Today’s narrow price range resulted in a lack of demand and supply interaction, with neither side willing to make aggressive moves. This stagnation harkens back to last weekend’s dull sessions. Such a boring sideways trend is unlikely to persist.

Naturally, cash holders wish for a decrease, while stockholders desire an increase; that’s the nature of the market. However, wishes never influence trends. The market’s major forces will reveal their intentions, and observable manifestations will occur.

After the second session of expanded price limits on June 24, which saw high trading volume, the current slower trading pace and lower volume indicate a reduction in selling pressure. Trading volume has been extremely low for the past three sessions, and today it dipped even further, with both exchanges reaching approximately 13.3 thousand billion. It’s not a lack of money; this liquidity drought results from a mismatch between buy and sell orders. Each price movement requires a decisive action from the order placer. Hence, this situation arises not from a scarcity of funds but from a lack of urgency to buy or sell at any cost.

The current sideways trend is psychologically similar to last week’s, but the crucial question is whether another drop like the one on June 24 could occur. Last week, low volume and a narrow price range created a sense of “scarcity,” yet pushing prices down was still achievable, and lower volume even made it easier to manipulate prices.

As the second quarter draws to a close, the market is approaching the final days of NAV adjustment, which could introduce variables. However, as mentioned yesterday, the process of loose inventory checking isn’t complete, and there’s a high probability of another round of pressure. Of course, it’s also possible that the market is genuinely balancing and gradually moving upward. All scenarios are probabilities, but the market needs to stimulate greed to attract capital inflows. When the expectations of capital are met, a consensus will naturally emerge.

The immediate supportive information flow will be the semi-annual macroeconomic data, released during the holiday. Then, it will take another two weeks for more second-quarter business results to start leaking. Apart from abnormal events (with exchange rates being the most significant factor at the moment), the information flow doesn’t contain any negative news. Therefore, the risk of a deep correction is low. If a session with expanded downside price limits occurs, it will be an opportunity to increase stock accumulation.

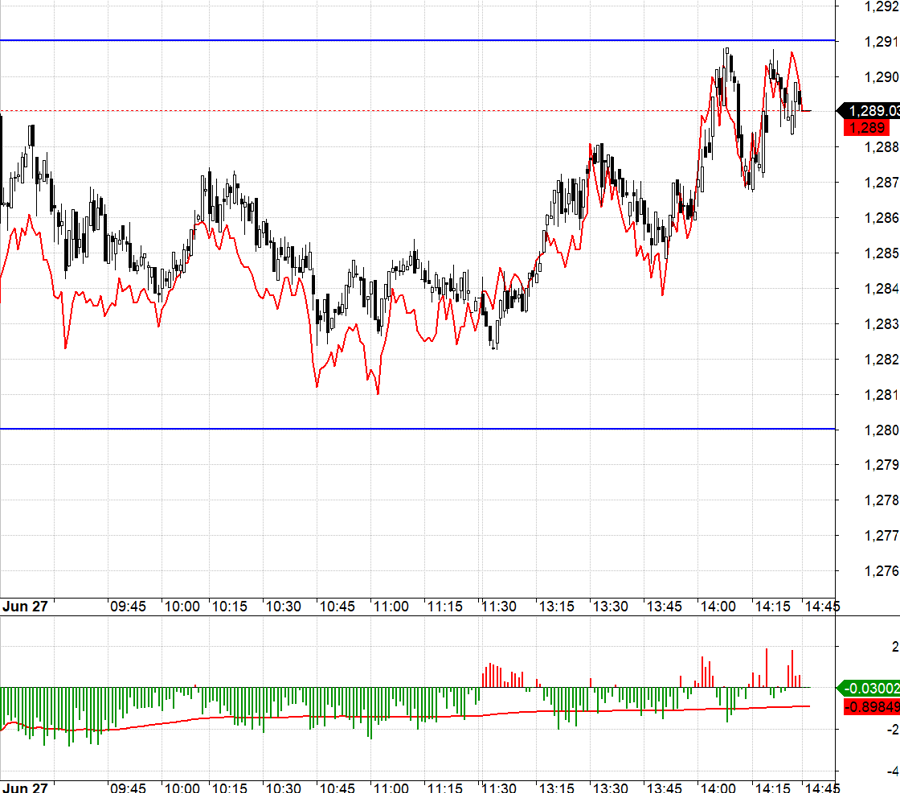

Today’s dull session in the derivatives market resulted from the narrow range of the VN30, hovering within the 1280.xx to 1291.xx range. Without a precise entry point, one could either stay on the sidelines or follow standard technical signals. Overall, today’s fluctuations were merely “noise” without any intraday trends. Derivatives trading volume decreased by about 15% compared to yesterday and was the lowest in 13 sessions.

The current reduction in selling pressure finds psychological support around the 1250 threshold of the VNI. To increase pressure, this level must break. Manipulation can be employed. If this scenario unfolds, observe the trading volume and the movement of leading stocks. The strategy is to watch for buying opportunities, employing a flexible Long/Short approach with derivatives.

VN30 closed today at 1289.03. Tomorrow’s resistances are 1292, 1297, 1304, 1309, 1315, 1320, and 1327. Supports are 1282, 1273, 1266, 1260, and 1255.

“Blog chứng khoán” reflects the personal opinions of the author and does not represent the views of VnEconomy. The opinions and writing style belong to the individual investor, and VnEconomy respects the author’s perspective. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented in this blog.