Protecting Customers with Cutting-Edge Technology

According to Clause 3, Article 3 of the Law on Identity in 2023, biometrics includes the physical attributes and unique biological characteristics of an individual for identification and differentiation from others, including facial images, fingerprints, iris patterns, DNA, and voice.

As per Decision 2345/QD-NHNN, from July 1, 2024, it is mandatory to use biometric authentication with facial recognition for online banking transactions over VND 10 million or a total daily transaction value exceeding VND 20 million, along with some other transactions such as first-time application login, login from a different device, login after a forgotten password, and successful password change. According to security experts, biometrics is considered a positive step to minimize risks and protect users from fraud and scams.

Implementing the Government’s and State Bank’s directives, BIDV has proactively deployed a biometric collection solution since Q1/2024. This process is carried out in phases, combined with communication about safety and security knowledge to help customers familiarize themselves with the new security method.

Specifically, for transactions requiring biometric authentication, in addition to authentication via Smart/SMS OTP codes, customers must match their facial image with the data stored in the chip of their e-ID (electronic identity card). This additional layer of biometric security will help prevent impersonation scams, unauthorized access to devices, or theft of information for property appropriation.

Multi-Channel Support for Customer Safety

Biometrics is a new technology for most customers, and biometric setup in banking transactions can only be done via e-ID with a chip through a mobile device with NFC (Near-Field Communication) functionality. However, this also poses a barrier for some customers as not all mobile devices support NFC technology, and some customers have not yet switched to e-ID with a chip.

Therefore, BIDV has proactively developed a support plan by providing specialized software and direct assistance at BIDV branches/transaction offices nationwide for cases where customers’ devices do not support NFC; customers who do not have an e-ID with a chip (only holding a paper ID card or a non-chip e-ID that is still valid), and individual foreign customers.

The implementation of transaction authentication using biometrics, as per Decision 2345/QD-NHNN, is considered the most timely and appropriate measure to help people raise awareness and skills to protect their assets. However, in the context of increasingly sophisticated scams, many customers still have a subjective mindset and are unaware of the importance of protecting their personal data. The situation of buying/selling/renting/borrowing accounts, accessing unknown links, downloading fake applications, and following the advice of malicious actors, leading to the exposure of personal information, e-banking passwords, OTP codes, etc., are the main reasons many people have their money stolen from their accounts.

To minimize risks for customers when transacting online, in addition to applying biometric authentication, BIDV regularly updates safety and security knowledge and new scam techniques. Customers can follow and learn through BIDV’s official communication channels (Website, Fanpage, Zalo), especially the BIDV SmartBanking channel, to be vigilant against scams and avoid unfortunate situations.

Easy Biometric Setup on BIDV SmartBanking

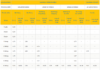

To avoid disruptions to transactions that require biometric authentication as per the State Bank’s regulations from July 1, 2024, customers who have not yet set up biometrics can access the “Biometric Setup” feature on the BIDV SmartBanking application and follow these three steps:

Step 1: Take photos of both sides of the e-ID with a chip.

Step 2: Read the information on the chip of the e-ID with a chip by placing the back of the phone near the chip on the back of the e-ID (the placement may vary depending on the device model).

Step 3: Take a facial photo to complete the setup.

See detailed setup instructions here.

Alternatively, customers can visit the nearest BIDV branch for setup assistance.

BIDV advises customers not to update their biometrics through any other websites or applications to avoid fraud and scam risks.

For more detailed information, please contact BIDV’s Customer Care Center at 1900 9247 for assistance.

Prime Minister issues plan for implementing Citizen Identity Law

Prime Minister Pham Minh Chinh has just signed a decision to issue a Plan for the implementation of the Identity Card Law, which was passed by the National Assembly on November 27, 2023 and will come into effect from July 1, 2024.

“Be Aware of These Extra Precautions When Banking Online: A Guide to Staying Safe”

“In addition to implementing information security solutions in accordance with Decision 2345, the State Bank also urges individuals to heighten their awareness of cyber security. It is imperative that users follow the provided guidelines to ensure safe and secure utilization of electronic banking services.”

What’s the Alternative for Those Without the New Chipped ID Cards or NFC-Enabled Phones to Perform Biometric Authentication for Transactions Over $500?

The State Bank of Vietnam (SBV) has issued a directive outlining the biometric authentication process for individuals who do not possess the new chip-based citizen identity cards and for those using mobile phones that do not support Near Field Communication (NFC) technology when conducting transactions that require biometric verification.