The money flow suddenly shifted outside, refusing to enter, causing the index to continue fluctuating without a clear trend. The VN-Index closed 2.15 points lower, retreating to the 1,259-point region with a negative breadth, as 214 declining stocks outnumbered 175 advancing ones.

There weren’t many changes from the previous day, as large-cap stocks continued to adjust, and mid- and small-cap stocks started to diverge. Specifically, banks decreased by 0.27%; securities dropped by 0.72%; oil and gas declined by 0.66%; and construction materials fell by 0.21%. The real estate sector witnessed a strong divergence, with residential stocks surging, such as VHM rising by 0.27%, NVL climbing 1.88%, KDH and PDR gaining over 1%, and DIG soaring more than 3.42%, mainly driven by the news of the government’s approval of the Real Estate Business Law and the Housing Law coming into effect six months earlier than scheduled.

Information technology still posted an increase but with waning strength, climbing by 0.46%. Retail rose by 1.09%. Top stocks that propped up the market today included FPT, MWG, BVH, SAB, MSN, and DIG. On the flip side, TCB shaved off 0.95 points, and BID sank another 0.56 points. Liquidity plunged to a low across the three exchanges, with matched orders reaching 17.5 trillion VND, including strong net selling by foreign investors totaling 1,143 trillion VND, mainly offloading FUEVFVND.

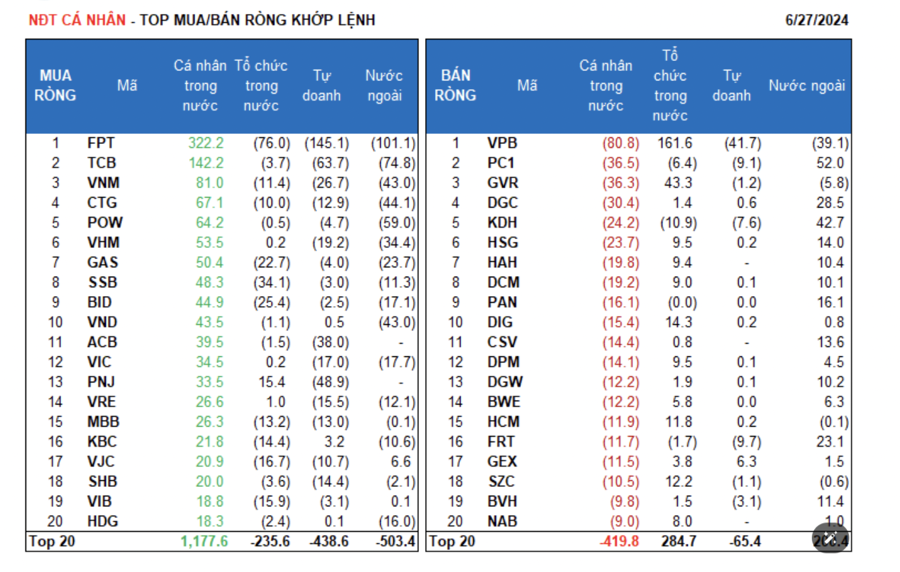

Foreign investors sold a net amount of 1,174.6 billion VND, and their net selling value in matched orders was 457.4 billion VND.

Their net buying in matched orders focused on the retail, construction, and materials sectors. The top net bought stocks by foreign investors in matched orders were MWG, PC1, KDH, DGC, HPG, FRT, STB, PAN, HSG, and CSV.

On the selling side, their net selling in matched orders targeted the banking sector. The top net sold stocks by foreign investors in matched orders were FUEVFVND, FPT, TCB, POW, CTG, VNM, VND, VPB, and VHM.

Individual investors bought a net amount of 860.5 billion VND, and their net buying value in matched orders was 998.9 billion VND.

In terms of matched orders, they net bought 11 out of 18 sectors, mainly focusing on the banking industry. The top net bought stocks by individual investors included FPT, TCB, VNM, CTG, POW, VHM, GAS, SSB, BID, and VND.

On the net selling side in matched orders, they net sold 7 out of 18 sectors, primarily focusing on chemicals and industrial goods & services. The top net sold stocks included VPB, PC1, GVR, DGC, KDH, HSG, DCM, PAN, and DIG.

Proprietary trading posted a net buy value of 11.9 billion VND, while their net selling value in matched orders was 624.5 billion VND.

In terms of matched orders, proprietary trading net bought 3 out of 18 sectors. The top net bought stocks by proprietary trading today included FUEVFVND, GEX, SAB, KBC, PVD, PHR, EIB, TCH, LPB, and PVT. Their net selling focused on the banking sector, with the top net sold stocks being FPT, TCB, MWG, PNJ, VPB, GMD, ACB, HPG, HDB, and VNM.

Domestic institutional investors bought a net amount of 268.8 billion VND, and their net buying value in matched orders was 83.0 billion VND.

Regarding matched orders, domestic institutions net sold 9 out of 18 sectors, with the largest net selling value in information technology. The top net sold stocks by domestic institutions included FPT, MWG, FUEVFVND, SSB, BID, GAS, VJC, VIB, KBC, and MBB. Their net buying focused on the banking sector. The top net bought stocks were VPB, HDB, GVR, GMD, REE, PNJ, DIG, SZC, HCM, and HVN.

Today’s matched orders reached 3,346.6 billion VND, a decrease of 42.6% compared to the previous session, contributing 19.1% of the total trading value.

A notable transaction today involved the DCVFMVN DIAMOND ETF’s FUEVFVND fund certificates, with over 21 million fund certificates (equivalent to 678.5 billion VND) sold by foreign institutions to domestic proprietary trading through negotiated deals.

Additionally, there were transactions involving tens of millions of units exchanged between foreign institutions in MSB and TCB stocks. Individuals continued to execute negotiated deals in the banking group (EIB, SSB) and mid-cap stocks (SJS, KOS).

The allocation of money flow decreased in securities, steel, warehousing, logistics and maintenance, power generation & distribution, plastics, rubber & fibers, and agricultural & marine products. Meanwhile, it increased in banks, real estate, software, food, construction, chemicals, retail, textiles, aviation, and oil & gas production and exploration.

In terms of matched orders, the allocation of money flow rebounded in large-cap stocks (VN30) and decreased in mid-cap stocks (VNMID) and small-cap stocks (VNSML).

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.