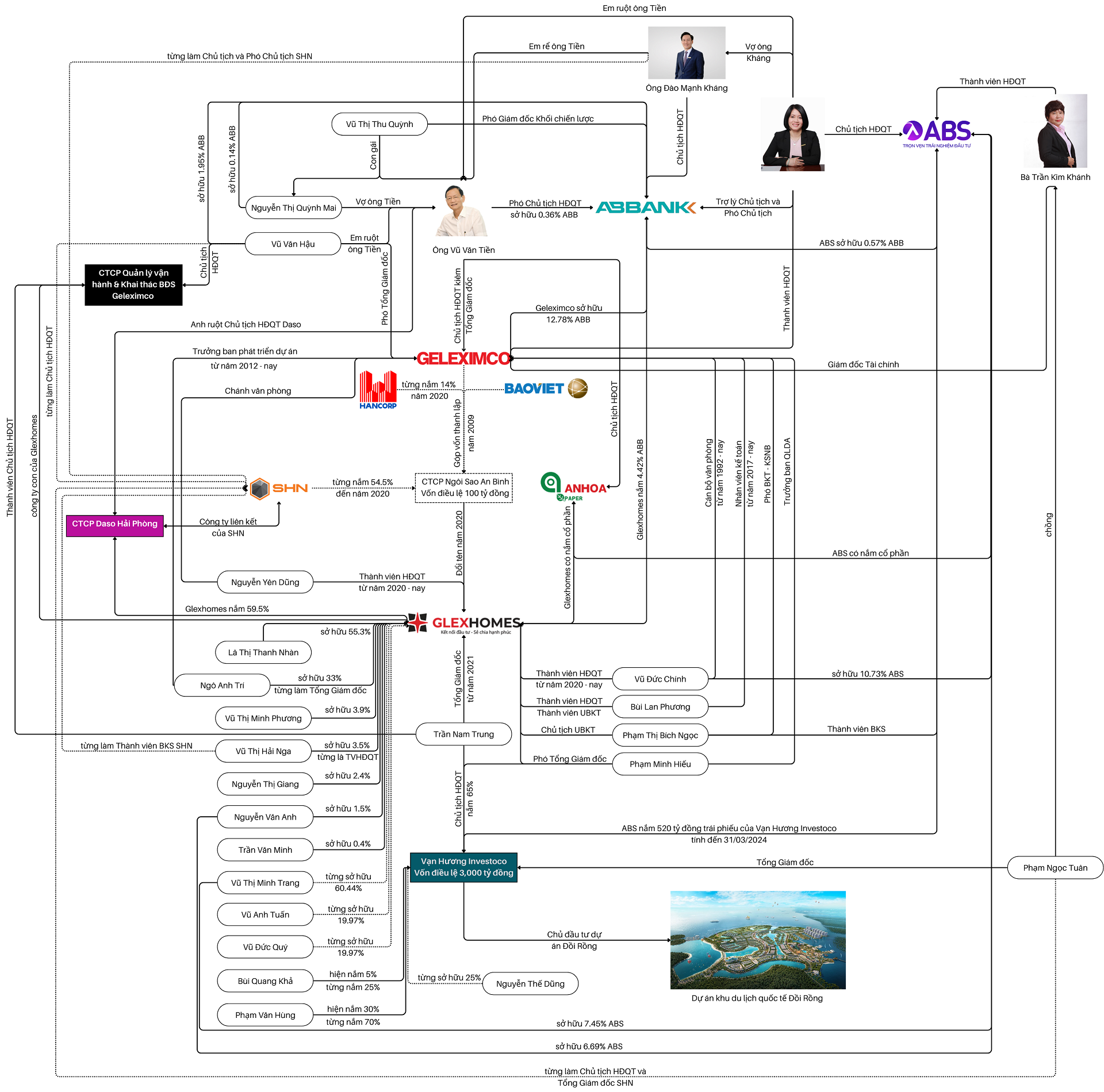

The Geleximco ecosystem, founded by entrepreneur Vu Van Tien

Glexhomes, formerly known as An Binh Star Joint Stock Company, was established in 2009 by the Geleximco Group, owned by Mr. Vu Van Tien, Baoviet Group, and Hanoi Construction Joint Stock Corporation (UPCoM: HAN). The initial chartered capital was 100 billion VND.

In 2014, HAN held 14% of the total 550 billion VND charter capital. However, from 2017 onwards, An Binh Star became a subsidiary of Hanoi General Investment Joint Stock Company (HNX: SHN). The name Glexhomes has been in use since 2020.

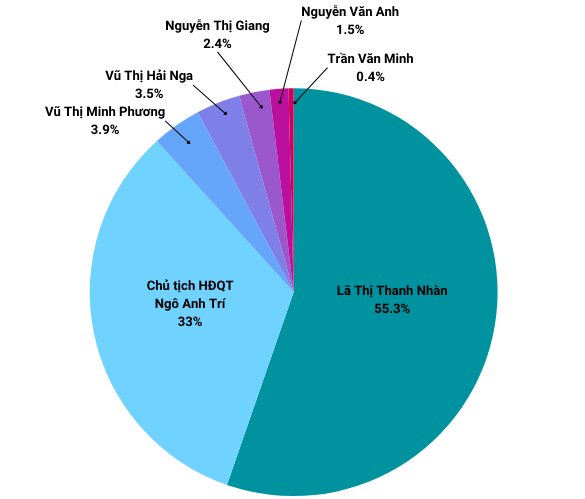

After several rounds of share offerings to existing shareholders, by the end of 2023, Glexhomes’ capital had exceeded 1,137 billion VND. The largest shareholder was Ms. La Thi Thanh Nhan with 55.31%, followed by Chairman of the Board of Directors Ngo Anh Tri with 33.02%. The company mainly operates in the fields of real estate business, consulting, and management of apartment buildings.

|

Shareholder structure of Glexhomes as of the end of 2023

Source: Author’s compilation

|

Established in 2010, Van Huong Investoco was also once a member of the Geleximco Group. The company is headquartered in Do Son District, Hai Phong City and is the investor of the Dragon Hill International Tourist Area project.

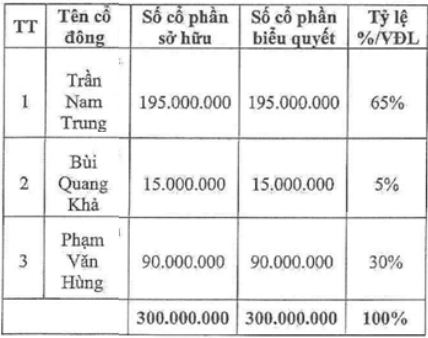

Currently, the chartered capital of Van Huong Investoco is 3,000 billion VND, of which Mr. Tran Nam Trung (General Director) holds 65%, Mr. Bui Quang Kha holds 5%, and Mr. Pham Van Hung holds 30%.

Shareholder structure of Van Huong Investoco – Source: Van Huong Investoco

|

Although no longer directly owned by Geleximco, the key leaders and business operations of Glexhomes remain closely linked to the ecosystem of entrepreneur Vu Van Tien.

For example, at Glexhomes, Chairman Ngo Anh Tri and the remaining members of the Board of Directors have been working at Geleximco for many years. Vice Director Pham Minh Hieu is also Vice Director of Van Huong Investoco. The Chief Accountant also comes from Geleximco.

Meanwhile, Glexhomes’ General Director Tran Nam Trung is the Chairman of the Board of Directors of Van Huong Investoco, the legal representative of Geleximco Nha Trang Joint Stock Company, and a member of the Board of Directors of Geleximco Real Estate Management and Operation Joint Stock Company (Geleximco PME, a subsidiary of Glexhomes) – the unit in charge of managing and operating the Dragon Hill project.

In addition to Glexhomes, Van Huong Investoco, and SHN, Mr. Tien and his close associates in Geleximco also hold shares and leadership positions in several companies, notably An Binh Securities Joint Stock Company (UPCoM: ABW) and An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB).

Glexhomes is currently collaborating with Geleximco on several projects, borrowing from ABB, lending to Van Huong Investoco, and transacting with Mr. Vu Van Hau (Mr. Tien’s younger brother). Mr. Hau and Mr. Tuan have both served as Chairman of the Board of Directors of SHN, and Mr. Hau was also Chairman of Geleximco PME.

The General Director and legal representative of Van Huong Investoco, Pham Ngoc Tuan, is the husband of Ms. Tran Kim Khanh, a member of the Board of Directors of ABW and Chief Financial Officer of Geleximco.

|

Some connections within the Geleximco ecosystem and Mr. Vu Van Tien

Source: Author’s compilation

|

Where does Van Huong Investoco’s borrowing come from?

Source: Glexhomes

|

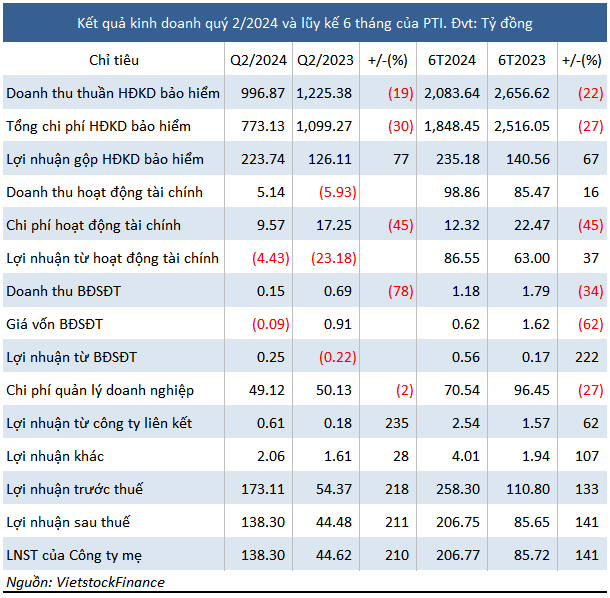

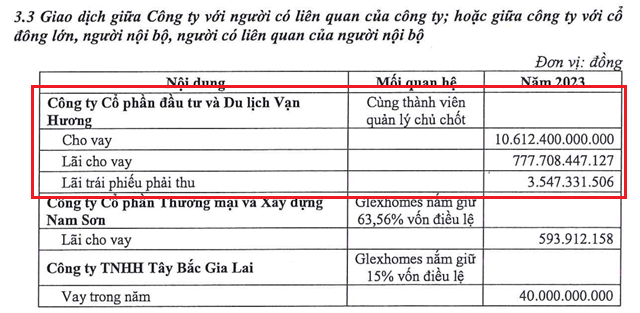

The transactions between Glexhomes and Van Huong Investoco last year were based on a loan contract with a term of 12 months, an interest rate not exceeding 8%/year, and two other contracts with a total limit of 10,000 billion VND over 36 months, with an interest rate of 7.42%/year for 2023.

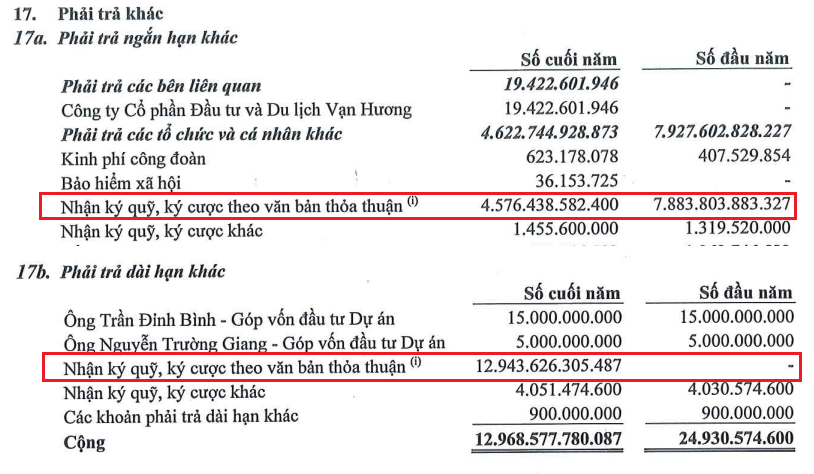

According to Glexhomes’ reports, total capital sources at the end of 2023 soared to more than 21,000 billion VND, double that of the beginning of the year. Long-term payables increased by 13,000 billion VND, explained as deposits received under an agreement to provide services in searching, introducing, and consulting customers on real estate information related to the Dragon Hill project.

Glexhomes states that it has been chosen by the investor as the consulting, brokering, and surveying unit for this project and will be in charge of selling the real estate when the investor meets the legal requirements.

The company also has short-term payables of more than 4,600 billion VND with the same content, a decrease of 3,285 billion VND compared to the previous year. Thus, the amount of deposits Glexhomes received for the project in Hai Phong exceeded 17,600 billion VND by the end of 2023.

Source: Glexhomes

|

Van Huong Investoco also has payables of more than 22,300 billion VND as of the end of 2023, 7.5 times its owner’s equity. Liabilities increased by about 5,000 billion VND compared to 2022 and tripled compared to 2021, while owner’s equity remained almost unchanged.

In reality, the Dragon Hill project, owned by Van Huong Investoco, is not performing well, incurring a post-tax loss for the third consecutive year, this time amounting to 62 billion VND. In 2022 and 2021, the losses were 5.4 billion VND and 15.5 billion VND, respectively.

While payables are surging, bond debt decreased by 1,600 billion VND to 4,400 billion VND.

Last year, Van Huong Investoco fully repaid 616 billion VND to bondholders and repurchased 1,660 billion VND of principal bonds, including the full repayment of the DRGCH2123005 bond issue worth 1,500 billion VND. This year, according to the plan, two more bond issues worth 1,500 billion VND each will mature, with the remaining principal falling due mainly in 2026. The company also repurchased 161 billion VND of bonds ahead of schedule in late February.

Recently, the bondholders of the VANHUONG.BOND.2019 bond issue worth 970 billion VND, including ABB, agreed to adjust the interest rate for the fourth interest period to a fixed rate of 9%/year and subsequent periods to a fixed rate of 10.8%/year, instead of a floating rate as previously agreed.

The collateral was also adjusted to be the property rights arising from the investment, construction, and business operations of lots ND-LK101, ND-BT103 to ND-BT111, and ND-BT116 to ND-BT117 in Zone VIII of the Dragon Hill project. The previous collateral was from the Balboa Island Resort, also within the same project.

Glexhomes is also facing challenges

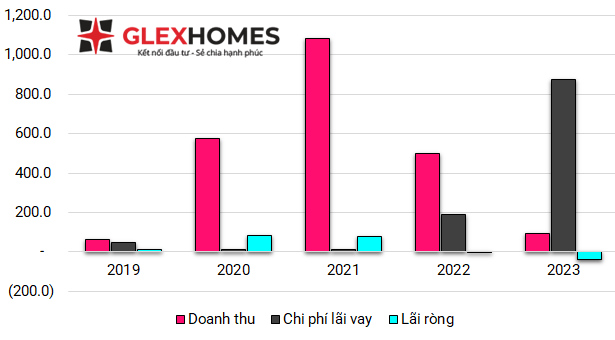

Glexhomes’ revenue in 2023 was a meager 93 billion VND, less than one-fifth of the previous year’s figure. Consulting services brought in 20 billion VND, second to the revenue from building management services, which amounted to nearly 60 billion VND. In 2022, the revenues from these two services were 339 billion VND and 117 billion VND, respectively. The main reason for the decrease is that the real estate projects are still in the investment development phase.

The main highlight did not come from pure business operations but from interest income on deposits and loans, which amounted to 883 billion VND. However, interest expenses also soared to 873 billion VND. As a result, Glexhomes incurred a loss for the second consecutive year, this time amounting to 36 billion VND.

In the past five years, Glexhomes’ business performance has been unstable. Revenue fluctuated, peaking at over a thousand billion VND in 2021 due to consolidated M&A results, while in 2019 and 2023, it plummeted to just a few dozen billion VND. Net profit reached a high of over 85 billion VND, while in the last two years, losses were incurred due to interest expenses.

|

Business results of Glexhomes from 2019 to 2023 (in billion VND)

Source: Author’s compilation

|

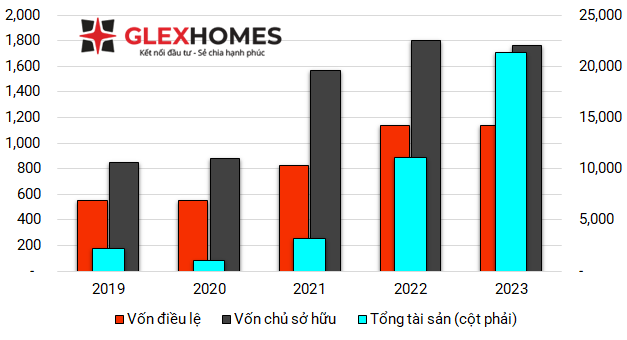

Despite making only a few dozen billion VND in profit, Glexhomes’ capital soared during this period – from over a thousand billion VND in 2020 to over 20 times that amount by the end of 2023. Chartered capital doubled to more than 1,100 billion VND, mainly from additional capital contributions from owners.

Last year, Glexhomes spent more than 1,200 billion VND (equivalent to 32,000 VND/share) and 858 billion VND (30,000 VND/share) to acquire 59.5% of Daso Joint Stock Company (Hai Phong) and 63.56% of Nam Son Trading and Construction Joint Stock Company, respectively. However, A&C Audit and Consulting could not obtain appropriate evidence to evaluate the amount paid for the transfers and the financial statements of the two companies to consider provisioning.

|

Financial and chartered capital performance of Glexhomes from 2019 to 2023 (in billion VND)

Source: Author’s compilation

|

Daso Hai Phong was previously part of Daso Group, founded by Dang Ngoc Hoa. The company mainly operates in the field of real estate project development and cosmetics, with Mr. Vu Van Hau as the Chairman of the Board of Directors and legal representative.

Explaining the investment, Glexhomes stated that it acquired the shares of the two companies with the approval of competent authorities, aiming to do business based on negotiated purchase prices between the parties, taking into account the potential and advantages of the real estate portfolio of Daso and Nam Son Construction and Trading.

The remaining shares of Daso Hai Phong are held by SHN, which spent about 484 billion VND (about 20,000 VND/share) to acquire 37.81% of the company’s capital in 2022. SHN‘s report stated that the investment in Daso Hai Phong aimed to develop the Van Huong Villa Village project (Phuong Hoa Island project) in Do Son District, Hai Phong City.

The project has a total area of nearly 60 hectares and is planned as a resort complex with a 5-star hotel and 400 villas for sale. Phuong Hoa Island was planned and approved in 2003, but after two decades, it remains unfinished.

Currently, some projects in which Glexhomes is participating in capital contribution and development include An Long Nam Sai Gon residential area in Long An (investment capital of about 3,541 billion VND), VP2 project in Hanoi (2,600 billion VND), and Ly Tu Trong road residential area project (1,800 billion VND).

Phuong Hoa Island project – Source: Daso Group

|