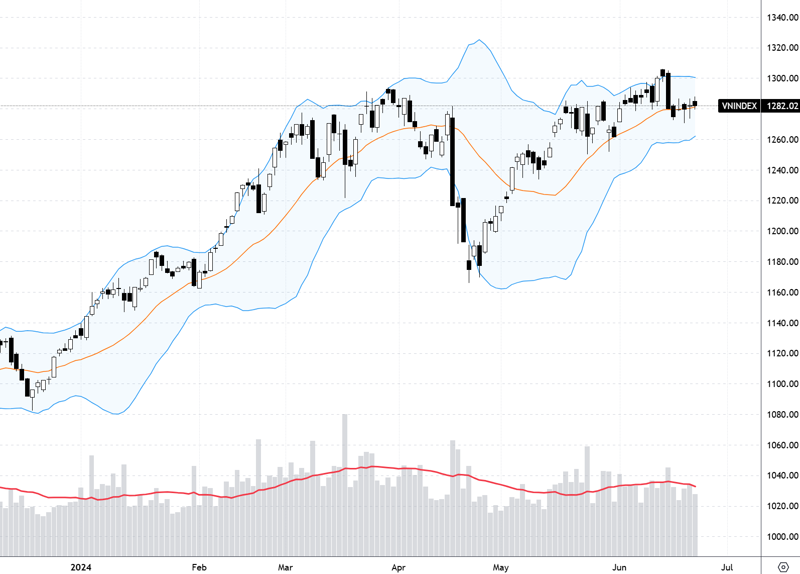

The market experienced a sharp weekly drop of 2.9% with 2 out of 5 sessions falling within a wide range. After last week’s cautious stance, experts are becoming more pessimistic and foresee further adjustments.

Despite the absence of any clear negative news during the past week and preceding weeks, selling pressure has been mounting with each session, particularly after narrow-range sideways trading. This reflects the typical profit-taking sentiment as the market remains devoid of supportive information, and the earnings season has yet to commence.

Commenting on the developments, experts highlight the high liquidity in the downward sessions and low liquidity in the narrow-range sideways sessions. This indicates limited buying interest, while profit realization is more pronounced. Moreover, the continuous net withdrawals by foreign investors, though a small portion of daily liquidity, also weaken overall demand, especially amid persistent forex rate tensions.

Some more pessimistic views suggest that the market has completed a five-wave advance and is entering a downward phase. Nonetheless, the initial decline is usually limited. Experts largely concur that after losing the 1250-point threshold, the VN-Index will seek deeper support levels, around the 1220-point region, corresponding to the 61.8% Fibonacci retracement ratio from the peak.

In line with this cautious sentiment, experts maintain average or low equity ratios and focus on capital preservation while awaiting lower investment opportunities.

Nguyen Hoang – VnEconomy

Last week, the VN-Index consecutively tested the 1250-point support level, as predicted two weeks ago, eventually breaking below to 1245 points. This significant volatility lacked any notable influencing factors. Why was the market pushed down so forcefully, despite it being the NAV closing week for the second quarter?

We won’t lose money if we’re not in a bull market, but we’ll surely lose a lot if we’re in a bear market.

Nguyen Thi Thao Nhu

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

In my opinion, the stock market’s downward trend in the recent period stems from the following factors: Firstly, this is a news vacuum. Despite the absence of negative news, there also haven’t been any notably positive developments. Investors are awaiting crucial data to be released soon, such as Q2 GDP growth and enterprises’ business results. These will provide a basis for assessing the stock market’s future trajectory.

The investors’ caution is evident in the second factor, liquidity. There’s a noticeable downward trend in transaction values in the past few weeks. With banks raising deposit interest rates and the stock market undergoing adjustments, there’s a likelihood of a partial shift back to savings deposits. Domestic capital weakness, coupled with persistent foreign net selling, poses challenges for the overall market.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

From a technical perspective, the VN-Index has undergone three deep-loss sessions, which can be considered distribution sessions with high liquidity. A common feature before significant price-suppressing sessions is that the index tends to stagnate, fluctuating within a narrow range and low liquidity. With no extremely negative news, the market is likely showing us the supply-demand imbalance. Most investors seem pessimistic, ready to reduce their holdings as the index recovers intraday or sell off when support levels are breached, while buying responses remain feeble.

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

Short-term fluctuations are often influenced by news, while long-term trends depend on enterprises’ intrinsic values. If there’s no negative news, but the market keeps declining, could this be a “random walk”?

Considering a large wave starting in late October last year, most investors are likely holding stocks with low cost prices or profitable portfolios. If we look at a smaller wave starting in late April this year, the average stock has risen over 15%. Thus, for short or long-term investors, it’s quite normal to sell off in this phase, given the lack of supportive news, and their desire to safeguard gains.

In my view, last week’s market adjustment was necessary for it to advance to higher milestones. The crucial question is the extent of this correction, allowing us to seize opportunities during this adjustment phase.

Money Flow Trend: Sideways in a Narrow Range, Awaiting Supportive Information?

Q2/2024 GDP Reaches Nearly 7%

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

I attribute the market’s sharp decline to multiple reasons: June is typically a news vacuum before the release of Q2 business results, prompting investor caution. Additionally, there’s been weak supportive capital, coupled with persistent net foreign selling; unresolved forex rate tensions; and the lack of expectations or robust capital in prominent sectors like banking and real estate.

Nguyen Hoang – VnEconomy

Since the VN-Index departed from its mid-June peak, the market has repeated a trading pattern: starting with a sharp drop, followed by a few sideways sessions with a narrow range, and then another significant decline. Will there be a “third time’s the charm,” and was last week’s final drop? If the market worsens, what levels do you anticipate below 1250 points as potential bottoms?

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

With the market’s current dynamics, it’s relatively challenging to pinpoint when it will bottom out. It’s likely that the VN-Index has entered a short-term adjustment phase, as technical signals indicate that the downward momentum hasn’t concluded, and selling pressure persists. Forex rate risks will likely persist, requiring the State Bank to continue intervening by selling foreign reserves. Hence, I don’t foresee a high probability of the market bottoming out around the 1250 level.

Consequently, the expected medium and long-term support levels for the VN-Index are around 1220 points and, further down, 1180 points.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Currently, I observe that the VN-Index has completed five upward waves and is in the corrective phase A. The last session approached the 50% fibo level, and although there were moments of sharp decline, panic selling didn’t occur, with liquidity below the 20-session average. I anticipate two potential regions where the market might halt its decline and rebound in wave B: around 1236 +/- 5 points and 1220 +/- 5 points.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The market performed quite negatively last week, with two substantial drops at the beginning and end, particularly closing below the 1250-point threshold on Friday. However, I discern less negativity in Friday’s session compared to the steep decline earlier in the week, as candle range and volume contracted, indicating waning selling pressure. Additionally, market breadth indicators are approaching oversold territory. These signals suggest that the downward trend might have covered most of its course and that a bottoming-out signal could emerge in early July. The critical zones to monitor are 1200-1220 points.

I anticipate two potential regions where the market might halt its decline and rebound in wave B: around 1236 +/- 5 points and 1220 +/- 5 points.

Nguyen Viet Quang

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

Based on the moving average (MA), the VN-Index is touching the MA100 (1250 points) resistance level. Applying Fibonacci retracement, the 1.236 (Fibo 50%) and 1.220 (Fibo 61.8%) levels could be the new thresholds the market might reach if it breaches the MA100 support level – corresponding to 1250 points.

As the market lacks notable news, neither overly positive nor negative, we can’t decisively conclude that it will “bounce back” upon encountering the robust MA100 resistance. The market often moves sideways within a narrow range, indicating investors’ ambiguity about the market’s prospects. The frequent Doji candles (a Japanese candlestick pattern with opening and closing prices nearly equal) in recent weeks reflect this uncertainty. Given the evident selling pressure in the past days, with substantial volume accompanying sharp declines, such dynamics don’t bode well for the short term. Hence, I lean towards the market breaching the 1250 resistance to descend to the 1220-1236 zone.

Nguyen Hoang – VnEconomy

The international market eagerly anticipates the upcoming US inflation data release. Domestically, forex rates remain elevated, and the State Bank of Vietnam raised the OMO interest rate to 4.5%/year last week. If the Fed maintains its hawkish stance, will this prolong forex rate pressures? Could this be a factor in the persistent net foreign selling?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Capital naturally flows from low-interest-rate regions to high-interest-rate areas. With the Fed maintaining high rates while Vietnam’s rates remain low, net foreign selling has persisted.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I believe forex rate risks are among the reasons for persistent net foreign selling, an issue I’ve mentioned previously. Hopes for Fed rate cuts are diminishing, with only a 1-in-2024 chance remaining, compared to 4-6 times expected earlier this year. This has triggered net outflows, not just from Vietnam but across emerging markets. Additionally, the global surge in tech stock investments, an area where Vietnam has limited representation, diminishes our market’s appeal.

However, from a long-term perspective, I think this adjustment presents attractive valuations for the VN-Index, with projected growth rates nearing 15-20% in 2024. Thus, I’m confident that after this restructuring phase and once the Fed’s interest rate policies become clearer, foreign capital will return, driving the market positively.

There are signs that the downward trend might have covered most of its course, and a bottoming-out signal could emerge in early July. The critical zones to monitor are 1200-1220 points.

Nguyen Thi My Lien

Nguyen Thi Thao Nhu – Director of Individual Customers, Rong Viet Securities

In my view, the migration of smart capital from one country to another or from one investment market to another with higher returns is commonplace in today’s world. Forex rates are always a significant concern for small economies with high openness like Vietnam. Notably, our stock market has witnessed substantial participation from foreign funds, including a recent surge in ETF investments.

We can’t deny that the overall macroeconomic context regarding forex rate pressures hasn’t positively influenced the stock market. Still, we can’t conclusively attribute the net foreign selling in recent days to this sole reason. There’s only one reason to buy: expecting a stock’s price to rise. In contrast, there are countless reasons to sell. It’s not that current stocks aren’t appealing enough; it could be that another opportunity is more enticing, prompting the decision to offload existing holdings.

Thus, regarding net foreign selling, I believe that the backdrop isn’t so pessimistic that investors would panic-sell. Instead, a “hurried” capital flow with high expectations in the previous months might have missed its “cycle,” leading to the recent wave of net outflows. From an investment perspective, I consider this normal, and investors need not be overly concerned. Net selling doesn’t diminish enterprises’ values but creates opportunities for buyers.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

Net foreign selling isn’t a novel phenomenon in Vietnam’s stock market. However, the sustained selling intensity and volume have exerted pressure on the index. In the first half of 2024 alone, foreign investors net sold over VND 40,000 billion on the HOSE, surpassing the full-year figure for 2023.

For now, the outflow trend from frontier and emerging markets will likely persist. The Fed hasn’t indicated any rate reduction plans, while some developed economies have initiated rate-cutting trajectories, potentially keeping the DXY index elevated. Overall, this could sustain forex rate pressures, and foreign capital might continue exiting the Vietnamese market.

Nguyen Hoang – VnEconomy

Last Friday’s sharp drop didn’t significantly boost liquidity. Sessions like June 14th or 24th witnessed high-volume declines. Are investors fearful now? Did you buy during Friday’s session? What’s your current equity ratio?

Nghiem Sy Tien