As we approach the second-quarter earnings season, MBS Securities forecasts a 9.5% increase in market-wide profits compared to the same period in Q2/2024. This is supported by a low base effect from the previous year, along with a mild recovery in production and consumption.

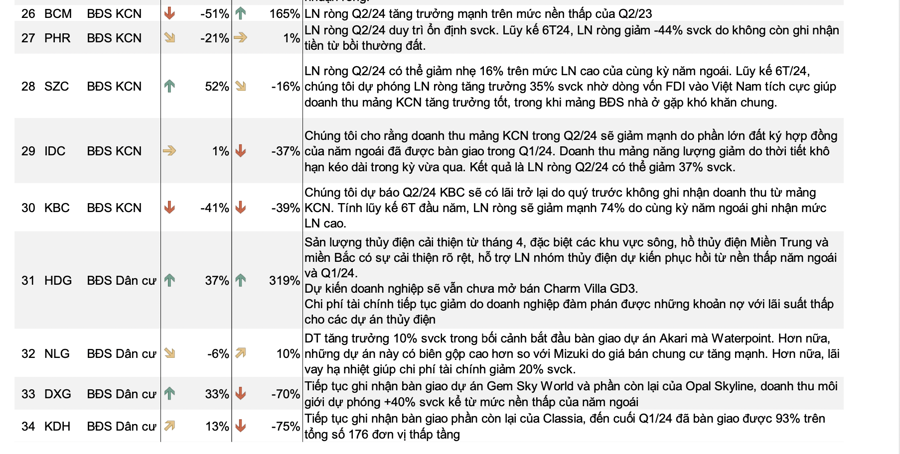

Banking sector profits are expected to slow down, with a growth rate of 12% in Q1/2024, a 14% increase year-over-year. Notable profit growth sectors include a 379% surge in retail and a 63% rise in basic materials, attributed to a low base in the previous year.

Some sectors are estimated to experience a decline in profit growth, such as a 26% drop in industrial real estate due to high base effects, and a 2% decrease in oil and gas due to underwhelming performance in downstream companies.

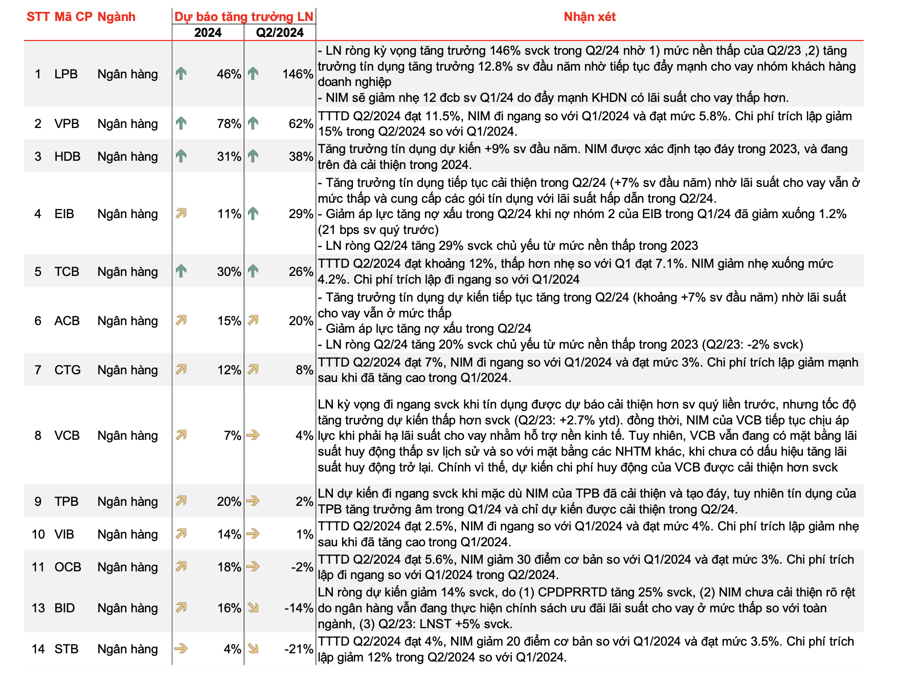

Specifically, the banking sector’s profit growth rate may slightly decrease. Net interest margin (NIM) will continue to face downward pressure as lending rates are expected to further decline, while deposit rates have already increased slightly across most banks. Credit growth in Q2 is anticipated to be more favorable than in Q1 (as of June 20, 2024, credit growth is estimated at 4.17% compared to 0.26% at the end of Q1/24), but it will still fall short of the previous year’s level. As a result, net interest income is unlikely to witness a significant increase.

Non-interest income remains subdued and has yet to recover, relying mainly on fee and debt processing segments. Foreign exchange operations and securities trading are not expected to exhibit high growth due to the challenging market conditions. Provision expenses will continue to rise as non-performing loans (NPLs) show signs of an uptick in Q2. An increase in NPLs and a decrease in loan loss reserves (LLRs) are common trends across the industry.

Overall, the banking sector’s net profits will not witness significant growth. Notable increases are expected in banks with strong credit growth, such as LPB, VPB, and HDB. On the other hand, some banks may record negative net profit growth year-over-year due to high base effects, including STB and BID.

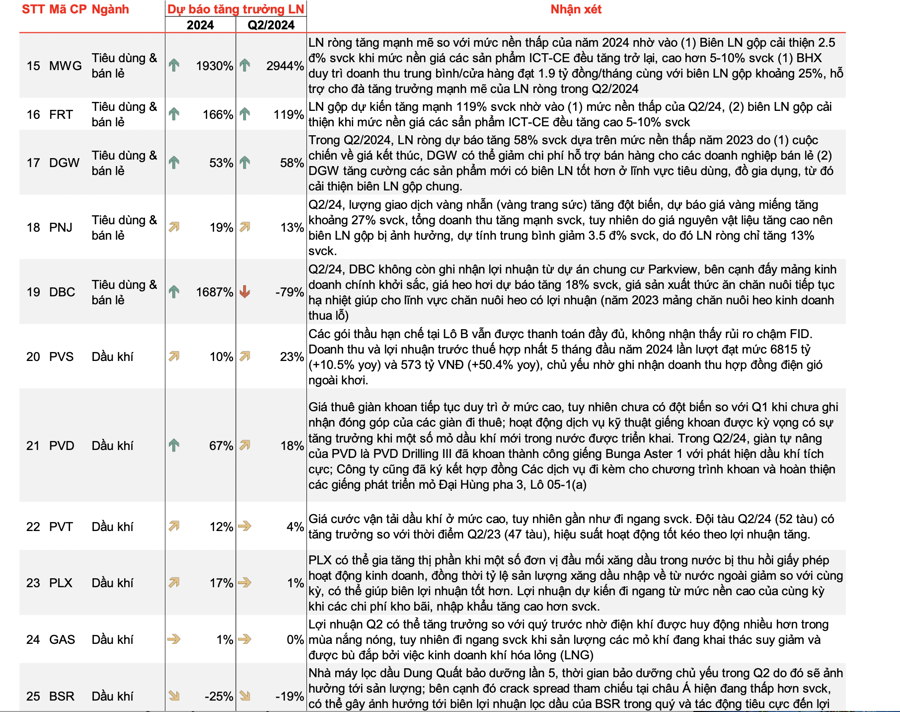

The retail sector is recovering from a low base. ICT-CE retail continues its slow growth, with a bright spot in the electrical appliances segment, which recorded double-digit growth due to hot weather and increased demand for air conditioners.

Retailers’ higher base prices compared to the previous year will lead to improved gross profit margins, resulting in a significant improvement in net profits for the ICT-CE segment. In the jewelry retail segment, gold prices in Q2/24 exhibited strong volatility, surging 27% year-over-year and increasing 15% from Q2/24 to Q5/24. This boosted demand for gold ring transactions, leading to an expected 12% growth in jewelry retail revenue.

However, the rise in raw material prices and the higher proportion of gold bar and gold ring sales will impact the gross profit margin of jewelry retailers, projected to decline by approximately 3%. In pharmaceutical retail, the expansion in the number of drugstores will drive revenue growth. Long Châu, for instance, plans to open 83 new stores, bringing the total to 1,670 and resulting in a 34% revenue increase. An Khang maintains its total number of drugstores, and overall, pharmaceutical retail revenue is expected to grow by about 57%.

The outlook for the upstream oil and gas sector remains positive. In Q2/2024, companies in this industry may continue to experience profit differentiation.

Upstream stocks (PVD, PVS) could report improved profits compared to the previous year due to increased workload. PVS, in particular, benefits from manufacturing offshore wind turbine foundations. PVD’s profits remain stable without significant changes from the previous quarter, as rental rates for JU rigs have been steady, and contributions from new rig rentals are yet to be realized.

Midstream companies (GAS, PVT) are expected to maintain their profits compared to the same period, as Q2 typically sees higher gas-fired power generation, resulting in higher gas production (dry gas and liquefied gas) for GAS. Oil and gas transportation rates have not increased significantly year-over-year, and the fleet expansion has not progressed as rapidly as anticipated.

In the downstream segment, profits of PLX and BSR exhibit a clear differentiation. PLX is likely to maintain its profits from a high base in the previous year, while BSR faces negative impacts on production and profits due to refinery maintenance during Q2.

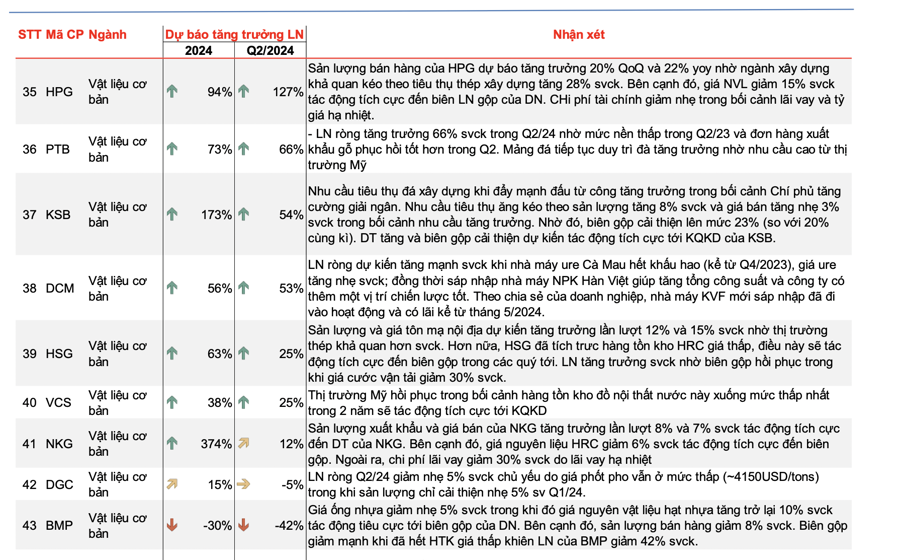

The basic materials sector will continue its recovery in Q2, with steel companies being a notable bright spot. Steelmakers have demonstrated a significant recovery in profits compared to the previous year, benefiting from a cooling-off in raw material prices, which positively affects their gross profit margins.

Coal and ore prices have dropped by 18% and 20%, respectively, year-over-year, while steel prices have only decreased by 7%, leading to an average gross margin of 12% (up from 5% in 2023). Raw material prices are expected to remain low, given stable supply and reduced inventory demand in China due to steel production cuts.

Additionally, consumption has improved, driven by a recovery in domestic demand. This positive trend in demand and domestic consumption is likely to persist, supported by an expected increase in real estate supply starting in Q3. Steel prices may witness an upward trend in Q3 due to improved demand and reduced pressure from China’s price cuts.

The real estate sector is recovering but remains differentiated. The performance of residential real estate companies in Q2 is unlikely to show significant improvements due to a lack of projects for handover and unchanged legal status before the enactment of related laws (expected on August 1, 2024).

Factors such as lower interest rates and reduced selling expenses will provide some support to profits in Q2. Overall, sector-wide net profits are expected to remain stable, mainly driven by VHM, which has ongoing projects with clear legal status and surrounding infrastructure developments.

Some companies may experience declines in profits ranging from 50% to 70% year-over-year, such as KDH and DXG, due to lower revenues from project handovers compared to the high base in Q2 2023. Land and resort real estate segments will remain subdued in the upcoming period due to speculative nature and legal issues.

Bank Bonus 2024: 4-Month Salary Surprise, Where…0 VND

Amidst the declining business results of many banks in 2023, the Tet bonus for employees has also significantly decreased. In fact, some branches do not have any Tet bonus or only give symbolic bonuses to their employees.