The Ho Chi Minh Stock Exchange (HOSE) witnessed a cautious buying sentiment on the last trading day of the week, with the VN-Index fluctuating before closing 3.15 points higher at 1,283. Trading liquidity remained low, with a matching value of nearly VND16 trillion on the southern bourse.

Foreign investors’ net selling was a downside, with a net sell value of VND311 billion in the entire market. This marked the 21st consecutive session of foreign investors’ net selling in the Vietnamese market.

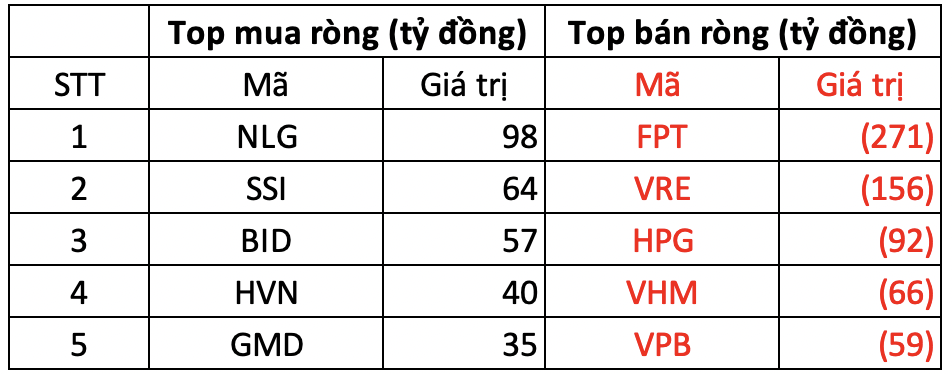

On the Ho Chi Minh Stock Exchange (HOSE), foreign investors net sold VND371 billion.

In the buying column, foreign investors heavily purchased NLG shares, with a net buy value of VND98 billion. SSI and BID stocks followed suit, with net bought values of VND64 billion and VND57 billion, respectively. HVN and GMD stocks were also added to their portfolios, with net bought values of VND40 billion and VND35 billion, respectively.

On the other hand, FPT faced the strongest net selling pressure from foreign investors, with a net sell value of over VND271 billion. VRE and HPG also witnessed net selling of VND156 billion and VND92 billion, respectively.

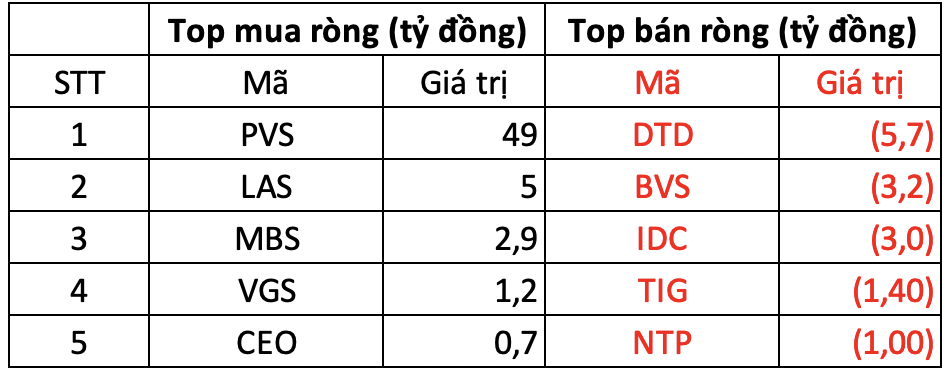

On the Hanoi Stock Exchange (HNX), foreign investors net bought VND42 billion

PVS was the most net bought stock by foreign investors, with a net buy value of VND49 billion. LAS followed suit, with a net buy value of VND5 billion. Additionally, foreign investors spent a few billion dong to net buy MBS, VGS, and CEO stocks.

On the opposite side, DTD faced the highest net selling pressure from foreign investors, with a net sell value of nearly VND6 billion. BVS, IDC, and TIG also witnessed net selling of a few billion dong each.

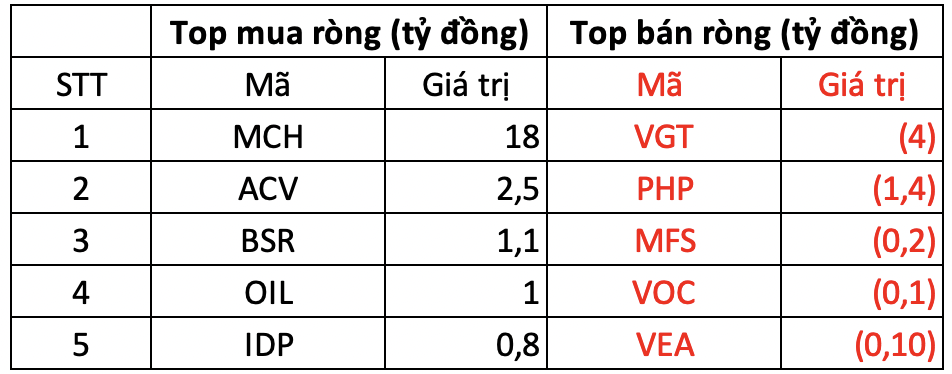

On the Unlisted Public Company Market (UPCOM), foreign investors net bought VND18 billion

In terms of net bought value, MCH led the pack with VND18 billion. ACV and BSR trailed closely behind, with a few billion dong net bought each.

Contrarily, VGT faced net selling pressure from foreign investors, with a net sell value of nearly VND4 billion. Additionally, foreign investors net sold a few billion dong worth of PHP and MFS stocks, among others.