As per Government Decree No. 74/2024/ND-CP, which stipulates the minimum wage for employees working under employment contracts, the minimum wage has been increased by VND 200,000 – VND 280,000 per region, effective from July 1st.

Following this adjustment, the new monthly minimum wages for Region 1, 2, 3, and 4 are VND 4.96 million, VND 4.41 million, VND 3.86 million, and VND 3.45 million, respectively.

This minimum wage increase brings about several implications for both employees and employers in Vietnam.

Higher Monthly Salary

As per Article 91 of the 2019 Labor Code, the minimum wage is the lowest salary that must be paid to employees performing the simplest work tasks under normal working conditions. It ensures a basic standard of living for employees and their families and is adjusted periodically to match socio-economic development.

With the recent increase, companies must adjust the salaries of employees whose current salaries fall below the new minimum wage. However, for employees whose salaries are already equal to or higher than the new minimum wage, the company is not obligated to provide an immediate raise, and salary increases will follow the internal salary adjustment policies.

Increased Social Insurance Contributions

According to current regulations, the monthly salary for compulsory social insurance contributions must not be lower than the regional minimum wage at the time of payment. Therefore, with the increase in the minimum wage, social insurance contributions will also rise.

Higher Unemployment Insurance Contributions and Benefits

Based on the 2013 Employment Law and Decision 595/QD-BHXH by the Vietnam Social Insurance, unemployment insurance contributions are based on the salary decided by the employer. The maximum contribution for those with a monthly salary higher than 20 times the regional minimum wage is capped at 20 times the regional minimum wage as per the Labor Code.

As a result, the maximum unemployment insurance contribution for each region, effective from July 1st, will be as follows: Region I – VND 99.2 million, Region II – VND 88.2 million, Region III – VND 77.2 million, and Region IV – VND 69 million.

Similarly, the maximum unemployment benefit, which is calculated as 60% of the average monthly salary of the last 6 months of employment, is also adjusted. For employees in the state-regulated salary scheme, the maximum benefit is 5 times the base salary, while for those under the employer-decided salary scheme, it is 5 times the regional minimum wage.

With the increase in the regional minimum wage, employees who lose their jobs will be eligible for higher unemployment benefits.

Other Implications: Suspension of Work and Job Transfer

According to Article 99 of the 2019 Labor Code, if work suspension occurs due to the employer’s fault, employees must be paid their full salary, which should not be lower than the regional minimum wage.

Additionally, when employees are transferred to a different job role, they must be paid at least 85% of their previous salary for the first 30 days. After this period, their salary must be adjusted to match the new role but should not be lower than the regional minimum wage.

DOUBLE INCREASE IN MINIMUM WAGE FOR SOME AREAS

Besides the general increase in the regional minimum wage, the Decree No. 74/2024/ND-CP also adjusted the regional classification for several localities, resulting in a double increase for employees in those areas.

The following localities have been reclassified to a higher-wage region: Uông Bí City, Móng Cái City, Quảng Yên Town, and Đông Triều Town of Quảng Ninh Province (from Region II to Region I); Thái Bình City of Thái Bình Province, Thanh Hóa City, Sầm Sơn City, Bỉm Sơn Town, and Nghi Sơn Town of Thanh Hóa Province, Ninh Hòa Town of Khánh Hòa Province, Sóc Trăng City of Sóc Trăng Province, Bắc Giang City, Việt Yên Town, and Yên Dũng District of Bắc Giang Province (from Region III to Region II); Triệu Sơn District, Thọ Xuân District, Yên Định District, Vĩnh Lộc District, Thiệu Hóa District, Hà Trung District, Hậu Lộc District, Nga Sơn District, Hoằng Hóa District, and Nông Cống District of Thanh Hóa Province, Thái Thụy District and Tiền Hải District of Thái Bình Province, and Ninh Phước District of Ninh Thuận Province (from Region IV to Region III).

Employees in these areas will benefit from a double increase in their minimum wage. However, for those whose salaries are already above the minimum wage, the adjustment will depend on the agreement between the employee and the employer.

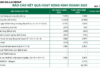

Over 64% of unemployed beneficiaries lack qualifications or certifications.

Unemployment benefit recipients without degrees or certificates in Q4/2023, although slightly decreased compared to Q3, still remain high and make up the largest proportion compared to other groups, according to the Ministry of Labor, Invalids and Social Affairs.

Fixing the flaws in calculating pension benefits

The length of time participating in social insurance is long, but the level of benefits is not proportional, which makes the pension not attractive to workers.