On July 1st, Vincom Retail Joint Stock Company’s VRE stock caught attention as it soared to the 7% ceiling, reaching 21,850 VND per share. It was the only stock in the VN30 to hit the ceiling that day.

This was the second time VRE stock has ceilinged since Vingroup divested from Vincom Retail. The company’s market capitalization now stands at VND 49,650 billion (approximately USD 1.95 billion), a decrease of over VND 4,500 billion from the beginning of the year.

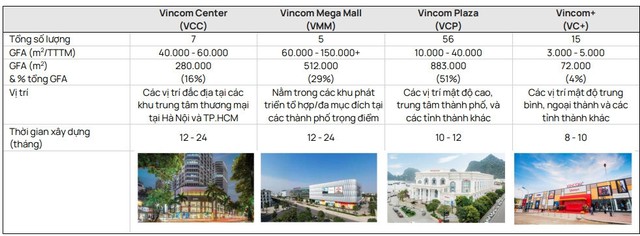

The surge in VRE stock came after the company simultaneously inaugurated two shopping malls: Vincom Plaza Ha Giang and Vincom Plaza Dien Bien Phu. Vincom Plaza Ha Giang spans 12,000 square meters across four floors of commercial space within a complex that also includes the 5-star Four Point by Sheraton hotel. It is located at the intersection of Tran Phu and National Highway 34 in Ha Giang Province. On the other hand, Vincom Plaza Dien Bien Phu is situated in Muong Thanh Ward, right next to Dien Bien Phu City’s 7/5 Square. It offers a total commercial area of 12,000 square meters across four floors.

Earlier, on June 1st, VRE also inaugurated Vincom Megamall Grand Park in District 9, Ho Chi Minh City, with a total floor area of 45,255 square meters. Thus, within just one month, the company has launched three shopping malls with a combined floor area of 78,255 square meters, bringing its total number of malls to 86 across 46 provinces and cities.

In the first quarter of 2024, Vincom Retail (VRE) recorded a total revenue of VND 2,254.6 billion, a 16% increase compared to the same period last year. After-tax profit after minority interest reached VND 1,082.6 billion, a 6% increase year-on-year, with a net profit margin of 48% of revenue. This performance represents 24% and 24% completion of the company’s full-year plan, respectively.

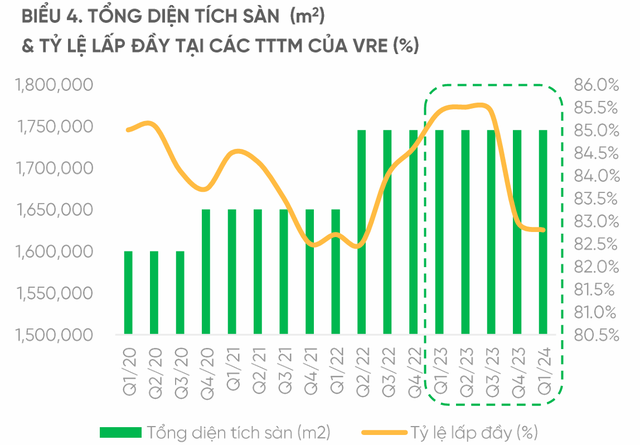

According to VPBankS’ latest report on Vincom Retail, VRE’s impressive profit margin growth is attributed to its focus on operational efficiency and management cost optimization. However, the continuous decline in occupancy rates over the past two quarters (down 2.6 percentage points year-on-year) is a risk that warrants attention going forward.

Retail rental revenue reached VND 1,928 billion, a 1% increase year-on-year but a 1% decrease compared to the previous quarter. The net operating income (NOI) margin for the retail rental segment was 72.3% in Q1/2024, a decrease of 5.7 percentage points from the high base in Q1/2023 and almost unchanged from the previous quarter. This was mainly due to the decline in the average occupancy rate. Accordingly, the average occupancy rate for Q1/2024 was 82.8%, a decrease of 0.2 percentage points from the previous quarter and 2.6 percentage points year-on-year.

VRE’s management expects the NOI margin for the retail rental segment to continue declining in Q2/2024 due to increased energy costs during the summer. They anticipate a recovery in the second half of 2024, supported by an improvement in the average occupancy rate.

For the full year 2024, VPBankS projects a 13% year-on-year increase in Vincom Retail’s retail rental revenue, driven by expectations of higher tenant sales due to improved consumer confidence and purchasing power. Consequently, the occupancy rate is expected to gradually increase from the low base of Q1/2024.

According to VPBankS, improving the occupancy rate is also Vincom Retail’s primary goal for 2024 to avoid impacting consumer experience. A low number of customers could further decrease the occupancy rate, and VPBankS believes that Vincom Retail may slow down rental rate growth to achieve this target.

Revenue from the transfer of shophouses will no longer contribute significantly in the future as VRE plans to recognize only VND 700 billion in shophouse revenue in 2024. The company’s real estate inventory as of Q1/2024 stood at VND 511 billion. VPBankS assesses that the transferred/leased shophouses will not significantly impact VRE’s short-term financial performance.

In the longer term, projects implemented after 2024 will require specific negotiations with Vingroup. While Vincom Retail’s expansion strategy will remain unaffected in the next year due to the early deposit payment made to VIC for land purchase at cost, in the longer term, transfer costs may become less favorable than the current original price, indicating a potential risk of increased costs associated with land expansion.

Vincom Retail (VRE) Stocks Surge: Who Holds the Key?

Based on the ownership structure of this company, over 70% of Vincom Retail shares are held by domestic shareholders, while the remaining shares are held by foreign shareholders.