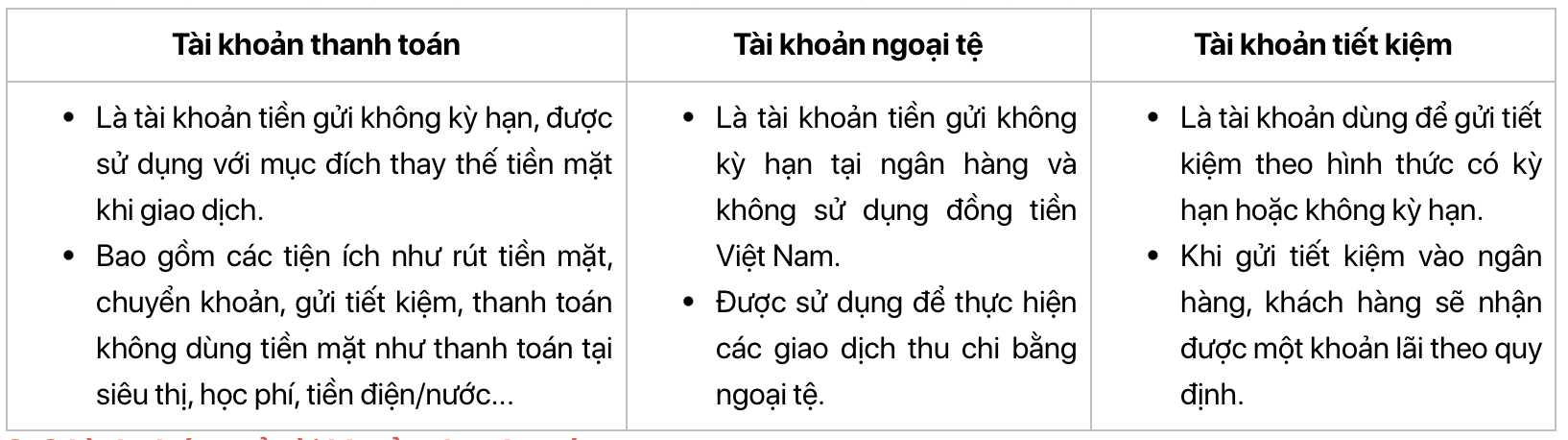

Payment accounts are a type of bank account that offers a wide range of features and utilities to its users for cashless transactions. A payment account is a non-term deposit account that customers can open at a bank to access various payment services provided by the bank, such as transferring funds to the same or different bank accounts, withdrawing cash, paying bills, insurance premiums, and purchasing train or plane tickets.

Most of the bank accounts used by the public today are payment accounts.

Cases for Closing a Payment Account:

Decree No. 52/2024/ND-CP clearly states that a payment account can be closed in the following situations:

– The payment account holder requests closure and has fulfilled all obligations related to the payment account;

– The payment account holder is an individual who has passed away or has been declared dead;

– The organization holding the payment account ceases operations as per the law;

– The payment account holder violates any prohibited acts related to payment accounts as specified in Clause 5 and Clause 8, Article 8 of Decree 52/2024/ND-CP.

– Other cases as agreed upon in writing between the payment account holder and the payment service provider;

– Other cases as prescribed by law.

These regulations come into effect on July 1st, 2024.

4 Cases for Freezing a Payment Account:

According to Decree No. 52/2024/ND-CP, a payment account may be partially or fully frozen in the following circumstances:

– By prior agreement between the payment account holder and the payment service provider or at the request of the account holder;

– When there is a decision or written request from an authorized agency as per the law;

– When the payment service provider detects a mistake or error in crediting the payment account of the customer or upon a request for refund from the payment service provider transferring the funds due to a mistake or error compared to the payment order of the sender after crediting the payment account of the customer. The frozen amount must not exceed the mistaken or erroneous amount;

– When there is a request for freezing from one of the holders of a joint payment account, unless there is a prior written agreement between the payment service provider and all holders of the joint payment account.

Lifting the Freeze on a Payment Account:

Decree No. 52/2024/ND-CP stipulates that the freeze on a payment account shall be lifted in the following situations:

– By written agreement between the payment account holder and the payment service provider;

– When there is a decision to lift the freeze from an authorized agency as per the law;

– When the mistake or error in the money transfer has been rectified as mentioned in point 3 above.

– When there is a request to lift the freeze from all holders of a joint payment account or as agreed upon in writing between the payment service provider and all holders of the joint payment account.

The decree clearly states that the payment service provider, the payment account holder, and the authorized agency shall be liable for compensation as per the law if they freeze a payment account unlawfully, causing damage to the payment account holder.

The Crypto Conundrum: Unraveling the Mystery of Vietnam’s Government Decree 52

The government has recently issued Decree No. 52/2024 on non-cash payments (effective from July 1), replacing Decree No. 101/2012 (as amended and supplemented). Notably, the new decree introduces additional provisions on virtual currencies, providing a clear definition and elucidating the nature of this emerging form of currency.