On July 1st, in Ho Chi Minh City, the Institute of Digital Economic Strategy (IDS) coordinated with Sai Gon Giai Phong Newspaper – Financial Investment to organize a scientific seminar on “National Comprehensive Financial Strategy – a new approach to capital for small, micro, and household businesses.”

The strategy, approved by the Prime Minister, aims to ensure that all citizens and enterprises (DNs) can access and utilize financial products and services conveniently, suited to their needs, and at reasonable costs. It particularly focuses on the poor, low-income individuals, vulnerable groups, and small and micro-enterprises.

Seminar Scene.

According to Dr. Tran Van, Director of IDS, there has been very limited information about the implementation process and monitoring efforts in the four years since the Prime Minister’s decision. For instance, there is a lack of evaluation regarding the process related to the implementation methods, the provision of financial services to various social strata, small and micro-enterprises, and households; the effectiveness and benefits to society; and the desired impact on citizens, small businesses, and the community of micro-enterprises.

Meanwhile, many fintech (financial technology) companies that have been present in Vietnam for quite some time are actively digitizing these modern distribution channels. “The legal framework to encourage innovation and facilitate the development of diverse organizations providing and distributing financial products and services seems to be slow in being reviewed, amended, and supplemented,” said Mr. Van.

Concurring, Prof. Dr. Tran Ngoc Tho, a member of the National Monetary and Financial Policy Advisory Council, cited an example: A farmer in the Mekong Delta (Mekong Delta) needs VND 15 million for crop improvement. However, this amount is too small to access bank capital. Meanwhile, there are many “black credit” organizations on the internet offering loans.

Opportunities for medium and small enterprises to access capital through the National Comprehensive Financial Strategy.

“These organizations ‘hunt’ with very attractive conditions. If someone takes out a loan, they may not be able to plan their cash flow and understand how to repay it on time,” said Mr. Tho. “In other words, people who lack financial knowledge will face risks, so we hope that our laws will protect consumers, especially those who lack financial knowledge.”

Dr. Truong Van Phuoc, former Acting Chairman of the Financial Supervisory Commission, opined that it is impossible to demand equality and fairness in the financial market, especially in perfect financial markets with fierce competition. Banks will always pursue maximum profits.

“The state takes on the role of ensuring equality and fairness. Specifically, it ensures that financial institutions do their job correctly. To achieve comprehensive financial development for the disadvantaged. Moreover, Vietnam’s financial market structure is not yet complete, so consumers are missing out on the benefits they should be entitled to,” said Mr. Phuoc.

According to Dr. Nguyen Thi Hoa, Director of the Banking Strategy Institute, one of the issues within the strategy is how to apply technology to produce financial products and services suitable for the target groups of the comprehensive financial goal. At the same time, banks should be encouraged to collaborate with fintech companies, and these companies should leverage each other’s strengths to best serve the people and businesses.

Dr. Vo Tri Thanh, Director of the Institute of Brand and Competition Strategy Research, suggested that three requirements are necessary to protect the disadvantaged and develop comprehensive digital finance: macroeconomic stability, as inflation affects low-income individuals; a legal framework, including consumer protection laws, in addition to legal provisions for fintech; and a series of policies to support both the supply and demand sides.

Promoting the establishment of an international financial hub in Ho Chi Minh City.

Expected in 2024, Ho Chi Minh City will propose to the National Assembly a legal framework and mechanism for an international financial center.

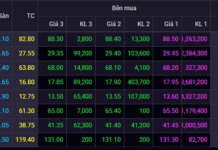

Shinhan Securities Vietnam triumphs over challenges, fostering sustainable development in the securities industry.

With belief in the potential of the Vietnamese market, Shinhan Securities Vietnam positions technology as the key factor in the race among securities companies. With the aim of bringing customers excellent experiences and benefits in investment through innovative solutions, Shinhan is reaping sweet rewards thanks to its dedicated service to Vietnamese investors.