To encourage customers to enable face authentication, ACB sent notifications via email and its ACB ONE mobile banking app, recommending that customers register for face authentication to avoid disruptions in high-value transactions.

In compliance with Decision No. 2345 by the State Bank of Vietnam on implementing safety and security measures for online and bank card payments, starting today, July 1, 2024, all online fund transfers or e-wallet top-ups exceeding VND 10 million per transaction or VND 20 million per day will require an additional step of face authentication for ACB customers.

“When we first implemented face authentication for our customers, we anticipated that the system might encounter some hiccups. However, in reality, the process has been seamless, taking less than 30 seconds for customers to complete,” shared Mr. Tu Tien Phat, CEO of ACB. “This is a comprehensive solution that effectively addresses risks related to account security and protection.”

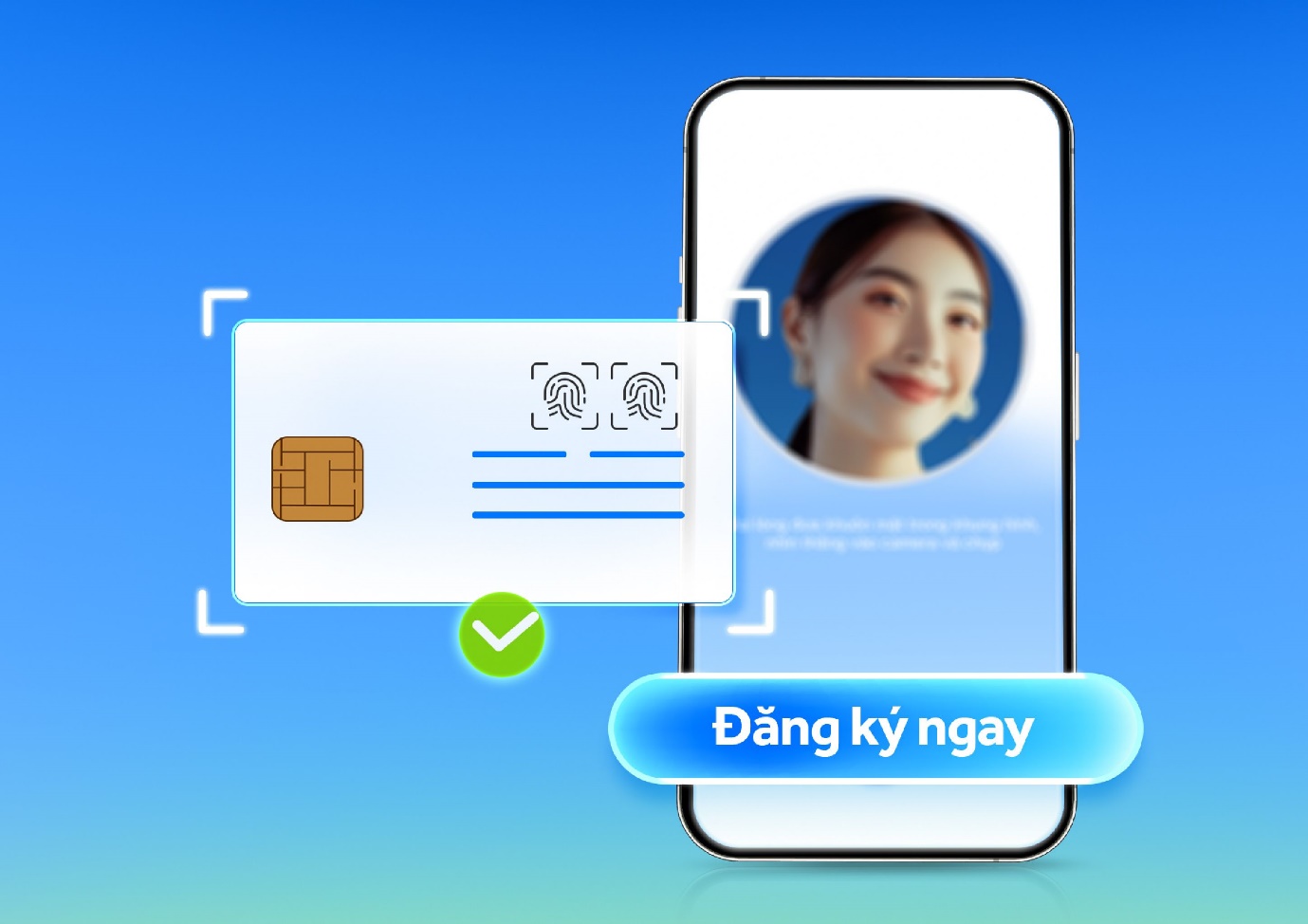

With face authentication in place, only the legitimate account holder can transfer funds. In the event that an account holder’s information is compromised, criminals may gain control of their phone to initiate unauthorized transactions. But with the additional step of facial verification, which matches the user’s face with the image on their ID card, it becomes significantly more challenging for criminals to successfully withdraw funds.

How to Register for Face Authentication on ACB ONE:

- Customers should have a smartphone with NFC capabilities and the latest version of the ACB ONE mobile banking app (version 3.27.0 or higher). They also need to have a valid ID card with a chip that matches their facial data, ensuring consistency with the biometric data verified and stored by the Ministry of Public Security.

- To initiate the registration process, customers can open the ACB ONE app, select “Add,” then “Face Authentication,” agree to ACB’s terms and conditions, and finally, choose “Register” to follow the guided steps.

Additionally, customers are advised to update their ACB ONE app to version 3.27.0 or higher to continue accessing online banking services through the application seamlessly.

Should customers encounter any difficulties with face authentication on ACB ONE, they can reach out to the hotline at (028) 38 247 247 or (028) 35 14 54 86 for assistance. Alternatively, they can visit any ACB branch or transaction office to register for face authentication if their device does not support NFC functionality.

ACB ONE is ACB’s digital banking service. Embracing the philosophy of “Live Light, Live Happy,” ACB ONE offers a wide range of features to cater to daily transaction needs, making life easier and more enjoyable for its customers. With a user-friendly interface, ACB ONE provides a seamless experience along with practical and free features such as online account opening, 24/7 fund transfers, bill payments, QR code payments and transfers, online deposits, and online loan disbursements. New customers who do not yet have an ACB account can easily open an account here to explore and enjoy the numerous benefits and promotions that ACB ONE has to offer.

For detailed information about face authentication registration, please visit ACB’s website: Enhanced Customer Protection in Online Transactions with Face Authentication (acb.com.vn)

“TPBank Offers Omnichannel Support for Customers Updating Their Facial Recognition Data for Seamless Transactions”

“With TPBank’s LiveBank, customers can now update their facial recognition data at their own convenience. No need to visit a physical branch or struggle with app updates; our remote tellers are available 24/7 to guide you through the process seamlessly. Experience the future of banking with TPBank – where your time and preferences are always respected.”