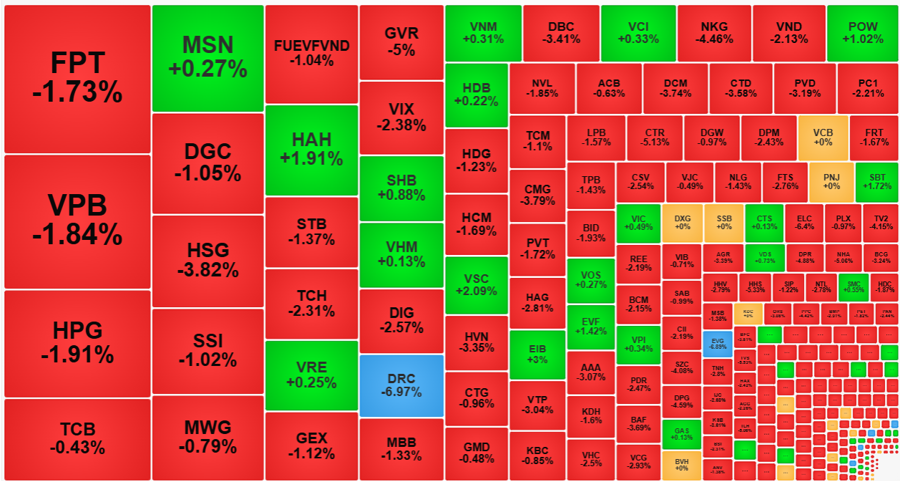

What seemed to be a calm afternoon of NAV closing turned chaotic as the market witnessed a sudden surge in selling pressure in the last 15 minutes of continuous matching, causing the VN-Index to plunge. The index lost nearly 19 points before a slight recovery in the ATC session, ending the day down 13.77 points (-1.09%). The trading volume in the afternoon surged to almost three times that of the morning session, reaching a two-week high.

Several pillar stocks witnessed sharp declines in a short period: GVR hit the floor, TCB fell by 4.05%, VPB by 2.11%, MWG by 2.84%, SSB by 2.85%, and SSI by 1.6%. Fortunately, some pillars only experienced minor losses, acting as a “shock absorber” for the VN-Index: VIC decreased by 0.24%, VCB by 0.23%, and VHM by 0.8%.

The rapid decline in a short time frame, starting around 2:15 pm, resulted in numerous buy orders being matched at lower price levels. This explains the high trading volume despite the continuously falling prices. It was only in the last few minutes of the continuous and ATC sessions that the trading volume showed signs of positive momentum. However, the trading value during this period on HoSE was just over 2,000 billion VND, not a significant amount.

Overall, today’s trading volume remained high: The matched order value on HoSE and HNX increased by 52% compared to the previous session, reaching 20,125 billion VND. This value is second only to the sell-off session on June 24, which saw a value of over 30,500 billion VND. This indicates a certain level of greed in the market.

The buying force at the bottom was unable to create a large enough recovery range. The VN-Index only recovered about 5.2 points. MBB fell by 1.33%, BID by 1.93%, HPG by 1.91%, SSI by 1.02%, STB by 1.37%, TPB by 1.43%, and VPB by 1.84%. FPT also declined by 1.73%. While these stocks witnessed bottom-fishing demand, they couldn’t pull the prices up significantly, even closing at the lowest price of the day. Some stocks, however, showed decent recoveries: TCB recovered by almost 3.8%, ending the day down only 0.43% from the reference price; POW reversed a 3.11% loss to a 1.02% gain; GVR regained about 2.1%, still closing 5% lower.

The negative impact of this sell-off is evident: The VN-Index’s breadth at the close showed only 79 advancing stocks against 355 declining ones, with nearly 130 stocks falling more than 2% and around 80 others falling within the 1% to 2% range. In terms of capital distribution, out of the 51 stocks on the HoSE with a trading value of over 100 billion VND – accounting for 64% of the total matched order value on the exchange – 34 stocks fell more than 1%, and only 11 out of the 51 stocks were in the green. The group of stocks falling more than 2% accounted for approximately 29% of the exchange’s value.

With a loss of nearly 14 points, the VN-Index broke below the 1,250-point threshold, settling at 1,245.32 points. Typically, a failed support level leads to a more negative market sentiment. However, today’s session also showcased a significant bottom-fishing force. Investors remain cautious, waiting for lower prices instead of chasing the market. If the trading volume can be sustained at high levels in the upcoming sessions, it may help absorb the selling pressure from cut-loss orders.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”