On June 28, the Taxation Department of Binh Dinh province informed that they had sent a document to the Department of Exit and Entry Management under the Ministry of Public Security to temporarily suspend the exit of Mr. Xu Xie Feng Pei (also known as Xu Feng Pei, a Chinese national), Director General of Hong Yeung Vietnam One-Member Co., Ltd. (Hong Yeung Vietnam), headquartered in Nhon Hoi Economic Zone, Nhon Hoi ward, Quy Nhon city, Binh Dinh province.

Nhon Hoi Economic Zone, where Hong Yeung Vietnam is located.

According to the Binh Dinh Taxation Department, Mr. Xu Feng Pei is the legal representative of Hong Yeung Vietnam, which is currently subject to enforcement of administrative decisions on tax management and has not yet fulfilled its tax obligations.

-

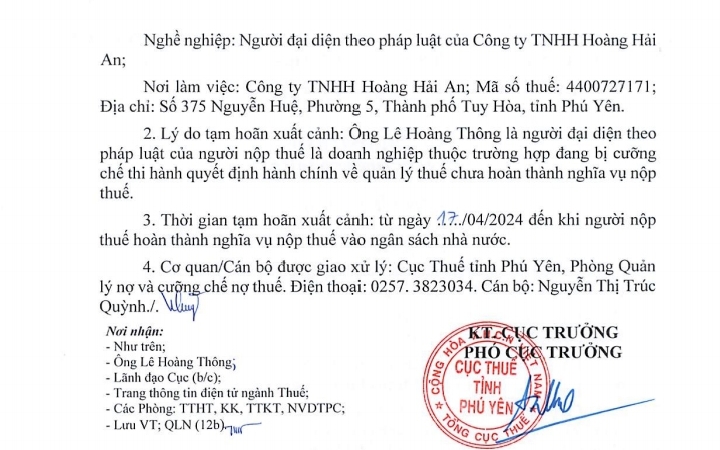

Related news: Temporary Suspension of Exit for a Successful Phu Yen Businessman

The temporary suspension of exit for Mr. Xu Feng Pei will be in effect from June 24 until Hong Yeung Vietnam completes its tax obligations to the state budget.

It is known that Hong Yeung Vietnam currently owes more than VND 70 billion in taxes. The company is 100% foreign-owned and was one of the first investors in Nhon Hoi Economic Zone, specializing in infrastructure construction and business in industrial parks.

Government tax authority cracks down on enforcing e-commerce tax debts

The tax authorities are planning to publicly disclose a list of e-commerce businesses that owe taxes. Additionally, they are considering implementing enforcement measures for taxpayers who have not fulfilled their tax obligations.

South Korean businesses pay 175 trillion dong in taxes, urge repeal of policy measures

Korean businesses in Vietnam have raised concerns regarding challenges they face to the Ministry of Finance, such as exceeding working hours of laborers and delayed value-added tax refunds. Meanwhile, the Ministry of Finance asserts that it has implemented numerous unprecedented support policies for businesses in general, including Korean businesses in Vietnam specifically.