On July 4th, the State Bank of Vietnam organized a workshop on solutions to protect customers using banking services. At the event, Captain Triêu Mạnh Hùng pointed out some characteristics of high-tech crime and the tricks commonly used by criminals today.

According to Mr. Hùng, online fraud is not just a problem in Vietnam, but also in many other countries. Taking advantage of anonymity online, many perpetrators have impersonated police officers, tax officials, and relatives to try to appropriate money from victims.

On the other hand, crime is now seen as a profession that brings high profits. High-tech criminal organizations operate in a structured, transnational manner, with large-scale collusion.

As evidence of the criminals’ model, Mr. Hùng said that in 2023, the Department of Cyber Security and High-Tech Crime Prevention (Ministry of Public Security) coordinated with the Quảng Bình Police to discover an online fraud ring with 300 members. These individuals underwent 2-3 months of training and worked in an office with a canteen for lunch breaks.

The tricks used by criminals today are also more sophisticated. High-tech criminals are divided into small groups to operate in a “specialized” manner. Some groups focus on researching and developing scams, while others execute the fraudulent acts or handle the illicit funds.

“There are groups dedicated to researching and developing scams, so the scams are changed daily: electronic identification, biometrics. The groups executing the scams are trained for 2-3 months, learning specific answers. So, when they impersonate police officers, the terminology they use is almost accurate,” said Mr. Hùng.

In addition, taking advantage of our country’s open-door policy, many criminal groups tend to transfer money abroad, making the investigation process more challenging.

After listing the characteristics of cybercrime, Mr. Hùng also pointed out four common scam methods used by these perpetrators.

Firstly, impersonating reputable organizations such as courts, police, or relatives, which accounts for 50% of the tricks used.

Secondly, inviting investment in “easy money” models, such as gold or stock markets, to prey on people’s greed.

“These individuals let their prey trade for a day, showing profits in their accounts but unable to withdraw. To withdraw money, the victim must deposit more. It goes on like this, and there have been cases where people lost 20-30 billion VND,” Mr. Hùng said.

Thirdly, tricks related to personal relationships, taking advantage of emotions to make acquaintances, giving gifts, and then asking for money to be sent to cover customs fees.

Finally, some perpetrators trick people into installing malware-infected applications to gain control of their accounts.

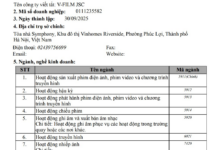

Vice Governor Phạm Tiến Dũng

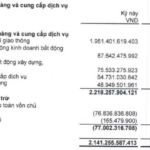

In addition to Captain Triệu Mạnh Hùng, at the workshop, Vice Governor Phạm Tiến Dũng also provided information on the implementation of Decision 2345 of the State Bank. As of the end of July 3rd, approximately 16.6 million bank accounts had been biometrically authenticated, with 90% of customers doing it themselves. The number of accounts with cleaned data is equivalent to the number of new accounts opened in a year.

Get Help from Facebook ‘Lawyer’ to Recover Scammed Money, Hanoi Woman Gets Duped for Even More Money

According to the Hanoi Police, there have been fake accounts on the social media platform Facebook impersonating lawyers and posting articles about supporting the recovery of scam money. Instead of reporting the incident to the authorities, many victims of scams have contacted these fake lawyer accounts in hopes of recovering their lost funds.

Beware of the Scam Strategy: Similar Bank Account Names Lead to Millions Lost

After seeing that the recipient bank account name matched that of someone they knew, many users acted recklessly and transferred hundreds of millions of dong to the scammer.