Today’s trading session saw a slight uptick in activity, but the total matched orders on both exchanges fell short of 7,500 billion VND, the lowest since the beginning of May. The day’s liquidity for matched orders barely reached 13,265 billion VND, equivalent to the week before the Tet holiday at the beginning of the year. Foreign investors resumed their net selling pace in the trillions of VND after a week of stagnation.

The net selling value on the HoSE this afternoon surged to 669 billion VND, and for the whole session, it reached 1,143 billion VND. Including HNX and UpCOM, the total net selling value reached nearly 1,179 billion VND. The latest session with similar net selling by foreign investors was on June 19, and since the beginning of the month, there have been 6 sessions with net selling of over 1,000 billion VND, and in May, there were 7 sessions.

It is worth noting that today’s large net selling figure includes a transaction withdrawing 791.7 billion VND from the FUEVFVND fund certificates. Although fund certificates are usually traded by agreement, the fund eventually has to sell stocks. Moreover, the number of stocks that were heavily net sold far exceeded those that were net bought. Significant net buying was only concentrated in a few stocks: MWG +105.2 billion VND, PC1 +52.3 billion VND, KDH +42.4 billion VND, DGC +28.5 billion VND, and HPG +26.9 billion VND. On the net selling side, we saw FPT -101.5 billion VND, TCB -74.8 billion VND, POW -58.7 billion VND, VPB -54.5 billion VND, CTG -44.1 billion VND, HDB -43.1 billion VND, VNM -43 billion VND, VND -42.9 billion VND, VHM -34.4 billion VND, and GAS -23 billion VND.

For stocks in the VN30 basket, the net selling amount was approximately 365.5 billion VND. The total selling value in the basket reached 1,618.4 billion VND, accounting for 25.2% of the total trading value of the basket (including matched orders and negotiated deals). This is a very large proportion. Of course, not all stocks sold by foreign investors turned red, but the pressure remains, and domestic money has to spend resources to absorb it.

Meanwhile, domestic money showed very weak performance. HoSE matched orders this afternoon increased by 33.5% compared to the morning session, reaching nearly 7,039 billion VND. The VN30 basket rose by 38.4%, reaching 3,268 billion VND. Most of the money in the VN30 basket in the afternoon went into 3 stocks: FPT, MWG, and VPB, accounting for 42% of the total increased trading. All three codes showed impressive price improvements: FPT this afternoon increased by 1.07% compared to the closing price in the morning, successfully reversing and surpassing the reference price by 0.76%. The liquidity of this code in the afternoon alone reached 588.4 billion VND. MWG also traded 413.9 billion VND, pushing the price up by 1.77% compared to the morning session and pulling it above the reference price by 1.28%. VPB matched 361.8 billion VND, with the price increasing by 1.32% compared to the morning session and returning to the reference price. With very good afternoon trading, all three codes maintained their top positions in the market’s liquidity for the whole day.

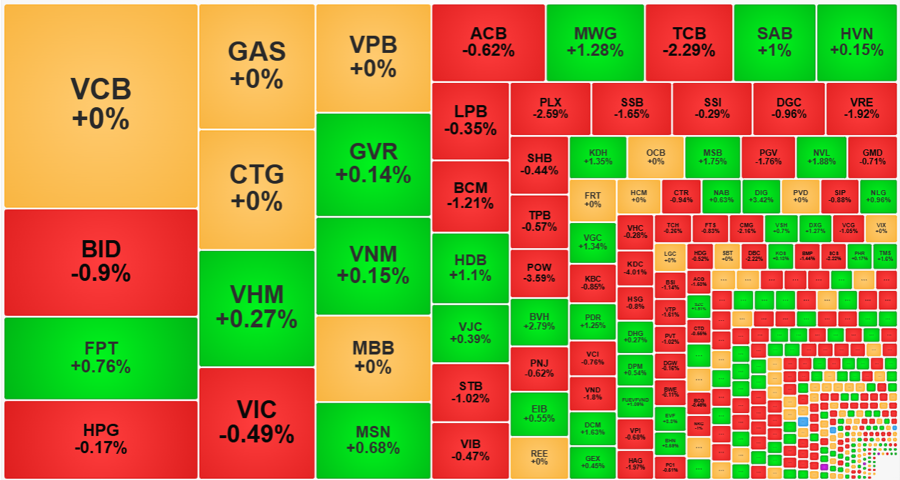

Although the overall liquidity was not strong, the market still had stocks that attracted good capital, such as the above-mentioned three stocks. The breadth of the HoSE improved significantly towards the end, with 175 gainers/214 losers, compared to 138 gainers/244 losers at the end of the morning session. Among the gainers, 90 stocks rose more than 1%, and liquidity was concentrated at 20.2% of the total matched orders on the HoSE. In the losers’ group, 82 stocks fell by more than 1%, and liquidity was concentrated at 19.5% of the total. Thus, there was clear differentiation in liquidity, even as overall trading weakened significantly.

With this differentiation, stock-picking ability becomes more important than the movement of the VN-Index. DIG, DCM, PDR, NVL, BVH, and EVF, which are mid-to-small-cap stocks, saw positive price movements and good liquidity, each trading hundreds of billions of VND. The so-called “lin kin” group, including HID, TDC, MIG, TIP, QCG, TTA, ST8, SAV, and TCI, even rose more than 4% despite having only a few billion VND in liquidity. On the losing side, TCB, POW, STB, HAH, VRE, VND, BCM, and DBC were heavily sold off. Overall, the majority of stocks today, similar to the previous two sessions, fluctuated within a narrow range, with increases and decreases at a “normal” level.