Specifically, Van Lang reported a revenue of only 988 million VND in the first quarter of 2024, a 69% decrease compared to the same period last year. During this quarter, over 96% of the revenue came from the training segment, amounting to 950 million VND. After deducting expenses, Van Lang recorded a net loss of 1.55 billion VND.

Van Lang attributed the decline in revenue to a significant drop in the number of students enrolling in their courses.

In 2023, Van Lang experienced a 70% drop in revenue, generating only 11.2 billion VND. After expenses, the company barely broke even with a net profit of just 137 million VND.

Formerly known as a subsidiary of NXB Giao Duc Viet Nam, Van Lang was established in 2007 and initially focused on traditional publishing, printing, and distributing educational materials. However, since 2020, under the leadership of Nguyen Thanh Tien, a renowned wealth educator, Van Lang has shifted its focus to offering training programs on various skills, including critical thinking, sales, communication, leadership, financial management, and public speaking.

As of the end of 2023, Mr. Tien held a 9.08% stake in Van Lang.

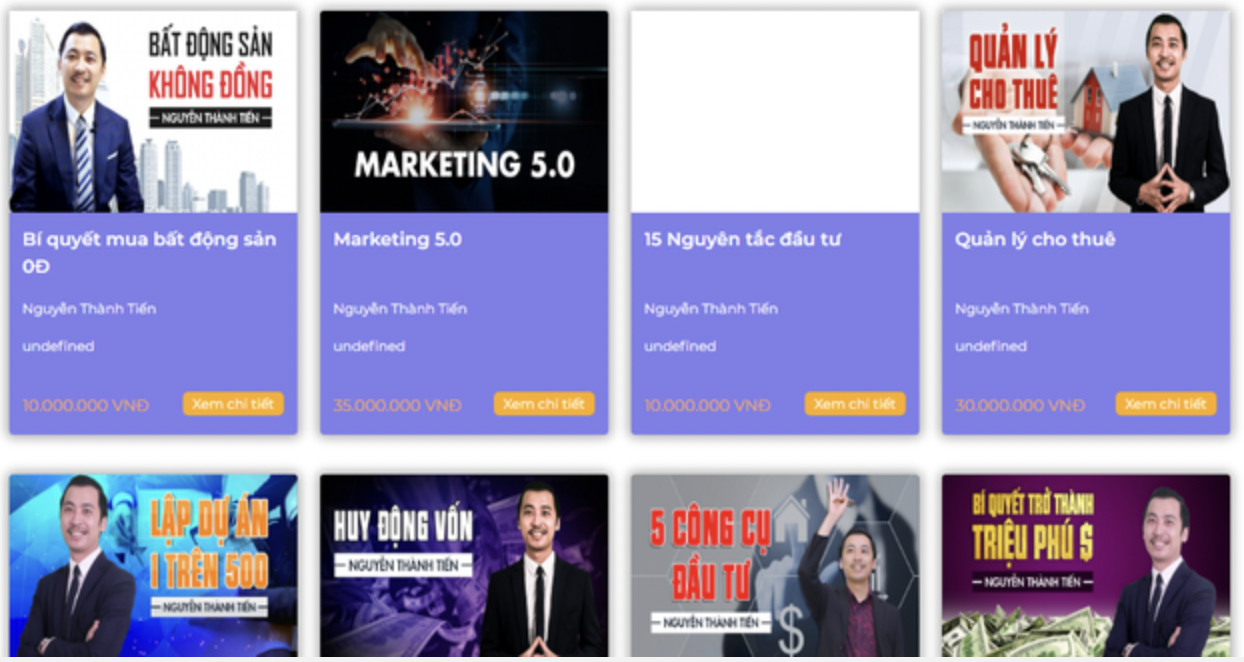

Image: Mr. Tien is also known for his online presence as a speaker and educator, with 1.2 million followers across his social media platforms.

Mr. Tien, an influential figure in the industry, runs a successful YouTube channel with 179,000 subscribers. The investment courses offered by Van Lang in 2023 covered a range of topics, including investment strategies, investment intelligence 5.0, effective capital mobilization secrets, and business intelligence.

Mr. Tien’s reputation as a speaker and educator is well-established, with a following of 1.2 million people across his online platforms. However, Van Lang, under Mr. Tien’s leadership, has yet to achieve significant success in the field of investment and real estate.

For instance, in 2022, Van Lang made a significant investment in a hotel property in Quang Ninh province worth 18 billion VND. Unfortunately, they encountered challenges in transferring the ownership of the asset and faced difficulties due to the impact on the hospitality industry, resulting in business hardships. As a result, the Board of Directors proposed a resolution to terminate the hotel purchase contract, recover the invested capital, and handle compensation procedures as per regulations.

In 2024, Van Lang aims to maintain its focus on training while expanding its course offerings to include investment and real estate strategies, business intelligence, and capital mobilization. The company also intends to diversify its revenue streams by investing in real estate, the stock market, and other services. They have set ambitious financial goals for the year, targeting a revenue of 20 billion VND and a net profit of 3 billion VND, with a projected dividend payout of 4% of charter capital.

Real Estate Expert Reveals 3 Promising Segments for the Year of the Rat 2024

There are high expectations for the real estate market’s recovery in 2024 across different segments of the industry. However, three specific segments are projected to have significant growth in the Year of the Wood Horse 2024.