Deep cuts in VND interest rates are putting pressure on important macroeconomic balances, most notably the exchange rate and asset bubbles. Illustration: DNCC |

Exports, the decisive driver of growth, will be favorable in 2024 and 2025.

Compared to other countries globally, Vietnam’s economy is highly open. According to World Bank statistics, the value of Vietnam’s exports of goods and services is equivalent to 94% of its GDP, ranking 14th worldwide.

In Vietnam’s total exports, goods exports account for the majority, contributing 82% of GDP. Service exports, mainly tourism and transportation, make up 12% of GDP. In comparison, two other critical components of economic growth, retail sales of goods and services (reflecting domestic consumer demand) and social investment (including private investment, public investment, and FDI), account for only 61% and 33% of GDP, respectively.

These figures indicate that exports are the most significant direct driver of Vietnam’s economic growth, with a substantial impact. Favorable exports will lead to positive GDP growth, and vice versa. In 2018 and 2019, Vietnam achieved GDP growth rates of over 7%, the highest in a decade. During the same period, exports increased by 13.2% and 8.4%, respectively. However, in 2023, when exports decreased by 4.6%, GDP growth reached only 5%.

|

The growth in 2024 and 2025 will undoubtedly be positive due to exports, not monetary easing. Therefore, the monetary easing up to this point can be considered to have fulfilled its mission. It is important to note that lending rates, a crucial factor in supporting growth, do not necessarily have to increase in tandem with deposit rates. |

Beyond its direct impact, exports also have an indirect influence on growth through employment and income, which are leading factors affecting consumer demand.

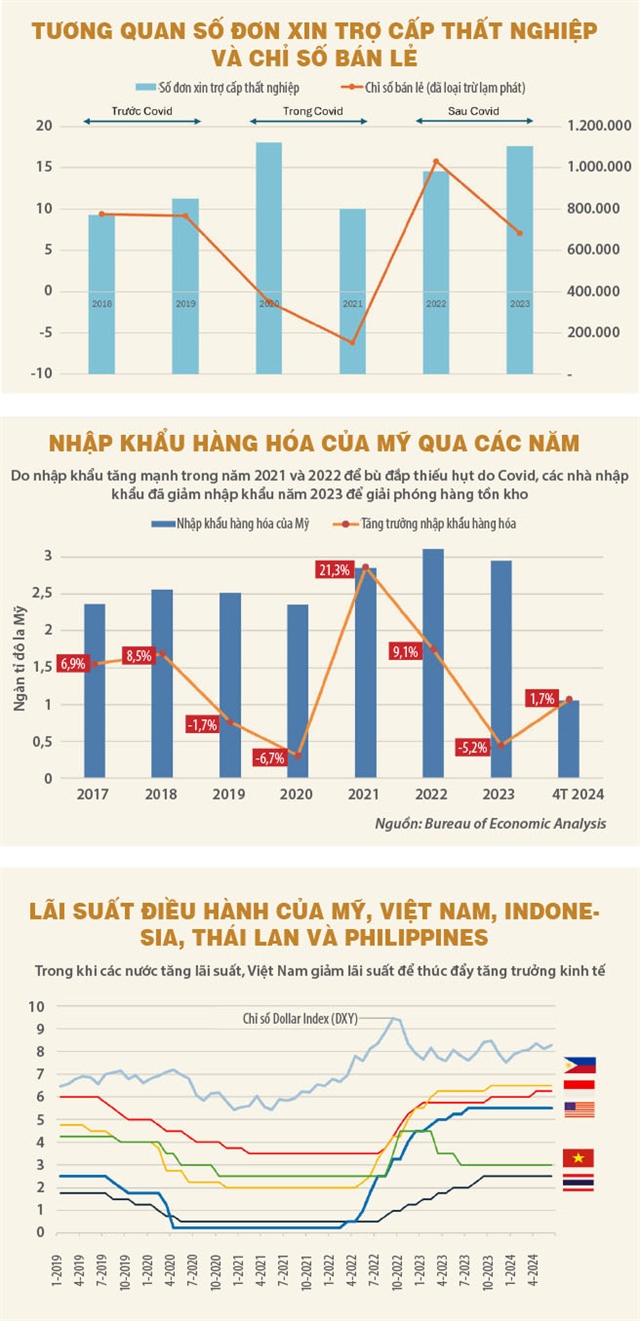

In 2023, when export growth turned negative, job losses and reduced incomes also increased. According to the Ministry of Labor, Invalids, and Social Affairs, the number of unemployment benefit claims in 2023 rose to 1.1 million, almost equal to the number in 2020, the year of the COVID-19 pandemic (1.12 million), and significantly higher than the number of claims in the pre-pandemic years. In 2018 and 2019, the number of unemployment claims was only 770,000 and 850,000, respectively.

The instability in employment and income has restrained consumer demand. The retail sales index in 2023 increased by only 7.1%, despite the significant reduction in interest rates and the VAT reduction to 8% for most consumer goods.

In the three years before the COVID-19 pandemic (2017-2019), the retail sales index grew by more than 9% annually, despite higher interest rates and VAT. Specifically, the 12-month deposit rate of the group of state-owned banks (the Big 4) in 2018 and 2019 fluctuated between 6.7-7.1% per year. In contrast, the average deposit rate of this group in 2023 dropped to 6.1% per year. Notably, in the last four months of 2023, deposit rates fell below 5% per year.

Deep cuts in VND interest rates are putting pressure on important macroeconomic balances, most notably the exchange rate and asset bubbles. Illustration: DNCC |

As the most critical driver of the economy, Vietnam’s exports are heavily reliant on the demand from developed economies. The US, EU, South Korea, and Japan account for 53% of Vietnam’s merchandise export value. The decline in exports to these markets has slowed economic growth in Vietnam. In 2023, exports to the US decreased by 11.3%, to the EU by 6.7%, and to South Korea and Japan by 3.7% each.

In 2024, the developed economies are regaining positive growth momentum, with projected growth rates of 1.7% in 2024 and 1.8% in 2025 (compared to 1.6% in 2023). The World Trade Organization (WTO) predicts that global merchandise trade will increase by 2.6% and 3.3% in 2024 and 2025, respectively, after a 1.2% decline in 2023.

The improved purchasing power in developed countries has had a noticeable impact on Vietnam’s economy. Merchandise exports in the first five months of 2024 grew by 15.2%, while in the same period in 2023, they decreased by 11.7%. Exports to the US, EU, South Korea, and Japan have all returned to positive growth, reaching 22.3%, 16.1%, 10.9%, and 3.2%, respectively.

Regarding the US market, the largest export destination, accounting for more than a quarter of Vietnam’s export value, in 2021 and 2022, US importers rapidly increased their imports to compensate for the disruptions caused by the COVID-19 pandemic. In 2023, as the pandemic concerns eased, importers realized that it was unnecessary to maintain such high inventory levels and proactively reduced imports to clear stockpiles.

This was the reason behind the 160.5 billion dollar (5.1%) decrease in US imports of goods in 2023. Within this, imports of consumer goods such as apparel, footwear, phones, and household goods – Vietnam’s key export items – fell by 80.6 billion dollars (9.6%). In 2024, US import trends have become more positive, with a 1.7% increase in the first four months. This explains why Vietnam’s exports to the US declined in 2023 and rebounded in the first few months of 2024.

Thanks to favorable exports, Vietnam’s GDP growth in Q1-2024 reached 5.66%, compared to 3.32% in Q1-2023. The number of unemployment benefit claims in Q1-2024 also dropped to 168,000, the lowest in ten quarters, indicating improvements in employment and business operations.

With the expectation of continued positive trends in developed economies and the resumption of growth in US imports of consumer goods, we can be confident that Vietnam’s exports in the remaining months of 2024 will maintain the positive trajectory seen in the initial months.

Furthermore, exports in 2025 are also anticipated to be favorable, as developed economies are forecast to continue growing at higher rates (2024: 1.7% and 2025: 1.8%). With this trend, we can be optimistic that Vietnam’s economy will witness a more positive transformation in both 2024 and 2025.

The stimulus policies have fulfilled their mission.

Since the COVID-19 pandemic, Vietnam has actively promoted growth through both fiscal and monetary policies. However, after a prolonged period of relaxation, both fiscal and monetary policies have reached their limits. On the fiscal side, this involved reducing VAT and increasing public investment. The budget for basic investment in 2024 could not be further increased, stopping at approximately 700 trillion VND. Regarding monetary policy, interest rates have been lowered to the “lowest level in 20 years” and cannot be reduced further.

Nevertheless, it became evident in 2023 that Vietnam’s economic growth did not improve due to this fiscal and monetary easing. A simple reason is that global trade and exports have little correlation with VND interest rates. FDI enterprises, which account for three-quarters of export value, can easily borrow in USD at low rates based on their existing relationships with foreign banks.

Meanwhile, deep cuts in VND interest rates are putting pressure on important macroeconomic balances, most notably the exchange rate and asset bubbles.

Regarding the exchange rate, since the beginning of the year, the VND has depreciated by approximately 5% against the USD. Before 2022, the exchange rate was very stable, and the VND even appreciated. However, since 2022, the exchange rate has continuously faced pressure due to the decrease in VND interest rates and the increase in USD interest rates.

At the beginning of 2022, due to various disruptions, prices of goods in many places, such as the EU and the US, surged. This prompted the US Federal Reserve (Fed) and most central banks worldwide to raise interest rates to combat inflation. US interest rates have increased continuously from 0.25% to 5.5% per year. In ASEAN, Thailand and Indonesia have both raised interest rates eight times in a row. In contrast, Vietnam briefly increased interest rates before reducing them from 4.5% to 3% per year.

Regarding asset bubbles, during the COVID-19 phase in 2021-2022, a wave of real estate price increases occurred across the board before the bubble burst at the end of 2022 when the policy rate was raised (in September and October 2022, the State Bank of Vietnam (SBV) raised the policy rate twice, each time by 1%, to defend the exchange rate). However, when the policy rate was lowered again in early 2023, another round of real estate price increases took place.

According to batdongsan.com.vn, apartment prices in Hanoi have increased by 30-40% from the end of 2023 to the beginning of 2024. Apart from real estate, gold prices have also surged. The gap between SJC gold prices in Vietnam and world gold prices began to widen from 2020, when interest rates were lowered.

Low-interest rates, rising property prices, a lack of profitable investment channels, concerns about inflation, and the upward trend in world gold prices have prompted people to shift towards investing and speculating in gold. In 2024, a situation of “too many problems falling on one person” emerged, with the SBV having to simultaneously stabilize the exchange rate and “stabilize” gold prices within a very narrow policy space.

As analyzed above, the growth in 2024 and 2025 will undoubtedly be positive due to exports, not monetary easing. Therefore, the monetary easing up to this point can be considered to have fulfilled its mission.

It is important to note that lending rates, a crucial factor in supporting growth, do not necessarily have to increase in tandem with deposit rates. Looking back at the time of the COVID-19 pandemic, commercial banks reduced lending rates more slowly than deposit rates, which led to a significant increase in the banking sector’s profits. At this juncture, commercial banks need to share more substantially with businesses by increasing lending rates at a slower pace. In May 2024, the government also issued a directive to further reduce lending rates by 1-2% in 2024.

Thus, monetary policy and interest rate orientation in 2024 need to be highly flexible, gradually increasing VND deposit rates to support exchange rate stability and reduce speculative asset bubbles while attempting to decrease, maintain, or slowly increase lending rates. By doing so, we will achieve both growth and macroeconomic stability in 2024 and 2025.

Nguyen Duc Hung Linh (Founder and Consulting Director of Think Future Consultancy)

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.