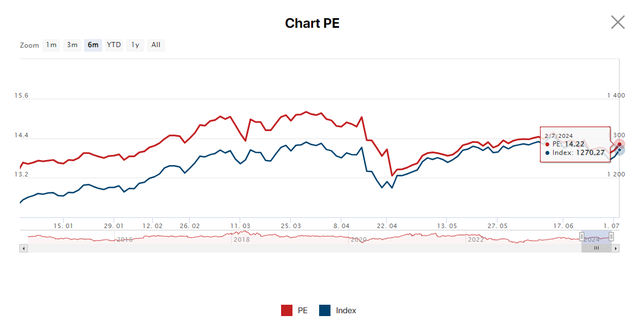

The Vietnamese stock market closed June 2024 with a 10% year-to-date gain. Agriseco Research reports that the market’s valuation is becoming attractive, with the overall market P/E ratio reaching 13.9x. Technical indicators suggest that the market is approaching an oversold state and could soon see some recovery.

Agriseco notes that the second-quarter and first-half 2024 macroeconomic data show positive signals, with economic growth reaching nearly 7%, inflation under control, and double-digit import-export growth. This bodes well for the expected recovery of listed companies’ business results, providing positive support for the stock market.

Risk factors in July include continued pressure on exchange rates and persistent net selling by foreign investors, with a scale of more than VND 50,000 billion since the beginning of the year and VND 16,500 billion in June. However, experts believe that these factors are expected to reverse in the latter part of the year as the Fed cuts interest rates, reducing the interest rate differential between the VND and USD. Additionally, expectations of a market upgrade in 2025 are anticipated to enhance the attractiveness of the Vietnamese market to foreign investors.

Based on the above analysis, Agriseco identifies potential stocks for July, focusing on expectations of strong second-quarter financial results, prioritizing leading companies, and considering reasonable valuations for investment. Agriseco highlights Mobile World Investment Corporation (MWG) as a potential stock, attributing its growth to the Bach Hoa Xanh chain. The restructuring of BHX has led to noticeable improvements in its business efficiency. In the first five months of the year, BHX’s revenue reached VND 15,800 billion, a 42% increase compared to the previous year. The average revenue per store per month was VND 2 billion, continuing to improve and surpassing the estimated breakeven point of VND 1.8 billion per store per month.

The The Gioi Di Dong (TGDĐ, including Topzone) and Dien May Xanh (DMX) chains also recorded positive growth compared to the previous year in the first five months, despite a reduction in the number of stores due to restructuring. The growth in revenue indicates a significant improvement in business efficiency.

Additionally, the analysts acknowledge the vast growth potential of the Era Blue electronics chain in the Indonesian market, which remains fragmented. MWG’s management expects Era Blue to reach the breakeven point by the end of 2024.

In the steel industry, Hoa Phat (HPG), a leading company, is highly regarded due to expectations of continued improvements in consumption volume. The report states, “The recovery of the domestic real estate market, the continued growth of exports to key markets such as the US and Europe, and the focus on constructing key transportation infrastructure in 2024 will drive the growth of the steel industry in the latter part of the year.”

Moreover, the Lien Hop Dung Quat 2 project, expected to commence operations in Q1 2025, is anticipated to increase Hoa Phat’s crude steel production capacity to 14 million tons per year, contributing an estimated VND 80,000-100,000 billion in annual revenue, thus serving as a long-term growth driver for the company.

In the oil and gas sector, Agriseco Research identifies long-term prospects for Binh Son Refining and Petrochemical Company Limited (BSR) from the Dung Quat Refinery expansion project, expected to be operational by 2028. In the short term, crack spreads are anticipated to widen in the latter half of 2024 due to escalating geopolitical tensions in the Middle East, which disrupt crude oil supplies from the main producing region to refineries in other countries, leading to a shortage of refined petroleum products. Simultaneously, inventories of refined petroleum products tend to decline due to increased consumption as the global economy recovers.

The analysts also predict that the second-quarter financial results of Dong Phu Rubber Joint Stock Company (DPR) will improve due to positive rubber price movements. The rubber segment is experiencing growth in both price and output. DPR’s 2024 sales price is expected to increase compared to the previous year, in line with the upward trend in global rubber prices amid a shortage of natural rubber supply. Additionally, DPR’s 2024 profit is projected to increase due to compensation income from the land in Binh Phuoc’s Tien Hung 1 and 2 residential areas, estimated at VND 100 billion.

Another company anticipated to report improved financial results for the second quarter is Vicostone Joint Stock Company (VCS). Agriseco expects VCS’s second-quarter performance to continue its recovery, as export revenue in May and the first five months of the year showed positive growth, with increases of 25% and 7%, respectively, compared to the previous year. By acquiring Phenikaa Chemical, which produces UP plastic—a critical raw material for artificial stone production, accounting for 40-50% of input costs—VCS can significantly improve its profit margin.

Regarding the financial sector, Agriseco mentions that Asia Commercial Joint Stock Bank (ACB) has achieved positive credit growth, particularly in corporate lending. Agriseco estimates that in the first six months of the year, ACB’s credit growth could exceed 8%, and it is expected that ACB will be able to complete the assigned credit limit of 16% for the year. Corporate lending is projected to continue expanding in scale and contribution as the bank shifts its credit structure to this segment. This will provide ACB with ample room to increase net interest income in the coming quarters. Additionally, retail lending is expected to recover by the end of the year.