The rapid shift in consumer habits from traditional markets and small grocery stores to modern channels implies a fertile ground for modern retailers in Vietnam’s grocery retail market.

MODERN RETAIL IS REPLACING TRADITIONAL

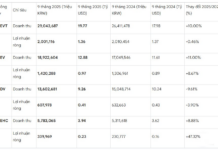

In fact, many modern retailers have recorded accelerated growth in the first months of the year. Mobile World Investment Corporation (MWG-HOSE) has just announced its business results for the first five months of 2024, with net revenue reaching VND 54,240 billion, a 15% increase compared to the same period last year, completing 43% of the full-year plan.

In terms of revenue structure, the largest contributors were The Gioi Di Dong and Bach Hoa Xanh chains, accounting for 47.4% and 29.2% of total revenue, respectively. Bach Hoa Xanh alone contributed VND 15,800 billion in revenue for the five-month period, a 42% increase year-on-year. In May, revenue reached VND 3,400 billion, a 6% increase from the previous month, mainly driven by the fresh produce and FMCG categories. The average revenue per store reached VND 2 billion per month, surpassing the expectations of the company’s leadership.

Similarly, for Masan, in the first quarter of 2024, the net revenue of WCM, which owns the Winmart+ and Winmart chains, increased by 8.5% year-on-year to VND 7,957 billion, up from VND 7,335 billion in the first quarter of 2023. This revenue growth was driven by the opening of additional stores, with the number of stores increasing significantly from the previous year. WinMart+ saw a net revenue increase of 11.4%, reaching VND 5,364 billion, while the WinMart supermarkets achieved VND 2,523 billion in the first quarter of 2024, a 3.1% increase compared to the same period last year.

In the first quarter of 2024, 40 new mini-supermarkets (“WinMart+” or “WMP”) were opened, bringing the total number of stores and supermarkets nationwide to 3,667.

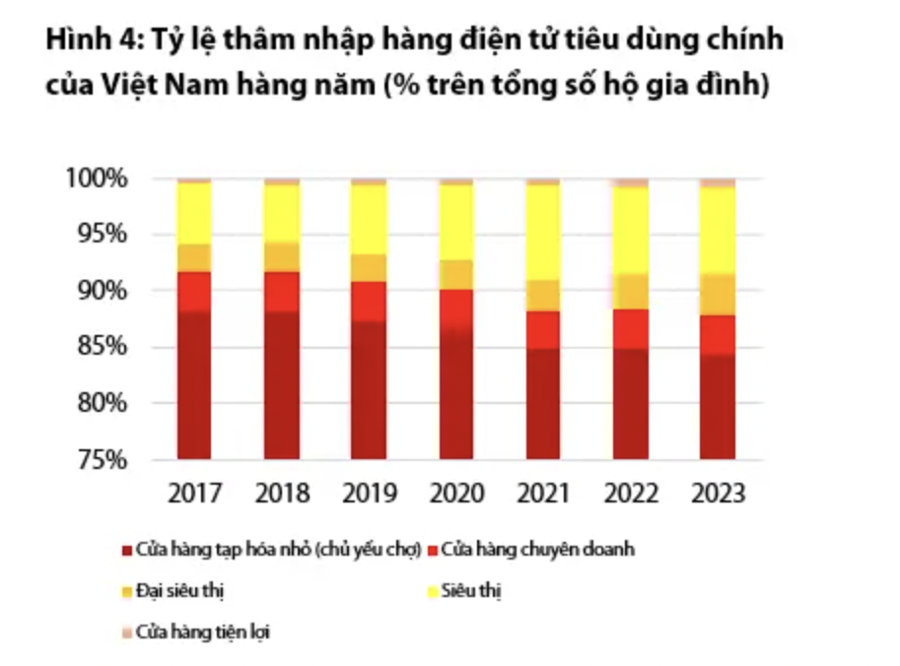

Commenting on the modern retail trend in Vietnam, Rong Viet Securities stated that during the 2017-2023 period, inflation and rural market expansion led the growth of Vietnam’s grocery retail sales, despite saturated sales volumes in urban areas.

The total sales of the grocery retail market are expected to achieve single-digit growth as the per capita consumption of groceries in Vietnam reaches its limit (~30% of income). According to Euromonitor’s forecast, the value of Vietnam’s grocery retail market will grow at a CAGR of 2.8% annually in the period between 2023 and 2028, a decrease of 28 bps compared to the CAGR of the 2017-2022 period.

Despite the low potential for market size growth, there has been a wave of entrants into the grocery retail market from both domestic and foreign grocery chains in recent years, including Go!, Aeon, BigC, Winmart, and Bach Hoa Xanh.

This indicates that Vietnam’s grocery retail market is fertile ground for modern chains, driven by the rapid change in consumer habits favoring modern channels, supported by superior services compared to traditional markets and small grocery stores (such as food safety, fixed pricing, clean and spacious shopping environments). The increasing market share confirms this trend.

Regarding specific market share, based on the modern channel’s approximately 12% market share compared to the small grocery stores’ 84%, there is significant growth potential in expanding the market share of these modern chains in the coming years. Meanwhile, the development of the modern grocery retail industry in Vietnam lags far behind that of other Southeast Asian countries.

A PROMISING OPPORTUNITY FOR BACH HOA XANH AND WINCOMMERCE

Looking back at the period before the restructuring of the WCM and BHX chains, they recorded significant losses of VND 20,451 billion and VND 8,077 billion, respectively, equivalent to net profit margins of -24.3% and -8.6%. In the context of “burning money” just to gain 1-2% market share, with poor customer experience and a huge cost burden even after 5-7 years of operation, both MSN and MWG actively implemented their restructuring plans.

According to representatives of MWG and MSN, these chains successfully completed their restructuring plans in 2023, achieving the following positive results: Although the number of stores is currently lower than before the restructuring, market share has increased, and revenue per store has been solid during 2021-23. This indicates improved efficiency in attracting a larger customer base and achieving better conversion rates.

Net margins are gradually approaching the breakeven point, thanks to improved revenue per store and cost optimization.

“In summary, thanks to their prominent market position, extensive store network, and significant potential for cost improvement based on references from leading Asian chains, these chains are playing a key role in shaping the long-term growth of MSN and MWG,” emphasized VNDirect Securities (VDSC).