On June 30, APG Securities JSC (code: APG) failed to hold its Annual General Meeting of Shareholders (AGM) for 2024 due to a lack of quorum. This came after the securities company announced disappointing first-quarter financial results.

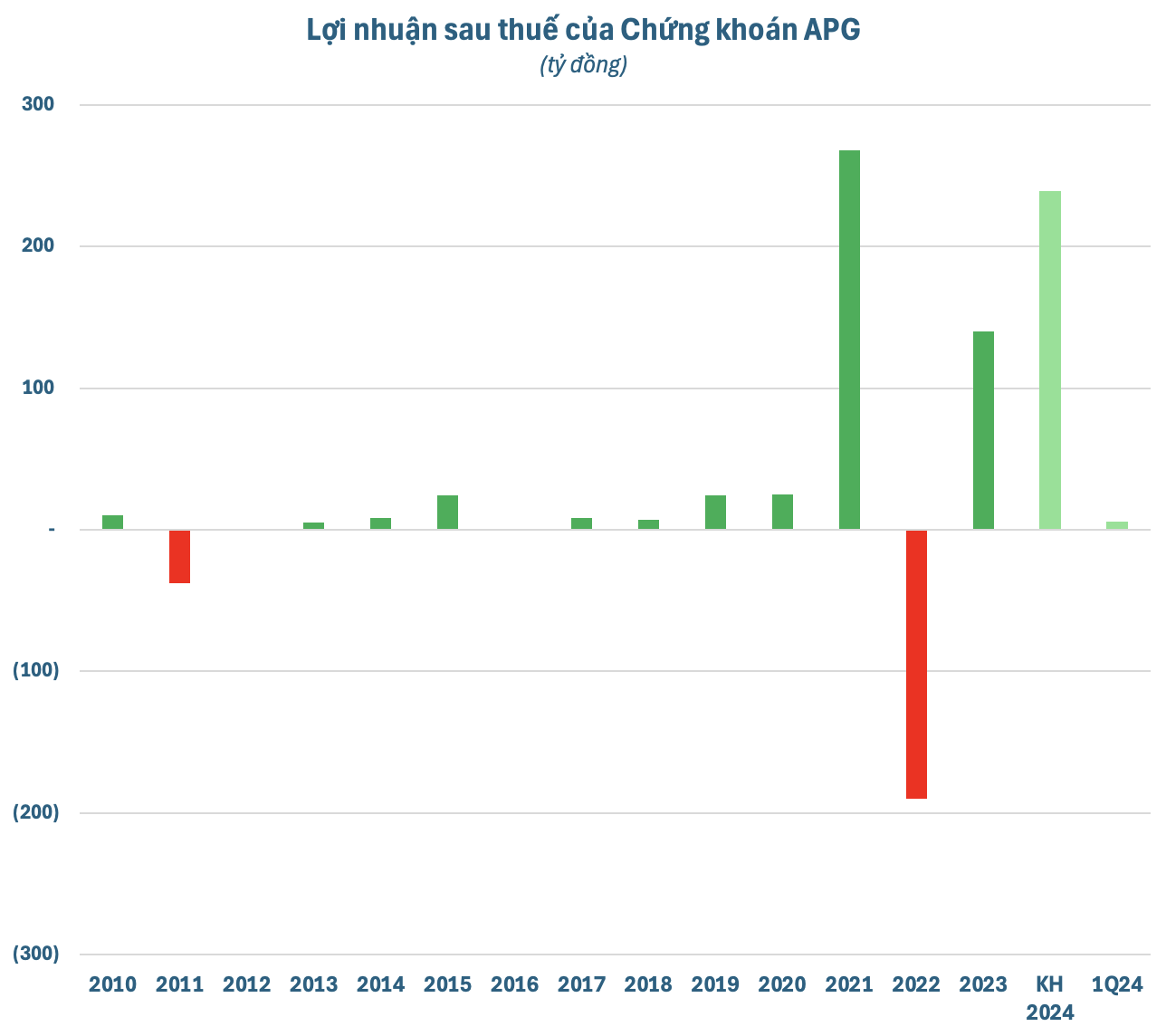

In the first quarter, APG recorded an after-tax profit of over VND 6 billion, an 85% decrease compared to the same period last year. APG attributed this mainly to losses from the sale of financial assets and revaluation adjustments of financial assets through profit and loss. This indicates that proprietary trading activities were inefficient despite a favorable market environment.

For 2024, APG has set ambitious targets, with revenue and after-tax profit planned to reach VND 390 billion and VND 239 billion, respectively, representing a 48% and 43% increase compared to 2023. However, after the first quarter, the company has only achieved less than 3% of its profit plan, which may raise questions among shareholders about the feasibility of its business plan.

Amid the lackluster business performance, APG has several significant capital-raising plans for this year. According to the published AGM documents, the securities company intends to propose a 9% dividend payout ratio for 2023 in the form of stock dividends (equivalent to the issuance of over 20 million new shares). For 2024, the dividend payout ratio is expected to be at least 5%.

Additionally, APG plans to seek shareholder approval for several equity offering plans to increase its charter capital. These include the proposed issuance of over 11 million shares under an employee stock ownership plan (ESOP), with an expected offering price of VND 10,000 per share.

Notably, the Board of Directors will propose a private placement of shares to existing shareholders at a price of VND 10,000 per share, with the issuance of nearly 224 million new shares, a 1:1 offering ratio. The expected proceeds from this offering of VND 2,236 billion will be allocated to proprietary trading (70%), investment in securities (20%), and brokerage activities (10%).

Furthermore, APG plans a private placement of up to 100 million shares to professional securities investors at a price of VND 12,000 per share, to be conducted in 2024. If successful, the expected proceeds of VND 1,200 billion will be allocated similarly to the proceeds from the offering to existing shareholders.

If all the proposed equity offerings and share issuances are completed, APG’s charter capital is expected to increase to nearly VND 5,800 billion. While capital raising is a legitimate need for securities companies, not all of them utilize the raised capital efficiently.

In the case of APG, since its listing in 2010, the company has conducted three large share offerings: in 2010 (a 2:1 offering to existing shareholders), 2019 (a private placement of 20.5 million shares), and between late 2021 and early 2022, when the market was at its peak with vibrant trading activities (a total offering of nearly 180 million shares, including offerings to existing shareholders and private placements). However, APG’s financial performance after these share offerings has not grown proportionally. Only the 2019 private placement resulted in relatively efficient capital utilization, while in 2011 and 2022, the company incurred losses. This raises concerns among shareholders about the risk of dilution following APG’s large share offerings.

Moreover, the allocation of a large portion of the expected capital raise to proprietary trading activities also gives investors pause. As mentioned earlier, even in a favorable market environment, such as the first quarter of this year, APG’s proprietary trading activities were inefficient. These factors could significantly impact the success of the securities company’s upcoming capital-raising initiatives.

According to the plan, APG will hold its 2024 Annual General Meeting of Shareholders for the second time on July 21, 2024, at 132 Mai Hac De, Le Dai Hanh, Hai Ba Trung District, Hanoi.