June’s bond market update from MBS paints a less-than-rosy picture for businesses, especially real estate companies. The report reveals a decrease in successful corporate bond issuances, with a notable absence of real estate enterprises due to their weak repayment capabilities.

During June 2024, the total value of corporate bonds issued was estimated at over VND 20,400 billion, a 37% decline year-over-year. In contrast, the banking sector dominated with a 94% share, including notable issuances from ACB (VND 10,000 billion), Shinhan Vietnam (VND 4,000 billion), and MSB (VND 2,000 billion). The interest rates on these bonds ranged from 4.5% to 5.3% per annum.

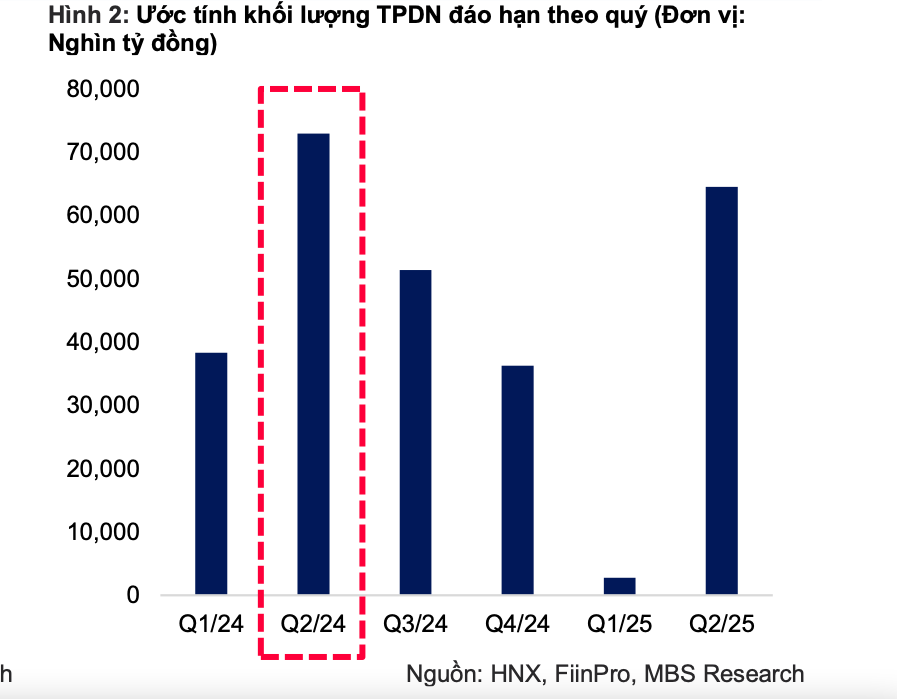

Estimated bond maturity by quarter

From the beginning of the year until now, the total value of corporate bonds issued has reached more than VND 93,800 billion, a 165% increase compared to the same period last year. The average interest rate in the first six months is estimated at 7.8%, lower than the 8.3% average of last year.

Notably, the banking sector has surpassed the real estate sector in terms of issuance value, with approximately VND 53,800 billion, accounting for 57% of the total market issuance. On the other hand, the real estate group ranked second in terms of total issuance value, reaching VND 25,300 billion, with an average interest rate of 12.3% per annum.

MBS also reported that in June, two more enterprises announced delays in principal payments, including one from the real estate industry, bringing the total number of delayed enterprises to 113. The estimated total value of corporate bonds with delayed payment obligations has reached VND 197,100 billion, accounting for 19.6% of the corporate bond market’s outstanding balance. The real estate sector accounts for the largest proportion of this delayed payment value, at approximately 70%.

Real estate businesses are not only facing challenges with delayed bond payments but are also competing to attract investors as deposit interest rates inch upwards.

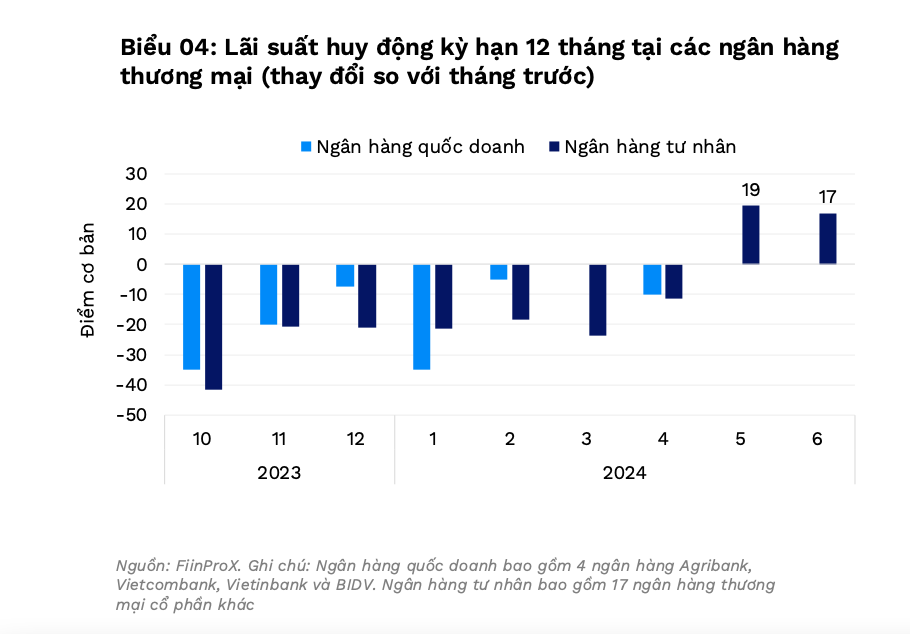

12-month average deposit interest rate has been inching up in the past two months. Source: FiinProX

According to the FiinRatings Credit Analysis and Research Block, domestic savings rates have recently reversed and are on the rise again, which could catalyze long-term bonds with fixed interest rates. Despite a cooling international interest rate environment, the 12-month savings rates of privately-owned joint-stock banks increased by an average of 0.19 percentage points and 0.17 percentage points in May and June, respectively.

“This will make floating-rate corporate bonds riskier. In reality, Vietnam still maintains the practice of determining bond interest rates based on the risk premium of large banks’ savings deposit rates. On the other hand, this is also one of the catalysts for enterprises to promote the issuance of long-term bonds with fixed interest rates to take advantage of the low-interest-rate environment and reduce interest rate risks,” said FiinRatings experts.