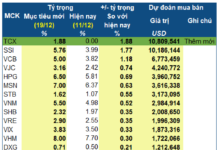

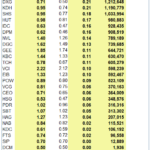

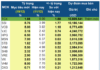

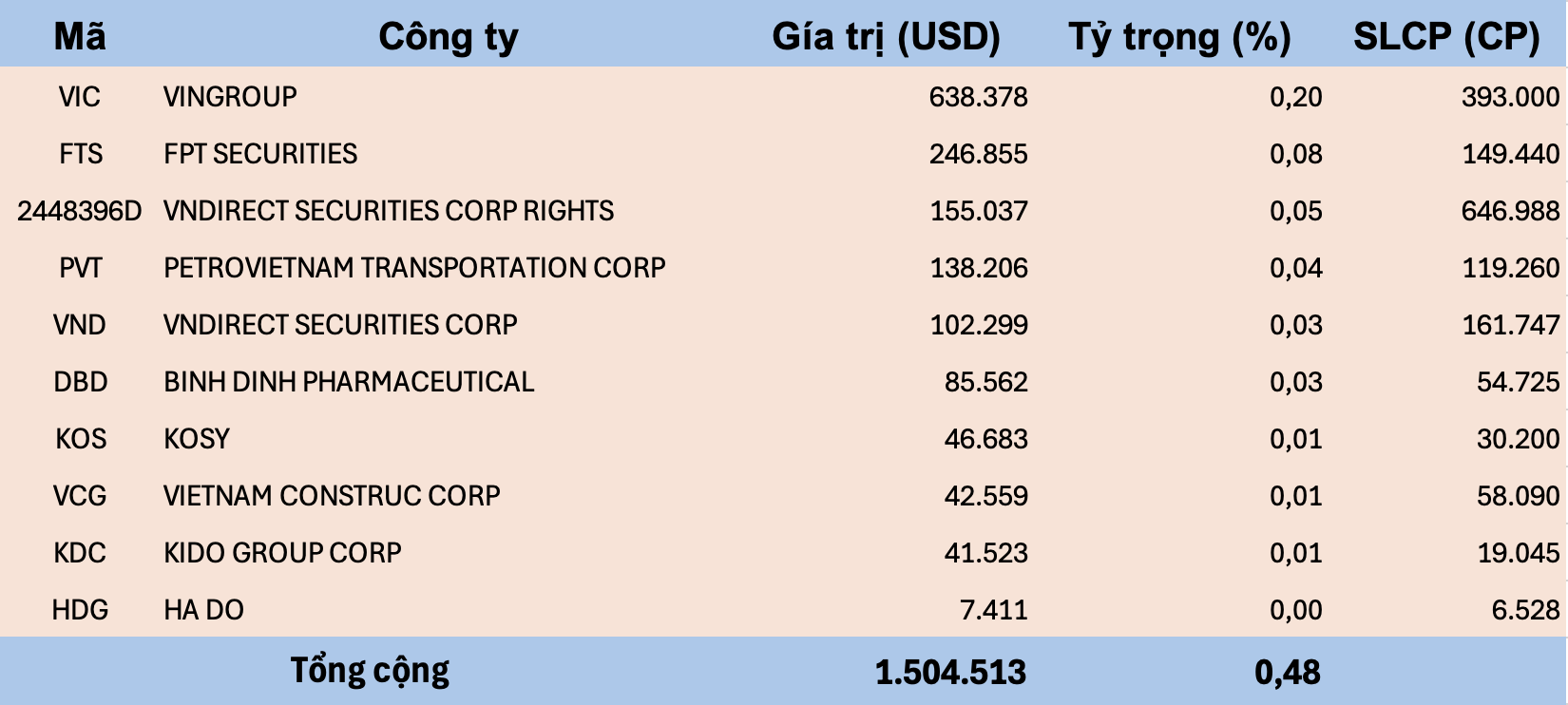

As of July 1, 2024, the total net asset value (NAV) of the iShares MSCI Frontier and Select EM ETF stood at approximately $314 million, with cash accounting for 93.4% of this figure. The weight of Vietnamese stocks in the portfolio has dwindled to a mere 0.48%, equivalent to around $1.5 million. The fund’s Vietnamese stock holdings now consist of just nine tickers: VIC, FTS, PVT, VND, DBD, VCG, KDC, and KOS, along with VND stock options (code: 2448396D).

Vietnamese Stocks in iShares MSCI Frontier and Select EM ETF as of July 1

The iShares MSCI Frontier and Select EM ETF is a fund that invests in frontier and emerging markets, previously known as the iShares MSCI Frontier Markets 100 ETF, which tracked the MSCI FM 100 Index. In March 2021, the fund changed its name to the current iShares MSCI Frontier and Select EM ETF and adopted the MSCI Frontier & Emerging Markets Select Index as its benchmark.

In a surprising announcement in early June 2024, BlackRock revealed plans to liquidate the iShares MSCI Frontier and Select EM ETF after 12 years of operation. According to the schedule, the ETF is expected to cease trading and no longer accept creation or redemption orders after the market closes on March 31, 2025. However, the statement also emphasized that this date could change.

BlackRock stated that during the extended liquidation period, the iShares MSCI Frontier and Select EM ETF would not be managed according to its investment objective and policy, as the fund would be selling off its assets. The firm decided that the proceeds from the liquidation would be distributed to shareholders within approximately three days after the final trading date.

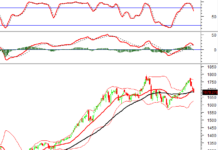

iShare has almost completed the portfolio liquidation, with cash holdings exceeding 93% as of July 1

Prior to this unexpected decision, Vietnam was regularly the market with the highest weight in the iShares MSCI Frontier and Select EM ETF’s portfolio. At the end of the first quarter of 2024, Vietnamese stocks accounted for 28.5% of the fund’s NAV. However, this proportion has steadily declined as the fund moved towards liquidation.

With the handful of Vietnamese stocks still held by the fund, it is possible that iShares MSCI Frontier and Select EM ETF sold off the remaining holdings in the sessions on July 2 and 3. The fact that this foreign ETF has “sold out” could be seen as a positive sign by millions of domestic investors. The strong net selling pressure from foreign investors over an extended period has had a negative impact on the market.

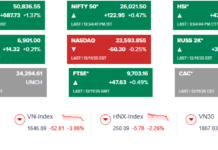

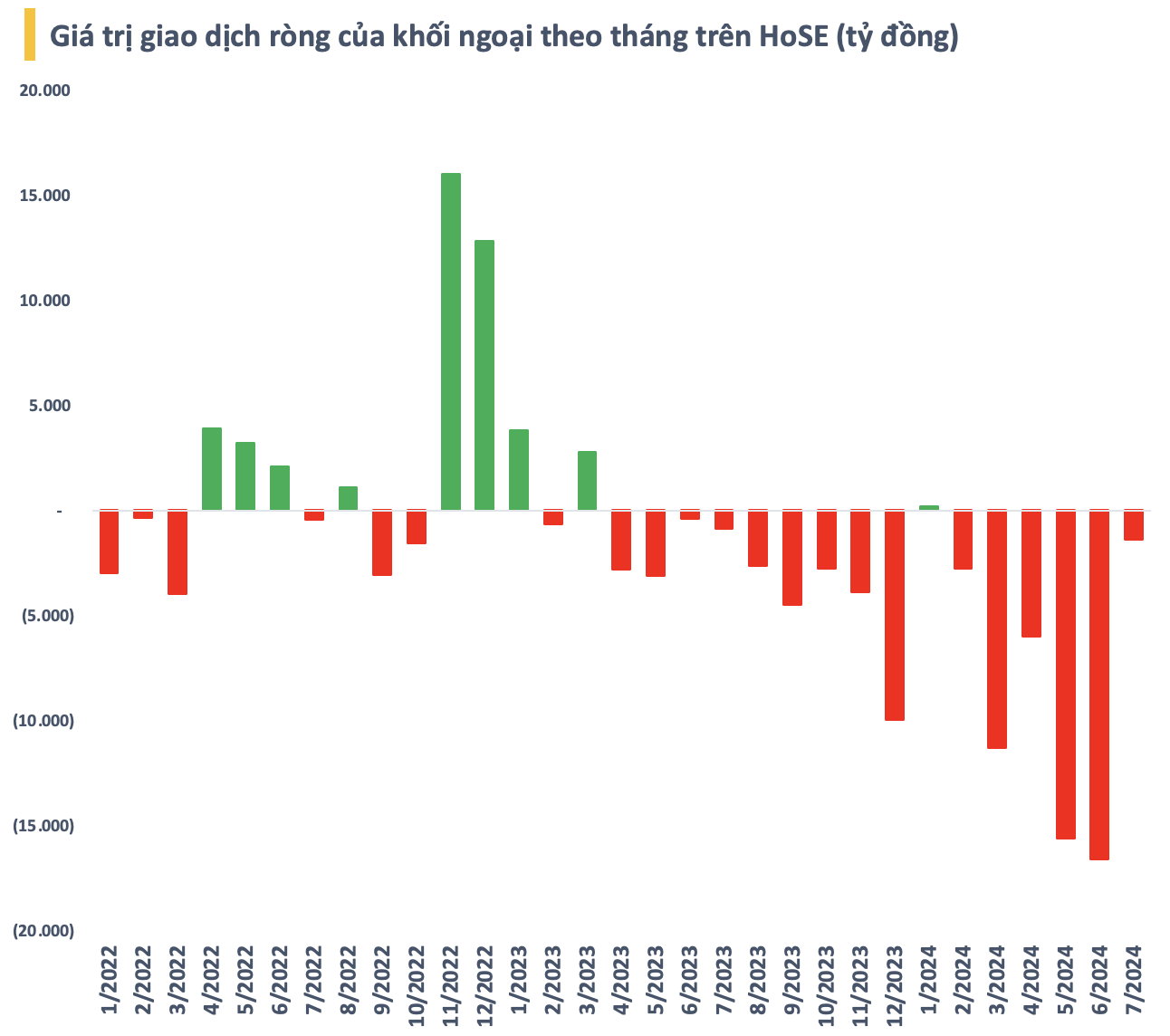

In June, foreign investors set a new record by net selling nearly VND 16,600 billion on HoSE alone. This trend continued in the first days of July, albeit at a slightly slower pace. Cumulatively since the beginning of the year, foreign investors have net sold over VND 53,000 billion (USD 2 billion) on HoSE.

According to some analysts, foreign capital inflows will reverse when the prospects for an upgrade become clearer. In a recent report, VDSC predicted that if Vietnam is upgraded by MSCI, the weight of Vietnamese stocks in the MSCI Emerging Market Index would be 0.44%. This implies an inflow of around $4 billion from foreign investment funds tracking this index into the Vietnamese stock market.

However, in its periodic market classification review published on June 21, MSCI has not yet included Vietnam on the list for a potential upgrade from frontier to emerging market status. The positive news is that Vietnam has improved on one of the critical criteria evaluated by MSCI.

Specifically, in the previous report on market accessibility, MSCI upgraded Vietnam’s “transferability” criterion from “-” (needs improvement) to “+” (no significant issues). This improvement is attributed to the increase in off-exchange transactions and the ability to perform physical transfers without prior approval from regulatory authorities.

Bank stocks plummet after overnight financial report release on January 31st.

The banking stock group, which has been leading the market in the first weeks of the year, experienced a collective downturn today.