A recent study by Wigroup reveals that after a challenging period, businesses across various industries have ramped up their investments. This is evident from the significant increase in their work-in-progress assets, indicating their renewed faith in the economy’s recovery.

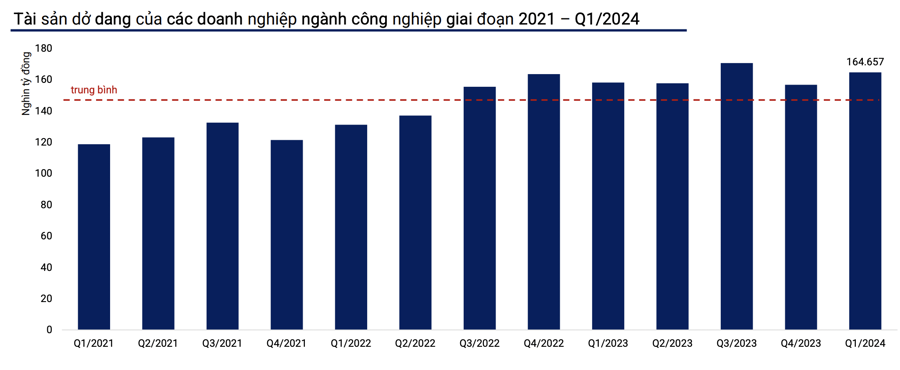

In the industrial sector, enterprises have been actively investing in expansion, as seen by the positive trend in their work-in-progress assets. This represents investments in new facilities or continued capital injections into existing ones, resulting in an increase of over 8.21 trillion VND after the 2023 downturn.

Entering Q1/2024, the industrial sector’s long-term work-in-progress assets reached 164.66 trillion VND, a 5.1% increase from Q4/2023 and a 4% surge year-over-year. While this is a relatively high level during 2021-2024, it still falls short of the peak in Q3/2023, suggesting a cautious approach to business expansion.

Long-term financial investments in the industrial sector for Q1/2024 amounted to 125.66 trillion VND, an 18.6% jump from the previous quarter. This marks the highest growth rate since 2021, primarily driven by the profits of joint ventures and associated companies.

The industry’s fixed assets value stands at its highest point since 2021. In Q1/2024, it reached 512.98 trillion VND, a slight 2.4% increase from the previous quarter, indicating optimism about the sector’s production capabilities in the upcoming period.

Turning to the consumer goods sector, enterprises have been relatively active in expansion, as evident from the slight increase in long-term work-in-progress and financial assets. In Q1/2024, their work-in-progress assets reached 35.53 trillion VND, a modest rise from the previous quarter.

However, fixed assets in this sector displayed a downward trend in the same quarter, which can be attributed to high depreciation rates while fixed assets remained unchanged. In Q1/2024, the consumer goods enterprises’ fixed assets stood at 166.08 trillion VND, the lowest since late 2022, due to high depreciation and a lack of new expansionary investments.

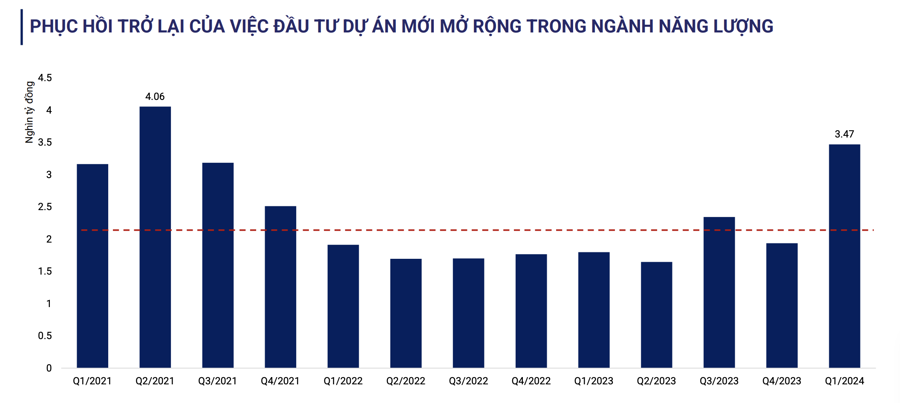

In the energy sector, expansionary investments picked up significantly in Q1/2024. Work-in-progress assets grew by a substantial 78% compared to the previous quarter, reaching 3.47 trillion VND. This indicates a robust recovery in the enterprises’ construction activities within the industry.

Long-term financial investments in the energy sector have been relatively stable over the years, with a slight increase in Q1/2024 to 6.26 trillion VND. Notably, the sector has lacked new fixed asset additions in the last four years, with significant new projects only emerging in 2024.

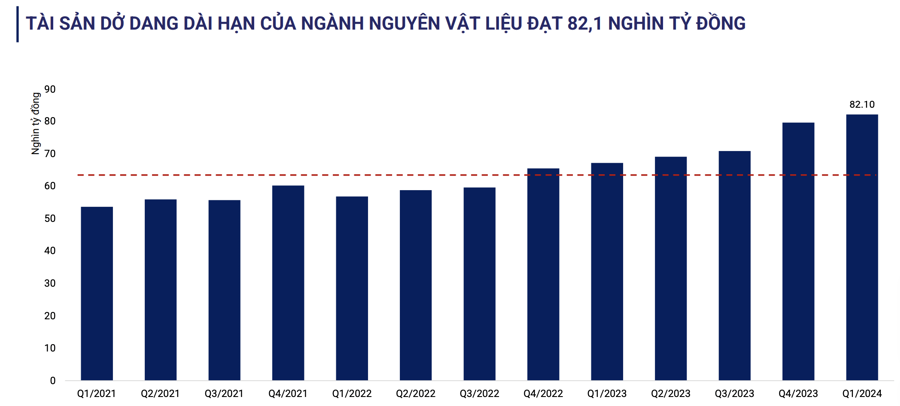

As for the materials sector, 2023 witnessed a substantial expansion, with investments surging to 14.06 trillion VND. This momentum continued into Q1/2024, with long-term work-in-progress assets reaching 82.10 trillion VND, the highest since Q1/2021. This recovery in investment signifies positive expectations for the development of materials companies in the remainder of 2024.

Fixed assets in the materials sector have been on a continuous decline for over two years, suggesting that enterprises have focused more on investing in projects rather than operational activities. There are high hopes that the expansionary investments of 2023, once operational, will significantly enhance the sector’s overall capacity.